Determining Value Proposition

Crafting a Digital Marketing Plan

Creating a Value Proposition

If you want to convince consumers to buy your product, you need to give them a compelling reason to purchase your brand instead of a competing brand. This argument to persuade the consumer is your brand's value proposition.

For example, when Amazon was launched, it offered three benefits to consumers. First, it provided the convenience of shopping from the comfort of your home without the need to go to a store. Second, Amazon offered a much larger variety of products because it did not have the space constraints of a physical store. And third, Amazon offered lower prices because it did not incur the fixed cost of maintaining a physical store. These benefits of Amazon evolved over time. And today you might choose Amazon for customer reviews or fast shipping, which are now part of their value proposition.

In general, you need to carefully think of two or three key benefits you can credibly offer your consumers that differentiate you from your competition. These benefits could be functional features, such as longer-lasting battery for a smartphone, or they could be more lifestyle or image-related. For example, you might not buy a BMW only for its functional benefits but also for the image that you want to project by driving that car.

Value proposition determines how consumers think of your brand compared to the competition. It is your brand's position in the minds of consumers. It can be easy to focus on the product features. But remember, brand is about the value you provide to consumers. This goes beyond the features of your product and focuses more on how your product solves their problems and meets their needs.

One simple framework to clearly articulate your value proposition is to write a positioning statement. This statement consists of four essential components. First, you must define your target audience whose needs you aim to serve, a topic we discussed earlier. Second, you need to articulate the unique value you provide to consumers. This value could be lower price, better quality, convenience of shopping, or intangible values such as image. These unique values form the basis for the message of your ad campaigns.

Third, you define the competitive set for your brand. This helps consumers establish a frame of reference for their purchase decisions. For example, should OOFOS consider other recovery shoe brands as their competition or all shoes? Ideally, this choice is driven by what alternatives consumers may be considering in addition to your brand.

Finally, the fourth component provides consumers reason to believe your brand's claims. Supporting evidence can come from patented technology, celebrity endorsements, or independent seals of approval.

Brand positioning statements often take this format:

For [target market], [Brand X] is the only brand that offers [unique value claim] among all [competitive set] because [reason to believe].

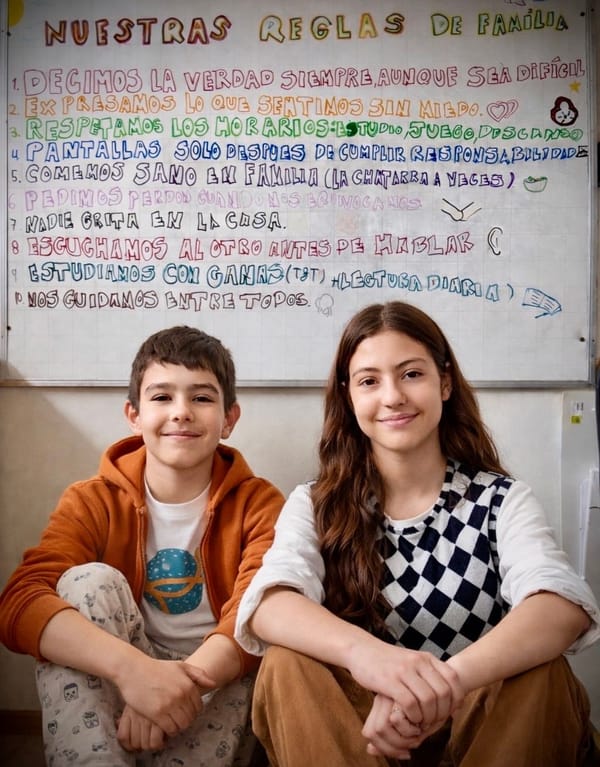

OOFOS is working to determine what it will emphasize when communicating its value to consumers. Lou Panaccione starts by describing OOFOS’s mission and how that mission plays into defining the brand’s value proposition.

Lou Panaccione: Our mission as a company is to make people feel better. Comfort is probably the most common word that people really gravitate to and understand. When they're experiencing footwear, to some level it's comfort, but I feel we go beyond comfort, because we're offering a way to make people feel better that they can't get with other comfort footwear type products.

