Customer Lifetime Value

Allocating Budget and Measuring Success

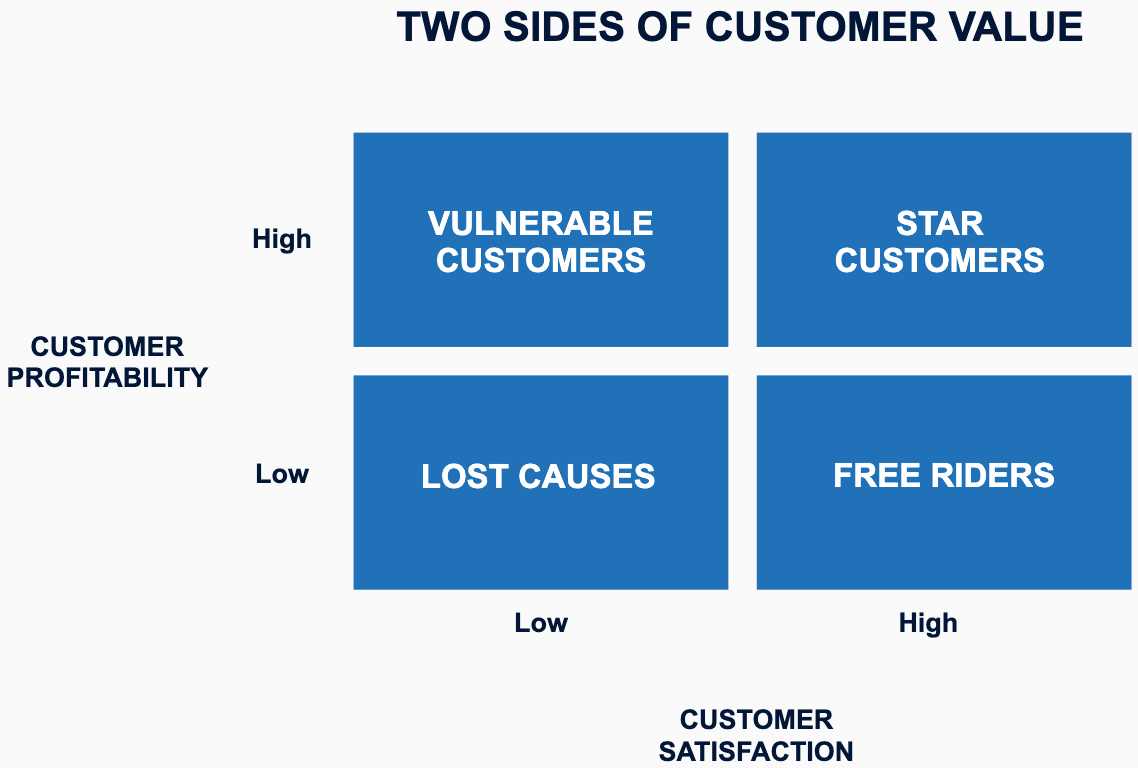

The Two Sides of Customer Value

We explored how to drive retention by investing in customer engagement. But keeping your customers engaged and delighted is not sufficient. Your investment in customer engagement may be creating tremendous value for customers, but is it capturing value for the business and driving profits?

A successful marketing strategy creates long-term value for both customers and companies. Many businesses miss this simple and intuitive concept.

In the early 1990s, vacuum company Hoover was faced with intense competition and economic recession. Hoover's UK division attempted to increase sales by offering two free round-trip plane tickets to any customer who spent over 100 pounds on a Hoover product.

The cheapest Hoover vacuum on the market cost 120 pounds, while the estimated value of the plane tickets was around 600 pounds. Needless to say, when word got out, customers began buying the cheapest vacuum just to cash in on the flight offer.

To mitigate customers taking advantage of the offer, Hoover added some restrictions to the reward. But these restrictions did little to curb the wave of customers that took advantage of the deal.

That year, Hoover made 390 million pounds in sales, but posted 23 million pounds in losses and faced a PR nightmare as many offers went unfulfilled. In its rush to delight customers, Hoover failed to see the impact of its actions on its own profits.

Spending money to acquire a customer is an investment. Therefore, it might be beneficial to spend more on acquiring a customer than the price of a product if this customer makes multiple purchases in the future. In other words, we should consider the long-term profitability of customers and not only their short-term sales.

Today, we have detailed data about customers that allows us to do analysis at an individual customer level to understand which customers are more profitable for the firm in the long run. Customer profitability can be combined with customer satisfaction to understand the two sides of customer value, the value that a company provides to customers to satisfy and delight them, and the value that it captures from customers to generate profits for the firm.

