DTC Brands: Innovations and Challenges - Part 1

Marketing in the Digital Era

Customer Insight

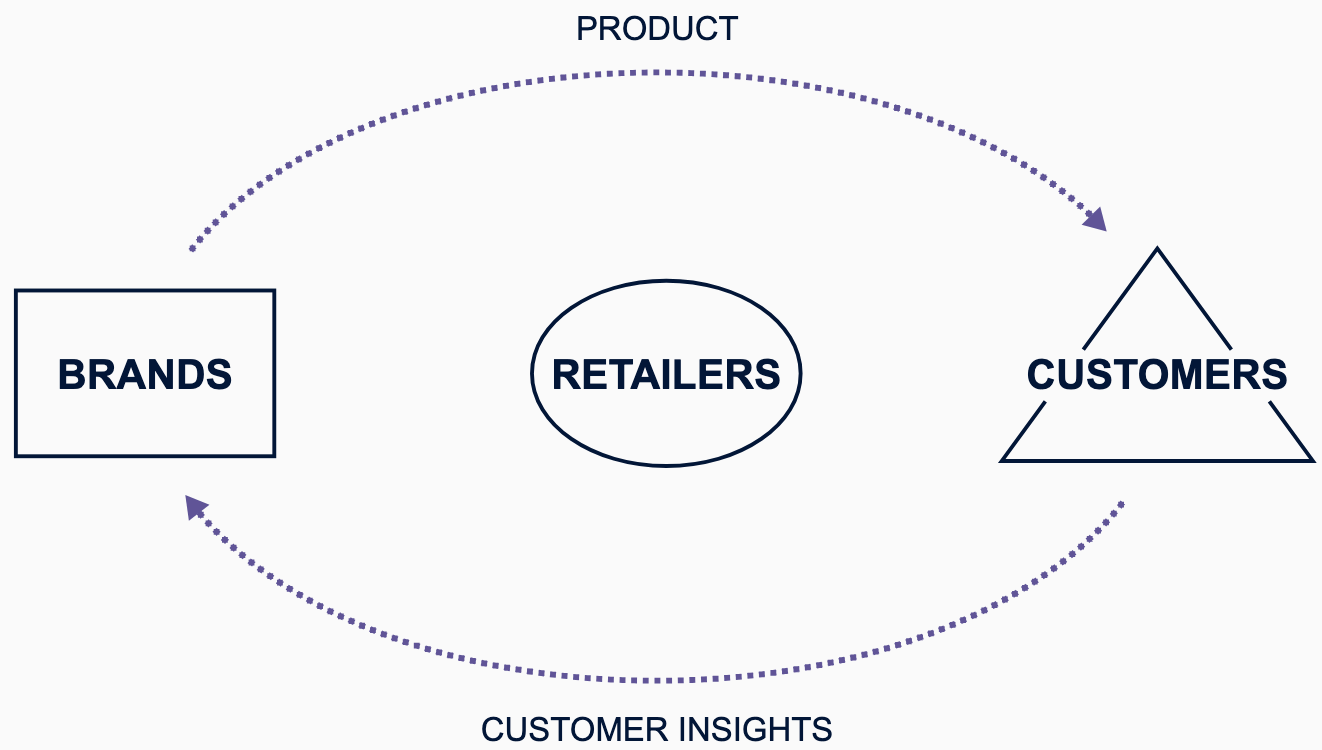

To understand whether DTC brands represent a broader shift in marketing, we will examine how these companies operate by deconstructing their value chain.

The value chain refers to the specific progression of activities of a business in delivering a good or service to its consumers. Understanding how DTC companies add value to their products at different points in the process helps us understand how the digital era is changing the ways that companies design, create, and, most importantly, market their products.

Let's examine the various stages of the value chain. These stages include the way companies get customer insights, do R&D and design products, manufacture products, market and distribute them, and create great customer experiences.

We'll assess how traditional brands have historically approached these functions and learn how DTC businesses approach them differently. This way, we will be able to evaluate the pros and cons of both approaches.

We'll start by examining how DTC brands gain insights about the behavior and preferences of their customers. We'll focus on two DTC brands you just met—Pattern Brands and Perfect Diary—and how they obtain insights about their customers using methods that are very different from those historically used by traditional brands.