Plantar fasciitis, I'll just pick that one as an example, because that's a very common ailment, unfortunately, among a lot of people. Plantar fasciitis, we're told from our customers, people can't get relief from plantar fasciitis with anything other than OOFOS. It's an ailment that it's difficult to get rid of it if anyone's had it. They step on a hard surface, you get out of bed in the morning and your foot's in pain.

Our foam technology with the way the footbed is designed is giving people more relief than anything else. Our value proposition is to make people feel better.

With a purpose to “make people feel better,” OOFOS needs to further define how it will position its brand. Recovery has been a key part of how it defined itself since the beginning of the company, when it put its shoes on the feet of Boston Marathon runners. This audience provided them with initial momentum.

However, many competitive brands are already positioned as lifestyle and comfort products, and the market for comfort and lifestyle is much larger than that of recovery. In a recent survey conducted by OOFOS, more than 80% of consumers mentioned comfort as the driving factor for their footwear purchase. In contrast, recovery is a relatively new category that most consumers don’t know.

Given that OOFOS is a small company, building a new product category of “recovery footwear” would be a significant challenge.

This is a tricky question for OOFOS. Comfort may seem like the more obvious answer, as many consumers tend to look for shoes based on comfort, so it is a category that many are aware of. But as you previously learned, this category is also crowded.

OOFOS may avoid this competition by focusing on the “recovery” category, but in choosing to go that route, it will need to spend significant resources making consumers aware of this new category of footwear.

The 3 Cs Model of Brand Positioning

Many consumers view OOFOS as a comfort brand, offering them a solid place in that category. However, OOFOS may not be able to differentiate itself as clearly from other brands if it centers its brand positioning around comfort. If OOFOS intends to create a new category of "recovery," it will need to be crystal clear on its positioning.

A framework that is often used to analyze the validity and potency of a value claim is the three C's model of brand positioning. This includes an analysis of your consumers, your competition, and your company.

First, let's consider consumer analysis. Is your claim relevant to consumers? Does it resonate with their needs? And is it a realistic solution to their needs? One way to think about this is by considering what job your product is doing for the consumer.

Innovation researcher Clayton Christensen used this question to improve the positioning of a milkshake for a fast food restaurant. He found that people, especially those with long commutes to work in the morning, did not buy milkshakes just for its nutritional value. It provided them a way to cope better with their boring commute.

Compared to a coffee or a juice, a milkshake lasted longer and could be enjoyed over the entire commute. It was less messy than a breakfast sandwich and easier to consume while driving. In short, it did the job of improving a commute better than other options. The product was relevant to consumers. It resonated with their needs, and it was a realistic solution.

Once the fast food restaurant identified this, they were better able to position their product.

Let’s take OOFOS’s position as a “recovery” shoe and analyze it from the point of view of its primary target audience, the Workout Warrior.

While OOFOS shoes may be relevant, resonant, and realistic for its target audience, the company must also determine how it can meet those needs better than the competition.

The Second C of Brand Positioning

The next important piece of defining your value proposition is to clearly differentiate yourself from the competition. Let’s turn back to e.l.f. and let Tarang Amin describe how the company communicates its unique value.

Tarang Amin: The core competitive advantage of e.l.f. is being able to bring the best of beauty, items you previously could only find in the prestige sector at very high price points, and make them accessible, as we say, to every eye, lip, and face, to a broad audience.

Historically, there were very good high-quality brands in our space if you think of prestige and a lot of the boutiques. On the other spectrum, there are some value brands but often lack, maybe, the quality of the higher-priced brands did. So the unique value proposition that e.l.f. offers is being able to get the best of beauty, things that previously you could only find in prestige at extraordinary values.

So I'd say that's one core advantage is the fundamental proposition.

I'd say the second is being a digitally native brand. Because this was a brand that was extraordinary value and started with an online community, inherently it was more disruptive to begin with in terms of our engagement model. So our engagement is 100% digital, very strong both socially in terms of bringing people to our site, how we're able to activate our community. That way, it was quite different from most of the other brands in our space.

The third core area of differentiation is we've spent 17 years to this day really building up an operations platform that gives us the best combination of cost, quality, and speed in our industry, married to an innovation approach where we can go from initial idea to selling online in as few as 13 weeks, about 20 weeks on average, over 100 launches a year.