A simple way to observe this is in a 2-by-2 matrix. Star customers are customers that receive high value from the company and deliver high value to it. These customers love your product and service and therefore tend to be loyal and satisfied. These are also the most desirable customers for a firm because they are very profitable.

On the other extreme, lost causes are customers that derive little value from a company's product and provide it little profit in return. These customers spread bad word of mouth or badger staff members. The cost to serve them is more than they are worth. In other words, customers don’t like the firm, and the firm does not like these customers either. We should either attempt to move them up to become more satisfied and profitable or get rid of them.

Free rider customers take advantage of all the offers, discounts, and promotions and are therefore very happy. But they are not very profitable. They are the Hoover customers who bought the product only to take advantage of the promotion. These highly price-sensitive customers switch brands easily, and investing money on them may not be the best strategy.

Finally, vulnerable customers are customers that are highly valuable to the company but receive little value in return. These customers are likely to be poached by competitors. Investing more resources in retaining these customers and meeting their needs should thus be a priority for companies.

In his 1945 book Animal Farm, British author George Orwell said that "All animals are equal, but some are more equal than others." This is true for customers as well. All customers are important, but some are more important than others.

This framework has important implications. It shows that you should allocate resources differently to different groups of customers based on their profitability. For example, you might want to take some resources away from the free riders and move these dollars to the vulnerable customer segment.

It also shows that increasing market share should not be your only objective because you may end up acquiring unprofitable customers. And it reminds us that we need to do profitability analysis at the individual customer level because aggregate analysis at the product or business unit level would mask these unprofitable customers.

Finally, we need to recognize that customer profitability must be viewed with a long-term lens that considers their future purchases. In a way, customers are investments. We invest to acquire and retain them, and they provide a stream of profits to us through their purchases over the long run.

This is why customer lifetime value is so important for measuring long-term profitability. Here, we abbreviate Customer Lifetime Value to LTV, but CLV is also widely used.

HBS Online began considering customer lifetime value (LTV) when it implemented learning tracks to satisfy customers that wanted to take more than one course from HBS Online.

Early in 2020, we launched what we call our Learning Tracks. So as our course catalog has increased over time, we found that people were taking an initial course, and then they would come back and take an additional course with us. And we started hearing from our participants that they were really looking to develop additional mastery in a particular topic area.

So they perhaps took one leadership course and were really looking for additional courses and a way to demonstrate that they have this additional specialization. We decided to launch Learning Tracks, which essentially—within a topic area, if a participant takes three courses out of a selection of five or six courses, they have the ability to earn a certificate of specialization.

This really signals to their employers and to the marketplace that they’ve invested in building a specific set of skills around, whether it’s strategy, finance and accounting, leadership, or business and society. We found that to be very successful in terms of meeting the needs of our participants but also, on the other hand, encouraging participants to take more courses with us.

Hand in hand with the Learning Tracks, we also launched a past participant discount. So, people who come and take a course with us get a 30% discount towards a future course.

Learning Tracks really affected us in two different ways. On the budget allocation, we really continued to focus on the topic-based allocation as opposed to the course-based allocation. Now that we have these Learning Tracks, it’s easy to say, here are the benefits of pursuing a certificate of specialization in strategy. Here are the courses that it applies to. It enables you to essentially spread your marketing budget across multiple courses with the same message. So on the incoming side, it definitely helps in that way.

On the other side, it also helps with customer retention and building towards that lifetime value. We don’t quite think about lifetime value in education in the same way that we do in other consumer products, because traditionally, not many people go out and get two master’s degrees or two PhDs. But from a certificate perspective, we do think about that discount that we provide to past participants as another marketing cost, if you will.

So rather than having to spend to acquire a new participant, the discount is what we see as the cost towards retaining that participant. Over time, as we launch more Learning Tracks, we’ll be shifting a little bit more towards that lifetime value.

Applying Customer Lifetime Value

Let's investigate how LTV can help guide us in business decisions.

In 2016, JPMorgan Chase launched the Chase Sapphire Reserve credit card. The Sapphire Reserve card was marketed as a new, next-generation rewards card targeted at affluent millennials through social media marketing. The card offered an unprecedented signup bonus of 100,000 points that translated to a value of $1,500 just for opening an account.

The response was overwhelming. Within 10 days of its launch, Chase ran out of the special metal alloy required to make the cards. The bank reached its annual customer acquisition goal for this card within the first two weeks of its launch. The card was especially popular among millennials. Half the new customers were under the age of 35.