Taking a value chain approach will give us a detailed understanding of the innovations that DTC brands have introduced at each step and how they have affected the practice of marketing. Let’s begin with the first stage of the value chain: customer insight.

David Huang will discuss how Perfect Diary thinks about customer insight by focusing on consumers’ online behavioral data, and Nick Ling remarks on how Pattern Brands obtains consumer insight.

David Huang:

So the way we do to get the consumer insights is based on the big data and then everyday data, and the behavioral data. So it's not a qualitative or quantitative market research. It's more based on the real actions consumers are taking.

To give you an example, if we ask a consumer what is your skin needs, and normally, they will give you a laundry list about anti-aging, wrinkle-removing, like whitening, hydration, moisturizing. So every time you ask them, basically you are getting the same list.

However, if we monitor consumers' behavior online, and then we try to analyze, when they are talking about an anti-aging, what kind of specific benefits are they looking for?

So for anti-aging, there are a lot of second-level benefits, like wrinkle remover or just fine lines. Or are you looking for firming benefit? And even for the firming benefit, what kind of age are you? And then what kind of KOLs are you following? And what kind of philosophy are you having?

So with all those data, we get those insights faster and at higher accuracy.

On the other hand, the way we get the consumers' data also enables us to foresee what kind of product will become popular in the future. Because when we have the consumers' test offline, normally, we will get a qualitative data coming back maybe three months or six months.

However, if we are doing that every day, every week, the model can tell us what kind of active ingredients or what kind of benefit space is getting higher popularity.

So that's why we can always capture the early stage of the consumers' rising needs. And that's why our products are innovative in the market. And that's why consumers think our brands are innovative, always leading in product innovation.

Nicholas Ling:

Yes. So in terms of how we came up with that insight, I think these things are a mixture of quant and qual. Some of it's feel and then some of it's research.

I think good entrepreneurs and founders build something that they need for themselves, and they want to build for themselves, right? So that could be building a space company if you're Elon Musk.

For us, it's building a company that reflects our day-to-day lives and things that we were facing as a group of people ourselves.

And I think that's the foundational origin of this, that all of us were feeling a bit scattered in our lives, right? Because of working too hard, all the things around you in New York City. And we were looking for that sense of calm that home gives you.

From there, we went out and talked, surveyed, and tested with thousands of other people who would fit into that millennial age group to say, was this a company worth building or not?

I think it was those insights at the individual brand level that caused us to move forward with building the business.

| Perfect Diary | Pattern Brands | |

|---|---|---|

| Method for gathering insight | Careful monitoring of consumer behavior and purchase data | Personal insight mixed with survey data |

Traditional brands have often gathered customer insight by doing focus groups and surveys in large random samples. These surveys can be done online or with paper and pencil, but the idea is the same. You are getting information on people's intent to buy your product. This method can be time-consuming and expensive.

Let's contrast that with the way DTC companies gain customer insight.

David Huang mentioned that instead of relying on consumers' intent, Perfect Diary monitors consumers' actual purchase behavior. This provides the company with a quick and more accurate view of consumer preferences.

Nick Ling suggested that the idea of Pattern Brands emerged from the founders' own frustration and stress of daily life. The founders of Bonobos, Dollar Shave Club, Harry's, and Allbirds all started from their own frustration as consumers that led them to form hypotheses on how to solve these problems.

One approach DTC companies take to test an idea or a hypothesis is to launch a website even before they create their product.

This is what Harry's did. The company created a site for its razor, asking people to sign up if they were interested. Harry's hadn't made the product yet. It was simply gauging consumers' interest. It encouraged people to share the campaign with their friends on social networks to get free products. Within a week, 100,000 people signed up. This gave a strong indication to Harry's that there was consumer interest in the product without the company having to spend its resources creating it first.

Another approach is to use Google Search and Amazon purchase data. Google search is a great tool to get a sense of what is trending in consumers' minds and what they are looking for in real time. Amazon purchases can give you information about consumers' purchase trends and reviews.

Google & Amazon Purchase Data

Google Search and Amazon purchase data can be used in various ways for business, marketing, and personal purposes. Here are the primary use cases and tools to access and analyze this data:

Use Cases

1. Market Research: Analyze trends, customer preferences, and popular products by examining search queries and purchase patterns to identify market gaps or trending niches.