And for context, many of the traditional players in our space can take two years to launch a new product.

To create an effective value proposition, you need to be able to explain how your product or service is different (and superior) to competitors. Let’s learn more about how to analyze the competition to make this differentiation clear.

After doing a consumer analysis, you will need to do a comparative analysis, an analysis of your product's value proposition against the competition.

In a competitive analysis, consider the three D's–is your value claim distinctive, defensible, and durable? Jerry Garcia, founder and lead guitarist of the Grateful Dead rock band, shared what it meant to be distinctive when he said, "You do not merely want to be considered just the best of the best. You want to be considered the only ones who do what you do."

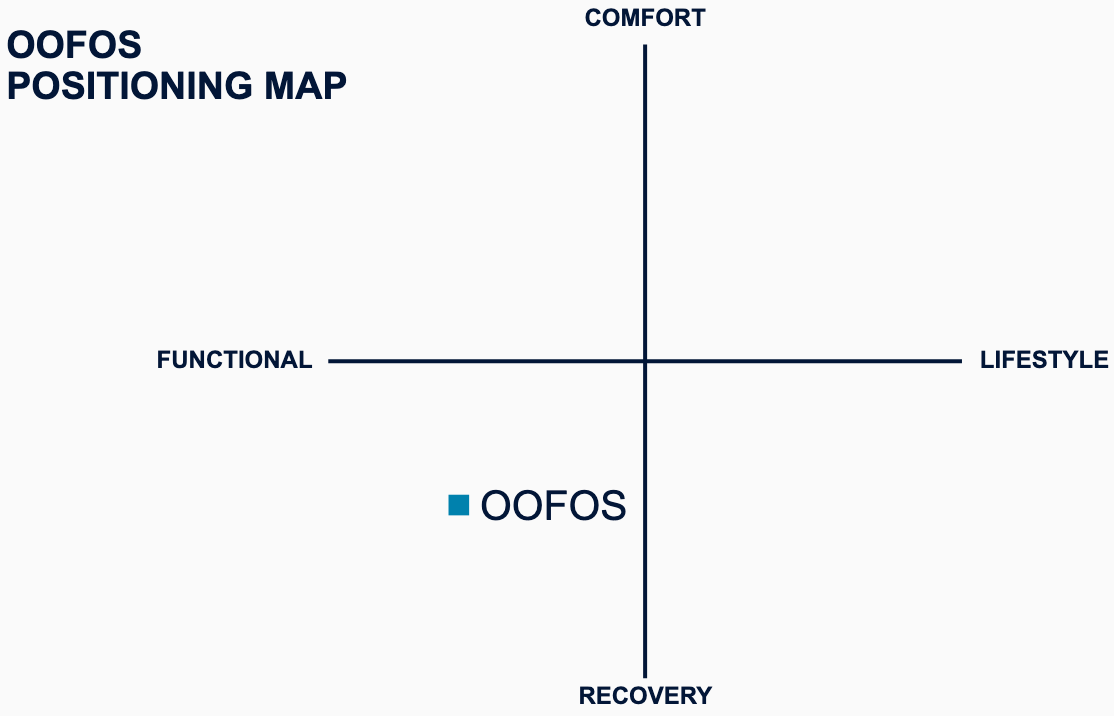

One way that marketers can determine the position of their brand is through a positioning map, which is a visual representation of how consumers view your brand compared to the competition.

For OOFOS, a positioning map may consist of two dimensions, comfort versus recovery and functional versus lifestyle. Most consumers use comfort as a key factor in their decision to buy footwear. And very few understand the term recovery. Although OOFOS is currently perceived as a comfort brand by many of its consumers, it wants to be associated with recovery. The company wants to build and own this "recovery" category.

OOFOS also has to decide whether to emphasize the functional aspect of its brand, in other words, the benefits of its foam technology, or create more of a lifestyle brand focused on fashion and style. As it decides how it wants to be perceived by its consumers, OOFOS first must consider how consumers perceive competing brands.

There are many brands in the comfort footwear segment–HOKA, Birkenstock, Crocs, Allbirds, and Clarks all have products in this area, as do Nike, Adidas, New Balance, and others. Some of these define themselves more as a lifestyle brand, while others present themselves as more functional. OOFOS is also starting to observe that HOKA, Crocs, Birkenstock, and Kane are moving into the "recovery" segment. However, this area is still much less crowded than the comfort segment.