This unexpected acceptance of its new card made the Chase management wonder if this was a huge success or too good to be true. A year later, in 2017, Chase management was wondering how they should measure the success of this new card. Was the unprecedented adoption of its card a signal of its success? Was acquiring customers with a signup bonus of 100,000 points equal to $1,500 worth it?

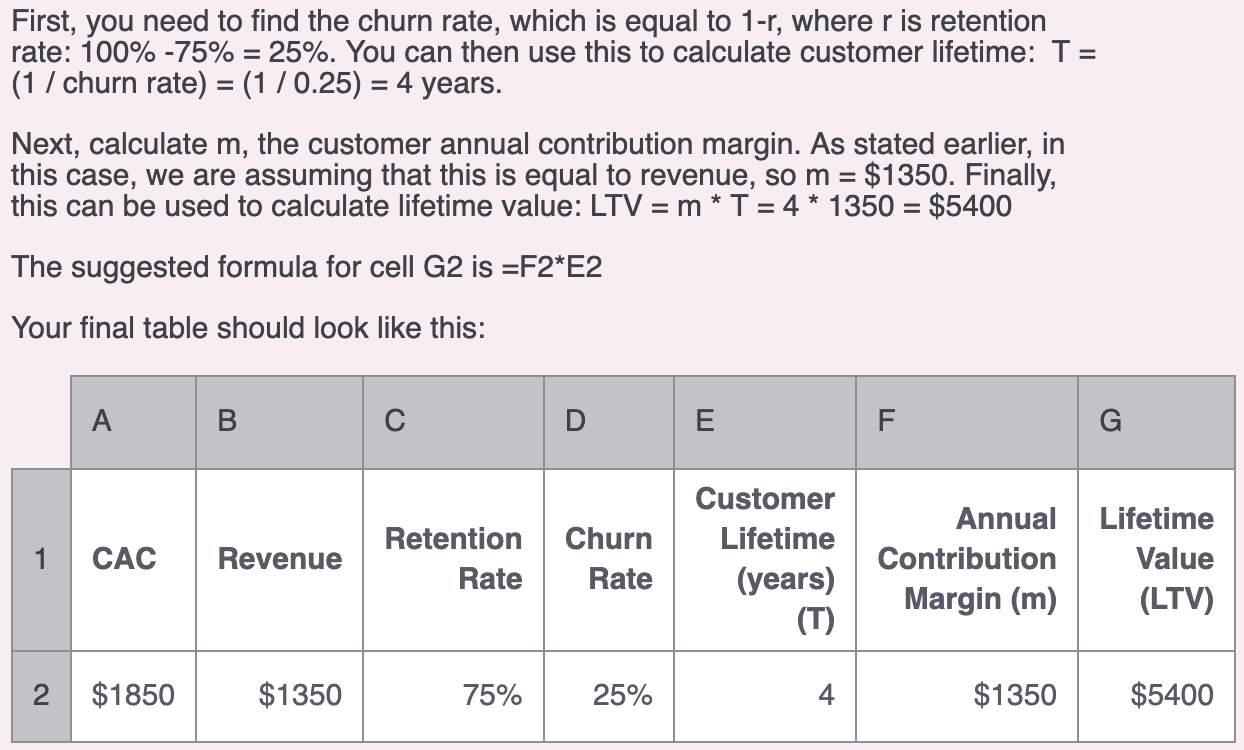

In addition to offering 100,000 points as a signup bonus, Chase also incurred an additional $350 in marketing to acquire a customer. In other words, the Cost of Customer Acquisition, or CAC, was $1,850.

To evaluate whether this was worth it, we need to know what future profits Chase can expect from these customers and whether these profits are more than the cost of acquisition. To answer that question, we will need to estimate the lifetime value of Chase's new customers. We will use simplified numbers for illustrative purposes.

From a typical cardholder, Chase receives:

- A $450 annual fee,

- $200 in interchange fees on spending,

- $700 in interest on their outstanding balance.

Based on industry estimates, Chase believes the average annual renewal rate for its cardholders to be 75%. In other words, it expects to lose 25% of its customers every year. This translates to an average life of four years for a customer.

In general, a customer's expected lifetime with the company, represented as T, can be estimated as:

T = 1 / (1 - r)

or

T = 1 / churn rate.

With this information, we can calculate the LTV of Chase Sapphire Reserve cardholders.

