DTC Brands: Fad or Disruption?

Marketing in the Digital Era

Learning Outcomes:

- Explain how digital technologies and innovations introduced by direct-to-consumer (DTC) brands have reshaped marketing practices in the last decade.

- Describe the risks and challenges of certain direct-to-consumer marketing innovations; explain why certain traditional marketing practices should stay in place.

- Discuss how incumbent brands should reshape marketing practices to compete with new entrants.

The world of marketing is constantly changing, and that's why I'm so excited about this topic. For decades, brands advertised on television and sold their products in retail shops. But this changed with the emergence of e-commerce, especially with the launch of Amazon in 1994. Then came Google in 1998, Facebook in 2004, and iPhone in 2007.

These technologies completely changed the way consumers connect with brands, how they search for information, and how they buy products. These seismic changes, in turn, had a huge impact on how we do marketing. They are the reasons digital marketing has become an integral and important part of every company.

This article series will help you understand these major shifts in consumer behavior and the fundamentals of how to acquire new customers, engage with your current customers, allocate your marketing budget, measure the effectiveness of your marketing spend, and ultimately, create and capture value.

We will use a variety of case studies across different industries to highlight some of these key concepts. We'll also use frameworks and tools to help you make these digital marketing decisions. You will witness digital marketing in action as you observe how companies today make critical decisions about marketing in an ever-changing landscape.

You will work through six parts in this article series:

- How marketing has changed in the digital era

- How to craft a digital marketing plan

- How you can acquire customers using paid media

- How you can acquire customers using owned and earned media

- How you can engage and retain customers

- Deep dive on measurement and budget allocation issues

We will end the series with a look at the future of marketing and what this means for you.

It is likely that you experience marketing every day. You may encounter ads on your phone or while you stream videos; you may encounter influencers promoting products or read product reviews online.

These are all forms of marketing that we will cover. Take a moment to reflect on how you encounter ads or other forms of marketing in your daily life.

The field of marketing has gone through profound changes in the modern era. We’ll begin by looking at some of the economic and technological shifts that laid the groundwork for the modern practices of marketing.

The Rise of DTC Brands

To get us started thinking about the economic and technological background of modern marketing, let’s consider a few examples.

In 2010, Dave Gilboa and Neil Blumenthal cofounded an online eyewear company called Warby Parker, which as of early 2023 is valued at $1.39 billion. Before Warby Parker, virtually everyone bought their eyewear in stores. Warby Parker challenged the industry by selling them directly to consumers. And since the launch of Warby Parker, hundreds of direct-to-consumer (DTC) brands have emerged in the market.

By selling directly to consumers, these DTC brands bypass retail channels. Instead of traditional advertising through television and print media, they utilize digital and social marketing tools to acquire and engage consumers. And even with limited budgets, they are able to challenge large, established traditional brands that have been dominant in their industry for decades.

This is what happened when a DTC startup took the world's number one shaving brand, Gillette, by surprise. In 2010, Gillette was a dominant brand with almost 70% share in the U.S. men's razor blade market. It spent hundreds of millions of dollars in R&D and marketing to build a strong position that allowed it to charge premium prices. A pack of Gillette cartridges would cost consumers $20, even though it cost Gillette only $0.50 to produce them. It seemed impossible to unseat such a large brand with deep pockets.

All this changed in January 2011 when entrepreneurs Michael Dubin and Mark Levine met at a party and shared their frustration with overpriced, overengineered, and overmarketed razor blades. They were tired of getting ripped off, and they knew others were too. So they created a subscription service known as the Dollar Shave Club. Offering free shipping and no commitment, they launched their simple blades online.

With no stores and no intermediaries, they shipped their products directly to consumers. And instead of spending millions of dollars on traditional advertising, they launched their company with a promotional video on YouTube. Within two days, they had nearly 12,000 subscribers. And in three years, they went from $4 million in revenue to $154 million. During this time, Gillette's share plummeted from 70% to 54%.

After seeing the success of Dollar Shave Club, Unilever bought it for $1 billion. And in 2019, P&G, the parent company of Gillette, wrote down the value of the Gillette brand by $8 billion.

DTCs, or “direct-to-consumer” firms, sell directly to consumers, bypassing intermediary retailers. Traditional brands, on the other hand, work in the following way:

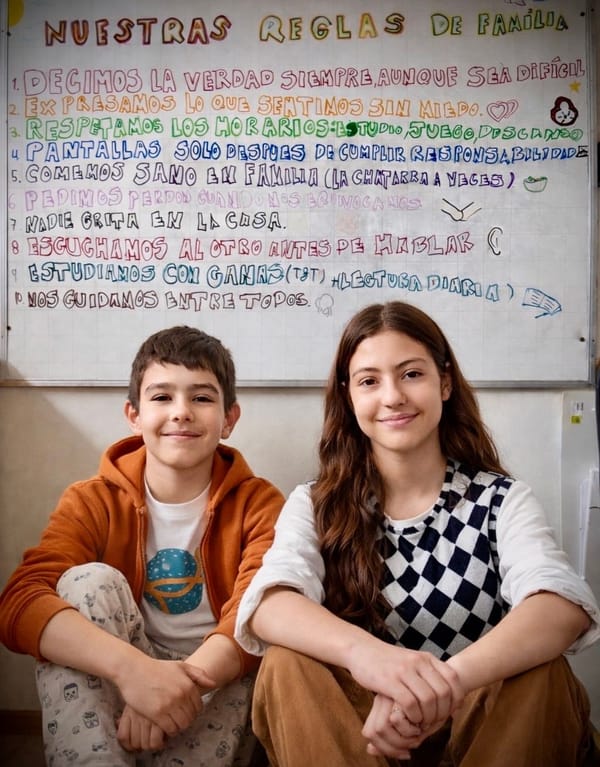

To help us understand the rise of DTC companies, let’s meet the founders of one direct-to-consumer company, who will share with us what their endeavors have taught them about marketing in the digital era.

In the following video transcript you will meet the founders of Pattern Brands: Nick Ling, CEO; Suze Dowling, CBO (Chief Business Officer), and Emmett Shine, CCO (Chief Communications Officer).

Nicholas Ling, Pattern Brands, CEO:

So I'm Nick. I'm CEO and co-founder of Pattern Brands. And I've really immersed my last decade of work in innovation and consumer goods. Before I was doing that, I was actually an HBS MBA student. What I loved about joining my first company out of HBS, which was Gin Lane, was that we were building brands that mattered to me and were things that I felt myself as well in my day-to-day life. Over the course of five or so years, me and my two co-founders, Susan and Emmett, built Gin Lane as an agency really centered around the direct-to-consumer revolution we're talking about today.

Emmett Shine, Pattern Brands, CCO:

Hello, I'm Emmett, currently co-founder at Pattern Brands. Prior to that, I was co-founder of Gin Lane. In Gin Lane, we focused a lot on digital-first branding, marketing, and web building. Going back to the early 2007, 2008, to 2010 or so, Warby Parker, Bonobos, Everlane, and the such reached out to us to build these presences, and a lot of the work we had done for some of the more progressive fashion brands online. And that really parlayed us into primarily doing a lot of start-up work, which then, as we got deeper and deeper into that, we saw an opportunity to do something more, which we turned into Pattern.

Suze Dowling, Pattern Brands, CBO:

Hi, I'm Suze. I'm one of the co-founders and chief business officer at Pattern Brands. I really oversee our brand management, our growth, and operations. We currently have four brands in the Pattern family, and they really all focus on finding a sense of enjoyment within that daily life at home. For us, it's really about those little micro moments in your day and how can you make them just a little bit better.

So our products range from kitchen tools and utensils, to home storage and organization, and home decor essentials. But we've really found a way to, I think, personify the brands in all of the small details in the way we develop their brand voice, in the way we develop their visual identity elements, and ultimately, in the way we market those brands.

Pattern Brands focuses on activities that foster daily enjoyment at home, such as cooking, organizing, and maintaining a space. Its brands cover four categories: kitchen, bathroom, stationery, and organization of home space. Its current brand portfolio includes:

- Kitchen

- GIR (Get It Right): colorful, easy-to-clean kitchen tools

- Equal Parts: non-toxic cookware for home cooks

- Yield: glassware with a focus on coffee-related items (such as French presses, cups)

- Bathroom

- Onsen: bath towels and robes

- Stationery

- Poketo: colorfully patterned objects with a focus on stationery

- Home organization

- Open Spaces: home storage solutions (such as bins and baskets) with a minimalist design

- Letterfolk: gifts and home décor, often with a personalized touch

Pattern Brands, as a small company, will face challenges in competing against established competitors that already have broad name recognition.

But Pattern Brands, like other DTC brands, has some unique characteristics and advantages that allow it to compete effectively against bigger companies.

To explore DTC brands further, let’s introduce a second brand whose digital marketing efforts we will examine. Perfect Diary is a China-based DTC beauty company.

A powerful tool for DTC brands has been their ability to reach their consumers directly through social media. By leveraging social media, a DTC beauty brand, Perfect Diary, was able to emerge as the second-largest cosmetic brand in China. Perfect Diary was able to do this within five years of its launch in 2017. Let's examine how the team accomplished this.

Perfect Diary's founder David Huang had a lot of experience in the beauty industry. He had worked as a market research manager at Procter and Gamble on their Olay and SK-II brands. Later, he joined a Chinese online beauty company while he was still a student at Harvard Business School. Huang spent five years at the company, becoming vice president in charge of sales, marketing, and supply chain. With experience in both traditional and DTC beauty companies, he felt confident to launch his own brand in China.

Let's learn from David Huang as he shares Perfect Diary's value proposition and what made it successful in such a short period of time.