While recovery is less crowded than comfort, OOFOS has limited marketing budget and low brand awareness. And it could be very difficult to create a new subcategory for "recovery" footwear. OOFOS will also need to consider what would happen if it builds the "recovery" category and big brands enter with their new products and large marketing budget.

To differentiate itself from competitors, OOFOS will need to determine if its claim as a "recovery" footwear is distinctive, for example, with its unique foam technology. It must also determine whether this claim is defensible, that is, whether it has the resources to occupy and hold this position. And finally, OOFOS must determine if this claim is durable and will stand the test of time.

Here is the positioning map that OOFOS created to help determine its value proposition:

Is OOFOS’s value proposition distinctive, defensible, and durable? A major distinctive aspect of OOFOS’s value proposition is its unique foam technology that provides superior recovery benefits to its customers. This claim is defensible based on the research OOFOS has conducted with independent third-party experts. Steve Gallo mentioned that lab tests have shown OOFOS foam to be 37% more impact absorbing than any other athletic foam. Finally, the value proposition is durable because OOFOS technology is a proprietary asset that competitors cannot copy.

Whether OOFOS should develop the "recovery" category itself or wait for others to create this category is a question of whether it should focus on creating primary or secondary demand.

Primary demand involves creating demand for a product or service category that does not currently exist. While secondary demand is about creating demand for a particular brand by gaining share in an existing product category.

There are advantages and disadvantages of each approach. Focusing on secondary demand allows you to leverage consumers' familiarity with a category. For example, if OOFOS decides to focus on comfort, it won't need to persuade consumers that comfort should be an important factor in their purchase decision. However, it will have to work hard to distinguish itself from competing brands that also claim to produce comfortable shoes.

Pharmaceutical giant Eli Lilly faced a similar decision in 2002 when it was planning to launch Cialis to treat Erectile Dysfunction, or ED. At the time of the Cialis launch, Viagra was the only player in the market. Since its launch in 1998, Viagra had created very high awareness for its brand. And by 2002, it was used by 3 million men in the US, who were generally satisfied with the drug.

However, studies showed that 27 million men in the US, who suffered from ED, were not using Viagra. Eli Lilly faced the decision of whether it should create primary demand for 27 million men who were not using any ED drug, or it should try to build secondary demand by taking share from 3 million people who were currently using Viagra.

If it chose to create primary demand, Eli Lilly would need to educate 27 million men about ED and its treatment. This could be a challenging task because a large fraction of men who suffered from ED either considered it a temporary problem related to stress and anxiety, or they felt it was a normal part of aging. Moreover, most men were hesitant to discuss this problem with their spouses and physicians.

If Eli Lilly decided to focus on secondary demand, it would have to convince 3 million Viagra users to switch to Cialis. While Cialis was effective for 36 hours after it was taken, compared to four hours for Viagra, its management wondered whether it would be enough to convince physicians and Viagra patients to switch.

Eli Lilly concluded that it would be challenging to create primary demand. Many non-users of ED drugs were either unaware or in denial and therefore, convincing them to take any ED drug, including Cialis would be difficult. After all, it took almost four years for Viagra to convince 3 million ED patients to take its drug.

Therefore, it decided to focus on generating secondary demand to persuade Viagra users to switch to Cialis. However, instead of highlighting that the effects of Cialis last for 36 hours compared to 4 hours with Viagra, Cialis decided to focus on the consumer benefit of this long duration. Viagra marketed itself as a drug for men, but Cialis focused on the relationship between couples by claiming that its long duration allowed people to find the right time for intercourse.

This strategy proved to be successful for Cialis and many of Viagra’s existing users switched to Cialis. By 2013, Cialis had over $2 billion in global sales and surpassed Viagra as the leading drug for ED.

OOFOS is facing a similar challenge. Should OOFOS create primary demand, or should it focus on secondary demand in the comfort segment?

Ultimately, OOFOS decided to focus on creating primary demand for a new recovery category. The company felt confident that its foam technology offered a unique benefit to achieve this goal and establish it as a leader in this new category before major competitors entered with a similar claim.