A customer’s expected lifetime with the company can be estimated as:

- T = 1 / (1 - r)

- Where r = annual retention rate

- Where (1-r) = annual churn rate

Lifetime value can be estimated as:

- LTV = m * T

- Where m = a customer’s annual contribution margin

- Where T = expected life (years) of a customer with the firm

For digital services, the marginal cost of an additional customer is close to zero, so the annual margin per customer is almost the same as average annual revenue in this case.

Here is Chase’s data on its CAC, revenue, and retention rate (these data are for illustrative purposes):

- Customer Acquisition Costs

- 100k Point Bonus $1500

- Card Acquisition Expense $350

- Revenue

- Annual Fee $450

- Interchange Fees $200

- Interest $700

- Retention Rate

- 75%

Your calculations should show that Chase will make almost three times its customer acquisition cost from the card holders.

Chase will lose money in the first year because it will spend $1,850 to acquire a customer who will provide only $1,350 in income in the first year. It is only when we consider the future income stream of these customers that we see the value of this investment. This shows why LTV is an important metric.

Note two things: In general, LTV is based on margin, not revenue. We have used revenue in this case for simplicity by assuming zero cost of serving a card holder. Also, we have ignored the time value of money, which we will introduce later.

Of course, not all customers will use the product in the same way.

In addition to providing a broad view of LTV across all customers, LTV can be a useful tool to understand the profitability of different customer groups.