2. SEO: Leverage Google Search data to identify popular keywords, optimize website content, and improve organic search rankings.

3. Product Development: Use Amazon purchase data to understand customer demands, helping design products that align with market needs.

4. Advertising Campaigns: Both Google Ads and Amazon Ads allow targeting audiences effectively using search and purchase data to focus on users with high buying intent.

5. Competitive Analysis: Analyze competitors’ positioning and strategies by monitoring trends and purchase data within your industry.

6. E-Commerce Optimization: Use Amazon purchase data to improve inventory management, pricing strategies, and customer reviews.

7. Personalized Marketing: Combine search and purchase data to create targeted email campaigns, personalized product recommendations, and retargeting ads.

8. Customer Insights: Use aggregated search and purchase data to understand customer demographics, preferences, and buying behavior.

9. Predictive Analytics: Apply this data for forecasting demand and sales trends to enable better planning and resource allocation.

10. Academic or Policy Research: Analyze societal trends, economic behaviors, or technological adoption by using anonymized data.

Google Tools

1. Google Trends: Analyze search query popularity over time and by region to identify seasonal or emerging trends.

2. Google Ads Keyword Planner: Research keywords, search volume, and competition to optimize paid ad campaigns and SEO strategies.

3. Google Analytics: Track website traffic, user behavior, and conversion metrics to improve user experience and performance.

4. Google Search Console: Monitor website performance in Google Search, including click-through rates and impressions.

5. Google Data Studio: Create interactive dashboards and reports for visualizing trends and insights.

6. Google Discover & People Also Ask: Gain insights into related search topics and user questions for content development.

7. Google Surveys: Collect direct consumer feedback for targeted market research.

Amazon Tools

1. Amazon Brand Analytics: Access customer behavior, search terms, and competitor insights to optimize product listings and ad targeting (Brand Registered sellers only).

2. Amazon Search Term Report: Analyze search terms driving traffic to your products to refine campaigns.

3. Amazon Advertising Console: Manage and analyze sponsored ads to optimize spend and targeting strategies.

4. Amazon Selling Partner API (SP-API): Retrieve detailed selling data programmatically for automation and advanced analysis.

5. Jungle Scout: Analyze product niches, estimate sales, and track competition to find new opportunities.

6. Helium 10: Conduct keyword research, track rankings, and manage Amazon SEO for better visibility.

7. Amazon Vendor Central/Marketplace Analytics: Access reports to monitor purchase orders, inventory, and sales trends.

8. Amazon A/B Testing (Manage Your Experiments): Test product titles, images, and descriptions to optimize conversion rates.

9. Amazon Insights (Customer Reviews): Monitor customer reviews to improve product quality.

10. Amazon Retail Analytics (ARA): Deep insights into sales and performance for Amazon Vendors to monitor demand and stock levels.

Additional Tips

Both Google and Amazon offer APIs like Google’s Custom Search JSON API and Amazon’s SP-API for developers to integrate data into custom analytics tools. These tools enable automated data extraction and in-depth reporting. Always ensure compliance with data privacy laws like GDPR and CCPA when using and sharing data, especially for commercial purposes.

For example, Aterian, a leading consumer product platform, gathers millions of data points from consumer search and product reviews to understand what products are selling well in the marketplace but also have high dissatisfaction among consumers. Using this data, Aterian has launched a series of products, such as countertop ice cream makers.

Yet another approach is to gain insight through social influencers with large followings. Monitoring consumers' interaction with these influencers allows brands to get valuable feedback about their products as well as ideas for new products.

Many social influencers have launched their own new products over time based on the feedback they've received on their platforms.

Emily Weiss, the founder of beauty brand Glossier, did this through her beauty blog initially, and now Glossier customers give constant feedback on new products, new shades, and new designs.