Robin Cohen, who works with OOFOS at Rain the Growth Agency, is both excited and optimistic about the possibility of creating a new category. However, she emphasizes how important it is for a company in this position to clearly differentiate itself from the competition.

Robin Cohen, Rain the Growth Agency, EVP Integrated Media Investment and Planning:

My name is Robin Cohen. I'm the executive vice president of the Integrated Media Investment and Media Planning practices at Rain the Growth Agency.

A lot of brands come to us with the idea of looking to create a new category. It's something as an agency that we experience quite a bit, and it's something we're excited to do. And we've seen examples of this with Chewy, which was a pet food company. It was the first to market pet food company that was direct-to-consumer.

We saw this with Peloton, where similarly to OOFOS, they were creating a category that was similar to something that existed, but it was about virtual at-home cycling experience.

And with OOFOS, it's a similar thing where they truly have a differentiator in the marketplace, and we believe in that differentiator. So we do think it makes sense to really own something that's very specific. And even if it's a category that seems very competitive, if you have something that's ownable, it can really grow and scale quite rapidly.

The Final C of Brand Positioning

Finally, let’s discuss the final “C” of our positioning framework: company analysis.

We've discussed how we can conduct a consumer and competitive analysis in order to determine your value proposition. The final C is company analysis.

Here you should consider three F's: Is your value proposition feasible, favorable, and faithful to the company?

In order for a claim to be feasible, it must be something the company can deliver to its consumers. If a company claims to be green, for example, it needs to consider not only if its product is made with sustainable materials but also if its entire supply chain can deliver on that claim.

For a valid claim to be favorable, it must be viewed positively by its consumers and generate positive returns for the company. If a company wants to position itself as green, it needs to ensure that consumers prefer green products. The company may also need to change its operations to align with this value claim, which may create additional costs that may not be favorable for its overall profitability.

Finally, a company must be faithful to its value claim. For a company to claim being green, it must ensure it can deliver on this claim at all levels. For example, when Chevrolet touted its Tahoe as a green sports utility vehicle, consumers quickly lambasted the company for the car's low gas mileage and lumbering weight.

As you work to create a value proposition, remember, a brand's position is not just defined by the brand itself. A brand co-creates its position with its consumers as they interact with each other and react to emerging cultural trends.

OOFOS has decided to establish its value proposition as a “recovery” product. Is this decision feasible and favorable for the company? Can it be faithful to the claim?

Let’s finish with some closing thoughts about OOFOS’s value proposition from Steve Gallo and Bianca Reed.

Steve Gallo: OOFOS stands for making people feel better. It's not just another piece of footwear. It is something that helps people with pain, people who understand the importance of recovery, as we've done a lot of research around the impact that OOFOS has had on recovery. You know OOFOS is different from just the normal, comfortable shoes. When you do try it on, there's something there where it takes the pressure off you. You actually can walk easier. And we're in the process of trying to prove that. We don't play into the comfort idea within our marketing.

Bianca Reed: I think for OOFOS, they're creating a category. "Active recovery" is a new category for the footwear marketplace. But what was different about OOFOS was their proprietary technology. And when we saw their proprietary technology, the actual impact it has on recovery, that was a big differentiator for us. And it was worth it to look at, that's a potential that someone will need and something that will scale in the future.

OOFOS has chosen to lean away from comfort because comfort means a lot of different things to people. But when it comes to recovery, that is something different in the space. So many brands lean into comfort. "Active recovery" is new. It is the harder lift on us as an agency to introduce a new category because I think that's a unique thing that people seek when they're like, I want to be able to recover and not just sit down and do it. I want to be able to keep my life going and recover.

OOFOS has decided to focus on recovery instead of comfort, and on the functional benefits of their products instead of building a lifestyle image. What are the potential benefits and challenges of this positioning?

Now that you have considered how to set your marketing objectives, defined a target audience, and created a value proposition to shape your brand’s message to your audience, we can turn to the fourth piece of the marketing plan: metrics.

Metrics play a critical role in a marketing plan to measure the success of your campaigns and to evaluate whether or not you have achieved your goals. Now, you’ll become familiar with various metrics and how they can be used in a marketing plan. In the next article, you will learn how to select the best ones to match your objectives.