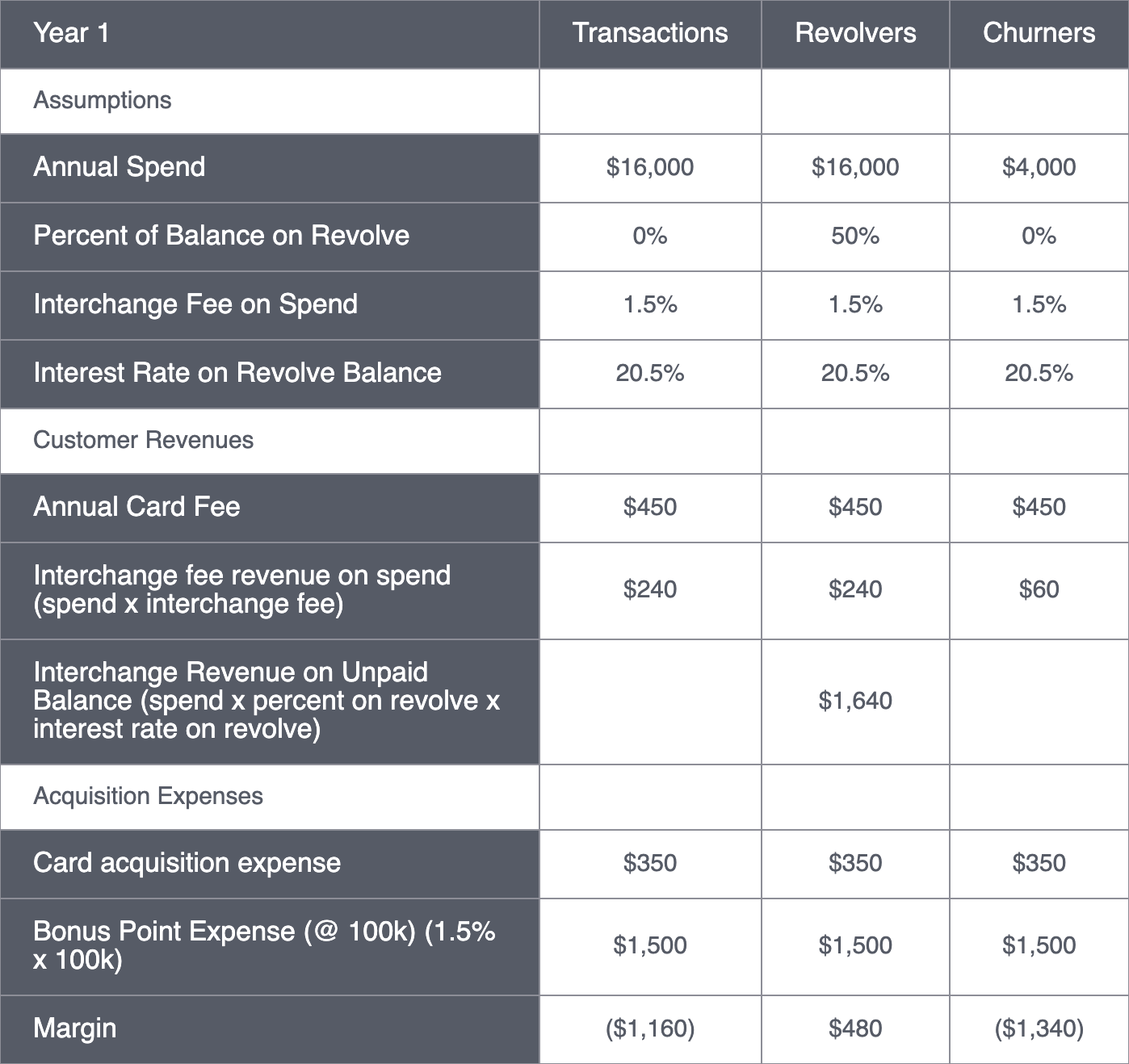

Let’s break Chase customers down into three segments:

- Transactors, who pay their balances off in full each month to avoid paying interest fees.

- Revolvers, who do not pay off their balance in full each month, and

- Churners, who take advantage of the sign-on bonus, but cancel before the annual fee is due again the next year.

Using this information, calculate how long Chase would need to retain each type of customer in order to cover their acquisition cost, then complete the interactive that follows.

- Note that the numbers in the table are for illustrative purposes only.

- You can determine the length of time it takes for each cardholder type to become profitable by dividing CAC by the annual revenue generated per customer.

- For example, for revolvers you can find the annual revenue by dividing the card acquisition expense and bonus point expense by the annual fee, interchange fee, and revenue from interest. (Again, we are using revenue instead of margin by assuming zero cost of serving cardholders).

Retention time period matched to a customer segment:

- Transactors - 3.60 years

- Revolvers - 2.68 years

- Churners - 0.79 years

Armed with an understanding of how different customers use the Sapphire Reserve card, Chase can take specific actions to increase the value of each customer type.

To maximize the lifetime value (LTV) of its transactors and revolvers, Chase should aim to increase their spending and reduce their churn. Chase could encourage greater card usage by introducing more ways to earn points on the card, or by offering additional incentives in the form of rewards for spending a certain amount each month. By encouraging higher levels of spending, Chase might be able to turn revolvers into transactors.

Churners don’t renew after a year. They sign up for the card only to take advantage of the attractive introductory offer. As a result, they are unprofitable customers. Chase should discourage them from signing up in the first place, or attempt to turn them into profitable customers by cross-selling them some of its other bank products.

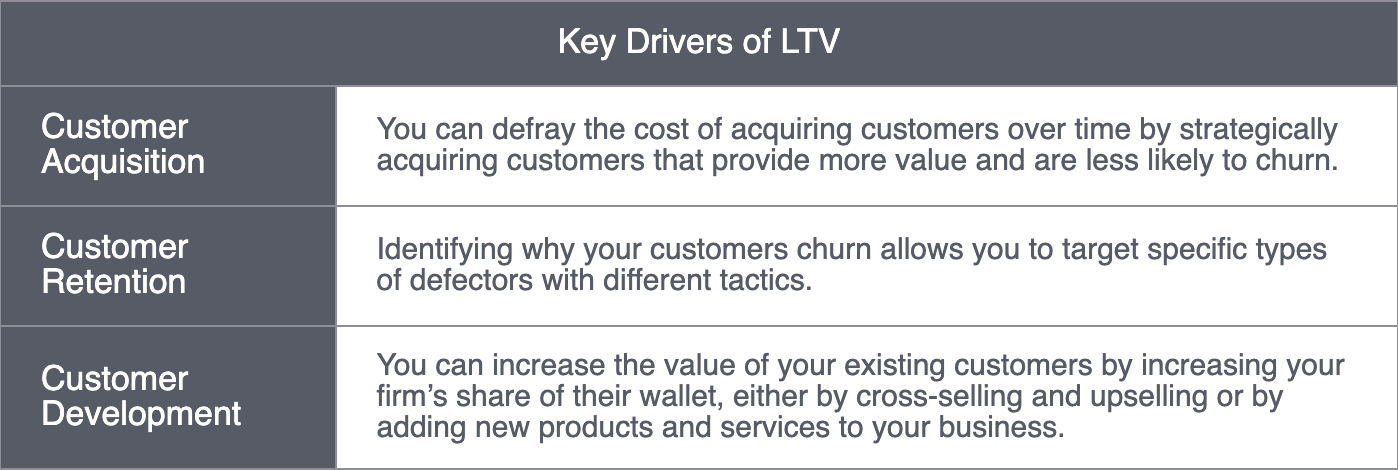

Drivers of Customer Lifetime Value

Were margin, churn, and customer selection among the factors you identified? These are the main variables we use to calculate the LTV of various customer groups. And we can use them to identify key drivers to improve LTV.