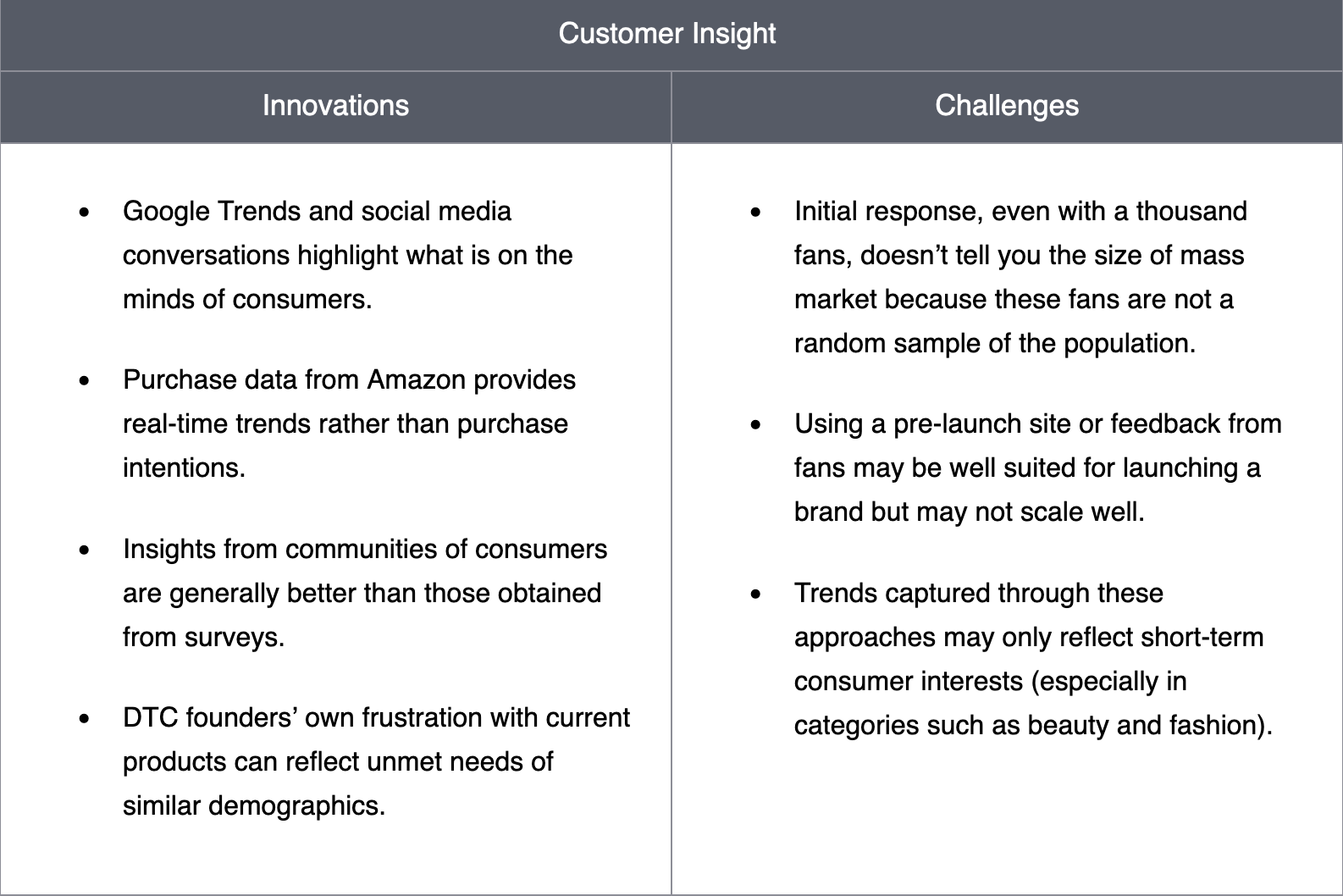

Let's summarize the innovations and the challenges of the DTC approach to gaining customer insight.

On the positive side, using Google Trends and social media to monitor conversations provides you with real-time information about what is on consumers' minds. Using these types of consumer data can provide a deep level of understanding around their tastes and preferences, as Perfect Diary found.

DTC brands also have direct access to customers without any distribution partner. This provides them access to consumers' purchase information, which allows these companies to modify their product and marketing plans quickly. They can achieve a greater reach than they might if they use surveys to get consumers' purchase intentions.

In addition, founders' own frustration and intuition, many of whom are millennials and Gen Z, resonate with the younger population in a way that many of the legacy brands cannot.

Those are the positive sides of how DTC brands get customer insights.

On the flip side, the initial response from launching a website before producing the product, like Harry's did, or drawing on the founders' own frustration, doesn't always tell you the potential size of the market because it may not reflect the desire of a large set of consumers.

These approaches might be well-suited for launching a brand or testing an idea, but they may not necessarily scale well.