David Huang, Perfect Diary, CEO:

Perfect Diary in Chinese is very easy to remember. Its daily products will become your daily routine and help you look good and feel good every day.

This value proposition is what we think is broad enough to be appealing and resonating to the young generation of consumers.

I think the vision going back to day one, where we founded the company, we wanted to create the next generation of the beauty platform.

In the past five years, what we have done is leverage the Perfect Diary brand to set up the digital infrastructure and now what we are doing is we leverage the digital infrastructure to duplicate the success of Perfect Diary.

So that's why we expand our brand portfolio from one brand in 2019 to eight brands right now.

So we have three color brands and five skincare brands. And so the more brands we have, the higher efficiency we are having for the infrastructure.

And then we see that's the future of the company.

Huang's vision was to create Perfect Diary to appeal to the younger generation of consumers. Despite this vision, however, initial sales were weak.

He and his team began studying where the youngest generation of consumers, Gen Z, were spending their time and how they were making decisions to buy from brands. The team observed the increasing importance of social influencers for these young consumers.

In 2017, the role of influencers in brand marketing was still limited, but Huang saw the trend and decided to invest heavily in these influencers, which Perfect Diary calls key opinion leaders or KOLs.

Within a few years, the company worked with over 15,000 KOLs and developed content and analytical tools to maximize the impact of these KOLs. Sales accelerated rapidly and in 2020, three years after its launch, Perfect Diary's parent company, Yatsen, went public on the New York Stock Exchange at a valuation of almost $7 billion.

Through its innovative use of Chinese social media and influencers, Perfect Diary had risen to the top.

Dollar Shave Club, Pattern Brands, and Perfect Diary are just a few examples of many DTC companies that have emerged in recent years.

You might be familiar with some of these DTC companies which took advantage of the rise of e-commerce and new ways of reaching consumers through social media.

Bonobos, a clothing company founded in 2007, recognized that many men don't like shopping for clothes and have trouble finding the right pants. Their solution was to develop an exceptionally well-made and well-fitting pair of pants sold online. The company grew, and in 2017, it was acquired by Walmart for over $300 million.

Another example of a DTC company is Allbirds, created by Tim Brown, a former professional soccer player from New Zealand. Brown introduced a simple shoe made from sustainable materials that gained significant traction in a market dominated by Nike and Adidas.

DTC brands are being launched all around the world.

In India, two young entrepreneurs started a DTC company in 2016 to sell connective cables and chargers for mobile phones. Within a few years, they expanded their product portfolio to include wired and wireless headphones and smartwatches and branded their products as BoAt lifestyle. In 2022, within five years of its founding, the company became the fifth-largest wearable device company in the world behind Apple and Samsung.

These are just a few examples of entrepreneurs who entered well-established markets dominated by large global players, yet managed to gain a substantial foothold in the market within a short period of time.

While not all DTC brands have been successful, many have done very well. Some of them have been acquired by large global companies like Unilever.

These DTC brands have emerged by exploiting the shifts in how consumers engage with brands through digital channels and online communities and how they shop through e-commerce.

As DTC companies engage through digital means, established companies are also considering how they should market in these digital channels to compete.

First, we'll focus on these shifts, how these brands have been built, how they change some aspects of products' value chain, and examine how these shifts change the practice of marketing.

Then we will consider how traditional brands should respond to some of these changes to remain competitive.

DTC Brands: A Fad or a Disruption

You’re now familiar with some DTC companies that rose quickly to success. But how exactly has the emergence of DTC companies changed the competitive landscape? Nick Ling shares his perspective on the rise of DTCs.

Nicholas Ling:

I think about two big things when I think about the rise of DTC brands, especially in the first phase of that happening.

One is that there was a new generation of consumers coming into a phase of their life where they were looking for brands that fit with their values rather than previous generations' values.

To us as millennials, things like sustainability and being good for the world, good for people, and good for the environment were really important buying decisions where maybe for previous generations those weren't quite as important for whatever reason.

Warby Parker, Harry's, Bonobos—all these different brands that were created really reflected the values of the consumers they were selling to, which were kind of millennials and the experiences they were going through. That voice and that brand experience which was created was a large part of this.

I think that brand creation was enabled by the injection of technology into consumer experiences.

So, suddenly, as an entrepreneur starting a brand, I can immediately reach the entirety of the U.S. through e-commerce websites, through Facebook, through Google.

I can develop my product through partners in China, when before I had to go through big retail networks and advertise on TV. There were really massive barriers to entry for people creating new brands.

There was one component, which is a new type of brand for a new generation, but two was that it was able to be created by entrepreneurs just because of the advent of technology that happened in 2008, 2015 and that's continued at a pace from then onwards.

While many DTC brands such as Perfect Diary, Dollar Shave Club, Warby Parker, and Allbirds have enjoyed success, others have stumbled. The valuation of many DTC companies, such as Casper or Glossier, has also come down dramatically because of increasing competition from similar DTC brands.

We will explore this question in the articles to come.