Firms can improve LTV by becoming more selective in who they acquire. They can improve churn by providing better service or retention offers. And they can improve margin by upselling or cross-selling.

With Chase, we learned that some customers are not worth acquiring in the first place. In the case of the Sapphire Reserve card, churners cost more to acquire than the value they produce for the firm. Chase would therefore be better off avoiding these customers in the first place.

One way that Chase attempted to ward off churners was their 5/24 rule. If a customer had opened five or more credit cards in the last 24 months, they were unlikely to be approved by the Sapphire Reserve card. Opening many credit cards in a short period of time indicated to the firm that customers could be taking advantage of sign-on bonuses and were more likely to close the account before the annual fee came due.

In another example, an insurance company whose customers only became profitable after 7 to 10 years discovered that the customers they acquired from ads in an offline channel were far less loyal than those acquired from word of mouth. This realization led them to stop advertising in that offline channel because it was attracting the wrong types of customers.

We also learned from the Chase case that even customers who paid off their balance in full and generated no revenue for the firm through interest became profitable if Chase retained them long enough.

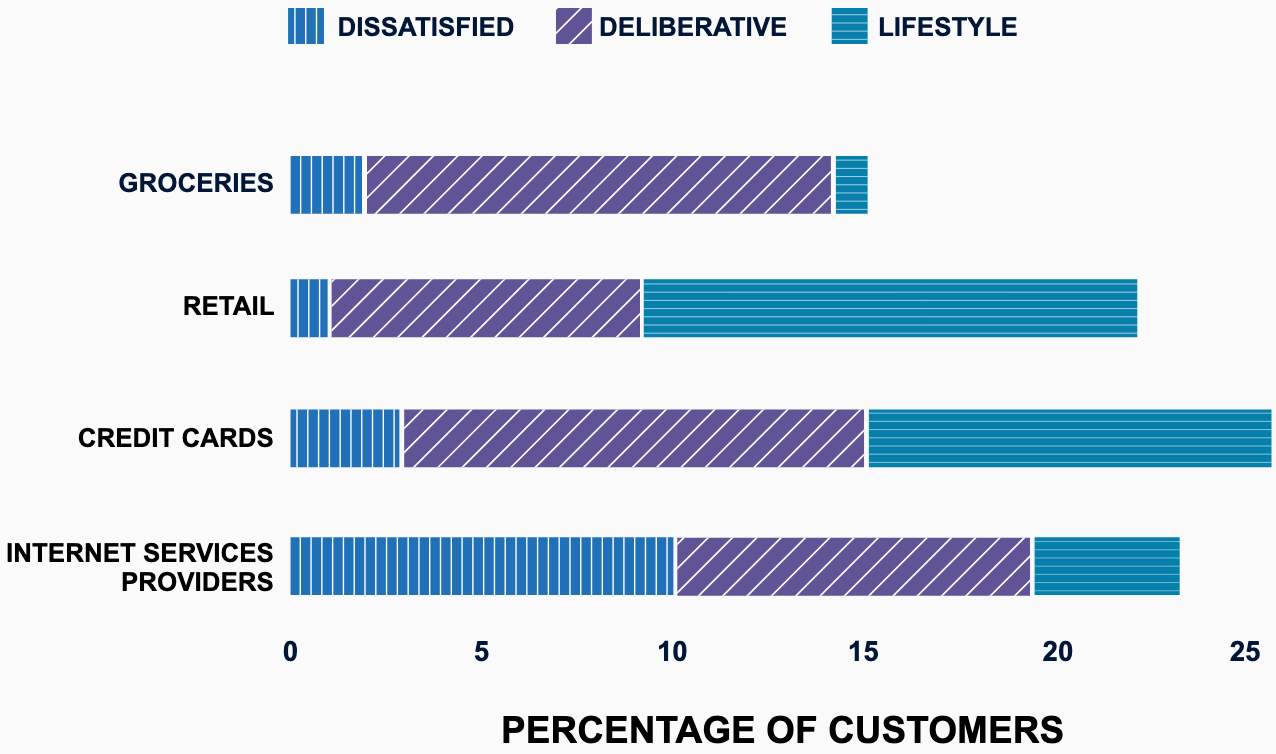

Understanding which of your customers are likely to churn and their reasons for defecting can help you reduce churn. A report by McKinsey & Company established three types of defectors:

- Dissatisfied switchers leave because of poor experience with the company.