In addition, the real-time trend may not necessarily reflect their staying power in the long run.

However, companies can respond to this limitation by being agile and responding quickly to changes in the market.

Here is a summary of the innovations and challenges of the DTC approach to customer insight.

R&D and Product Design

The next stage of the value chain is research and development (R&D) and product design. Traditional companies typically spend millions of dollars on R&D to create new products, but most DTC companies spend almost nothing on R&D.

Let’s examine legacy companies’ approach to R&D and how it contrasts to the approach that many DTC companies have taken.

Unlike product categories where technology evolves rapidly, most DTC brands have emerged in product categories where innovation has reached a certain level of maturity.

In these mature markets, established brands, like Gillette, attempt to differentiate themselves from the competition by adding new features. For example, razors used to have one blade to shave, then Gillette added two blades with tracks. Then it decided that two blades are not enough, and it needed to add a third blade, so it launched Mach3. Then its competitor Schick came to the market with four blades and Gillette responded with Fusion, which has five blades on the front and one blade on the back.

This war for features is not limited to Gillette. You see the same race in smartphones, where Apple and Samsung are trying to outdo each other by adding more and more cameras.

What you observe here is that these traditional companies spend a lot of their R&D budget adding more and more bells and whistles to their products to outshine the competition. For example, Gillette spent $750 million in R&D to come up with Mach3.

This investment in R&D for new features often leads to a complex and expensive product, which is more focused on competition than what the customer really wants. This provides an opportunity for new brands to enter.

DTC brands often start by offering a selection of simple, well-designed products. This is what Dollar Shave Club founders did. They recognized the blades were overdesigned and created a new and simpler product.

Tim Brown had the same feeling when he launched Allbirds. He had the insight that legacy brands often featured too many logos and too many colors, and they change frequently for no reason. He responded by creating a simple brand of shoes.

This brings us to an important point about product design. There is a fundamental difference between features and benefits.

A feature is created in the R&D lab, but a benefit is what the customer really wants and receives from the product.

Ted Levitt, a former professor at Harvard Business School, used to say that consumers don't buy a 1/4 inch drill, they buy a 1/4 inch hole.

Why is this distinction important? Because a firm focusing on the features of a drill may spend an enormous amount of money on adding new features to the drill, but it may get blindsided if a new laser technology allows customers to create a hole without a drill.

Instead of focusing on product features, it is better to focus on customer benefits or jobs to be done.

This focus on customer benefits instead of investing millions of dollars in new features becomes especially important in mature categories where new features add only marginal benefit but add far more complexity and cost.