- Deliberate switchers leave because of better options elsewhere.

- Lifestyle switchers leave for external reasons, like outgrowing their initial need. For example, a lifestyle switcher might not buy diapers after their baby no longer needs them.

Customer defection types can vary across industries. For instance, more than half the churn in retail comes from lifestyle switches, while grocers see much more churn from deliberate switchers.

Being knowledgeable about why customers churn can help managers be proactive in addressing these customers' needs. A better diagnosis can lead to more targeted measures of customer engagement.

Consider a product/service category with which you are familiar. State the category and answer this question: what strategies could firms in that category use to acquire the highest value customers?

Keeping that category in mind, which types of defection are most common within it? How could firms in that category anticipate the needs of defectors to reduce churn?

Finally, what methods could firms in this category use to increase the value they derive from their existing customers?

Acquiring and retaining customers is essential. But LTV shows us that firms must also work to develop these less valuable customers into more valuable ones.

Let's consider three ways that companies can increase the value of their existing customers.

The first is share of wallet. Two customers that both spend $1,000 on a Chase Sapphire Reserve card may appear to have the same LTV. But the bank's transaction data is missing an important element—competition. One customer may only use their Sapphire Reserve card, while another may spend $10,000 across several cards. In this case, Chase has 100% of the first customer's share of the wallet, while it only has 10% of the other's.

Estimating customer share of wallet is challenging. Companies rarely know how much their customers spend with competitors. Firms can use third-party data or customer surveys to get a better idea of their share of the wallet.

Secondly, companies can cross-sell or upsell. Once a company has a better idea of their customers' wallet shares, they can target their marketing strategies for cross-selling or upselling to these customers.

- Cross-selling involves marketing different products to existing customers. For example, Geico might sell home insurance to an existing auto insurance customer.

- Upselling involves selling premium products to an existing customer of a nonpremium product. For instance, Chase may attempt to sell the Sapphire Reserve card with an annual fee of $450 to a customer who currently has a Chase Sapphire Preferred card and pays an annual fee of only $95.

Upselling raises sales margin, while cross-selling has the additional benefit of increasing customers' brand loyalty and retention rates.

Finally, another strategy is to redefine the scope of your business. Organizations can foster growth by expanding into adjacent product and service categories. For example, U-Haul recognized that the rental truck market was becoming very competitive, and its margins were getting squeezed. The company realized that customers who rented trucks needed packing supplies. As a result, U-Haul decided to stock packing supplies that not only provided added service and convenience to its customers but also improved the company's margins.

LTV with Time Value and its Relationship with other Metrics

So far, we have ignored the time value of money, or the fact that a dollar today is more valuable than a dollar tomorrow. Think of the interest rate that you might get by putting money in a bank. Since LTV captures profits over many years, it's important to incorporate the time value of money in LTV calculations.

Let's illustrate this with an example from the streaming service Disney+. In 2019 Disney launched its streaming service, Disney+, at a price of about $7 for a monthly subscription or $70 for an annual subscription. By 2020, it had attracted 50 million customers globally.

Let's assume that after this initial burst of subscribers, Disney ran an ad campaign to acquire new subscribers. This campaign cost Disney $150 million and resulted in 1 million new subscribers. Let's further assume that each of these new subscribers generated $60 in annual revenue, net of discounts and promotional offers. Disney expects the retention rate of these customers to be 80%, resulting in a customer lifetime of five years.

For a digital service, the marginal cost of servicing an additional customer is minor. So we will assume that revenue is the same as margin in this case. We can use the simple LTV equation we used before. That is, LTV is equal to annual margin times the expected life of a customer. This gives us $60 times 5 years, or $300, as the LTV of a Disney+ customer.

However, this formula does not account for the time value of money. To account for this, we can add another variable to represent the discount rate. If we assume cost and margin m, retention rate r, and discount rate i, then LTV can be written as this geometric series.

The firm acquires customers at time 0, and the customer starts paying at time 1 and continues to generate margin m from that time on. To account for time value of money, we discount the margin of period 1 by 1 divided by 1 plus i, where i is the discount rate.

For example, if the discount rate is 10%, or 0.1, then $110 in year 1 is equal to $110 divided by 1 plus 0.1, or $100 today. If retention rate r is, say, 80%, then in year 2, we are left with only 80% of the customers, each of them providing us a margin m.

To get the present value of year 2 profits, we divide it by 1 plus i squared to account for compounding of discount rate over time. This equation is a geometric series that we can rewrite as m divided by 1 minus r plus i, or margin divided by churn rate plus discount rate.

Now you can try out calculating LTV accounting for time value. For our purposes, let's assume a discount rate of 10%.

Use the following data table to answer the question below.

| Ad Spend | 150 million |

|---|---|

| Customers Acquired | 1 million |

| CAC | $150 |

| Average Annual Margin per Customer | $60 |

| Retention Rate | 80% |

| Customer Lifetime | 5 years |

| Discount Rate | 10% |

Calculate the LTV of a Disney+ customer.

For Disney+, using a margin of $60 per year, annual retention rate of 80%, and annual discount rate of 10%, we get: LTV = $200

Note: LTV without discount rate is $300, 50% more than LTV after accounting for the discount rate. This highlights the importance of accounting for the time value of money in estimating LTV. This consideration becomes especially important if a company expects its customers to generate profits over a very long period of time.

You're now very familiar with several metrics that companies can use to measure the success of their marketing campaigns: Customer Acquisition Cost (CAC), Return on Ad Spend (ROAS), Return on Investment (ROI), and now Customer Lifetime Value (LTV).

Now let's review these metrics and examine how they are related.

Return on Ad Spend (ROAS) is calculated as revenue divided by ad spend. It measures incremental revenue generated from each dollar spent on ads. Return on Investment (ROI) is calculated as profit net of ad spend divided by ad spend. It measures incremental profit generated from each additional dollar spent on ads.

We can write ROI as:

ROI = (Profit - Ad Spend) / Ad Spend

Since profit is revenue times profit margin, we can rewrite ROI as:

ROI = (Revenue × Profit Margin - Ad Spend) / Ad Spend

Or:

ROI = (Revenue / Ad Spend) × Profit Margin - 1

Which means that:

ROI = ROAS × Profit Margin - 1

We used sales and profits from the immediate purchase, that is, those that occurred soon after the click on an ad. However, as we have now learned, we should use long-term profit that includes the profit from the future purchases of a customer. Including the profit from a customer's likely future purchases provides a more accurate picture of the return on money spent to acquire that customer.

Considering long-run profits, we can write:

ROI = (Long-run Profit - Ad Spend) / Ad Spend

If n customers are acquired at a cost equal to CAC per customer, and long-run profit of a customer is LTV without CAC, then:

- Total long-run profit = n × LTV

- Total ad spend = n × CAC

Therefore:

ROI = [(LTV - CAC) × n] / (n × CAC)

Which simplifies to:

ROI = LTV / CAC - 1

Entrepreneurs and VCs often talk about the LTV/CAC ratio and expect this ratio to be greater than 3 for a promising business.

Now that you know the relationship between LTV and other metrics, let’s complete our Disney+ example.

- Recall that Disney+’s LTV from the ad campaign was $200, and its CAC was $150.

- Also remember that ROI = (Profit – Ad Spend)/Ad Spend.

- If “n” customers are acquired at a cost equal to CAC, and the long-run profit of a customer is LTV (without CAC),

- Then total profit = n*LTV, and Ad spend = n*CAC

- Therefore, ROI = ...

Given a CAC of $150, this ad campaign is profitable. The LTV/CAC ratio for Disney+ is 1.33 and the ROI is 0.33.

Retention is a very powerful factor in the LTV/CAC ratio formula. If Disney+ can improve its retention rate from 80% to 90%, its LTV increases to $300, or a 50% increase.

Decreasing CAC could be another strategy for Disney to pursue, however, this may not be the best course of action as it is more difficult and costly to acquire new customers than it is to retain existing ones.

Customer lifetime value (LTV) is a powerful metric that managers can use to ensure that they are not simply delighting their customers, but investing in customers in a way that will continue to produce value for the firm in the future.

We learned that LTV depends on margin, retention rate, and discount rate. A simple way to estimate LTV is to divide margin by customer churn and discount.

We also learned that the key drivers of LTV are customer acquisition, customer retention, and customer development.

LTV requires robust customer data. In some industries, top-line revenue cannot be broken down and attributed to individual customers. In restaurant or retail settings, for instance, customers are often anonymous, making LTV calculation challenging.

In these cases, loyalty programs or customer identifiers like phone numbers can help.

Ideally, managers should calculate LTV at the individual customer level, but without individual-level data, LTV can be calculated at the customer segment level.

LTV allows companies to make strategic decisions such as how much to invest to acquire new customers, which customers the company should prioritize, and how to improve the profitability of customers.

LTV of customers provides a useful indicator of the overall health of a company and is often used by entrepreneurs, venture capitalists (VCs), and financial analysts.