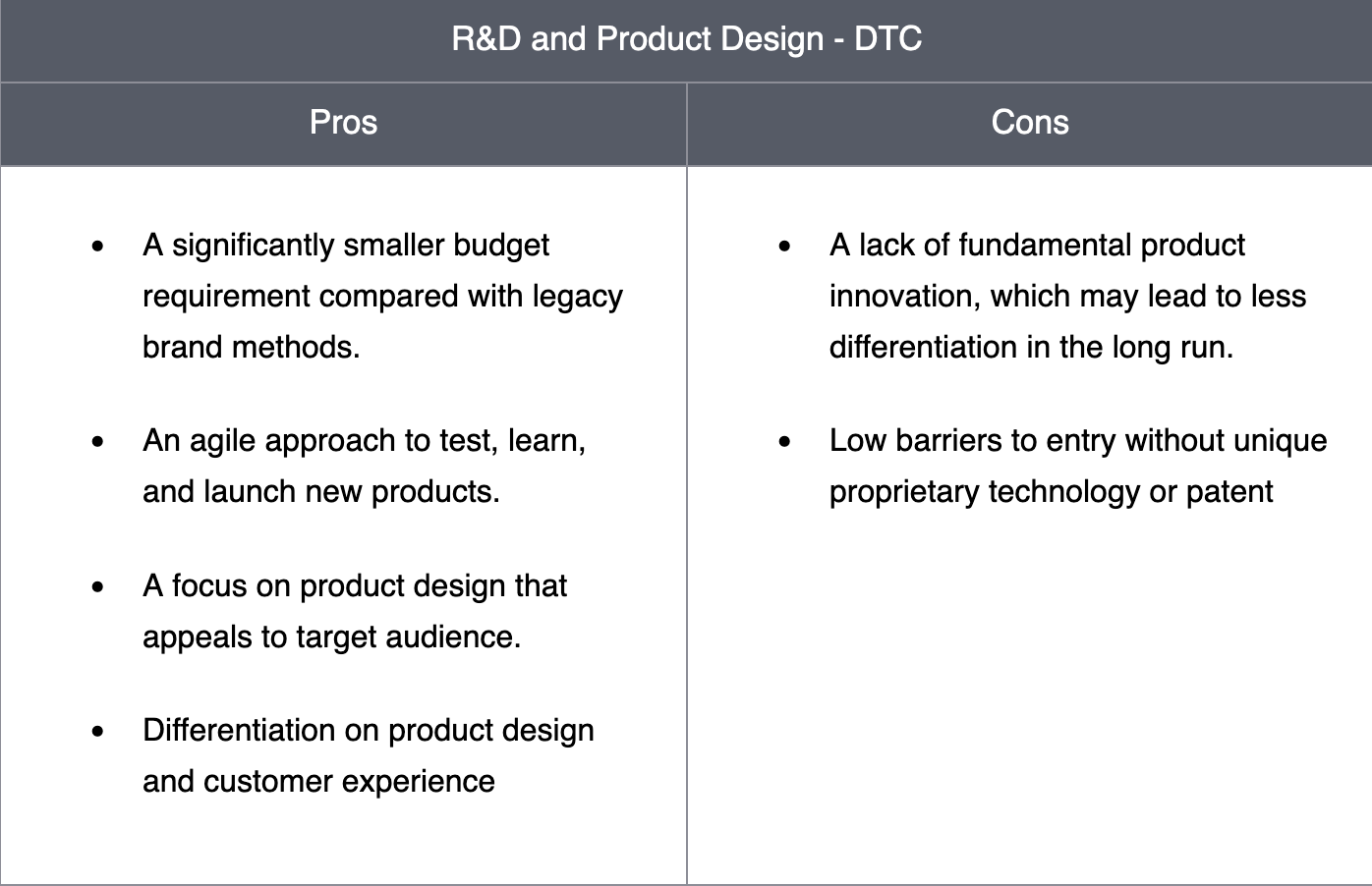

Let's summarize the pros and cons of the approach that DTC brands take for R&D and product design and reflect on what that means for marketing.

Typically, DTC brands have almost no budget for R&D. They don't have the resources. They don't have the people, and they don't have the capability for R&D. However, they recognize that adding new features in mature product categories can make these products overly complex.

So instead of focusing on adding new features, many DTC companies attempt to simplify them. This was the focus of Dollar Shave Club and Allbirds.

Second, they have a very agile approach to testing new products. They get very quick feedback from customers and use that feedback to improve product design and create products that appeal to their audience. For example, Perfect Diary gets quick feedback from the market to design and deliver a large selection of niche products.

Third, instead of product features, differentiation for DTC brands might come from their mission, the way they respond to customers in creating their products, their unique delivery, or their exceptional service.

The downside to this approach is that there is usually no fundamental innovation in these products. So, as a result, it's relatively easy for other new players to launch a similar brand.

In other words, there are low barriers to entry and less differentiation because there are no proprietary technologies. This makes it hard for many DTC brands to scale and be profitable.

In summary, DTC brands have a disadvantage in R&D in terms of resources and capabilities. But instead of focusing on product features, they leverage their agile approach to differentiate themselves on product design, customer feedback, and customer experience.

Emmett Shine discusses Pattern Brands’ approach to product design, combining personal tastes and insight with a rapid and agile approach to prototyping and collecting data from its consumers.

Emmett Shine:

We want to have our home be a sanctuary where we can feel energized and safe. The products we sell are items that, for ourselves and our audience, we think can satisfy that.

With that as a brief, when we're designing something, we'll share it and show it to the team. Then we'll share it and show it to some initial customers or people in the community to gauge concentric circles of feedback. By the time we release something to a larger audience, we've usually refined it thoroughly internally and with close groups, and we feel really excited about it.

A lot of our team will want to have or already have these items in their homes, using them. This approach also allows us to communicate effectively, offering a first-person perspective: "Hey, here's how we use this. Here's how we're engaging with this," rather than simply asking, "Hey, what do you think? Here's something. Let us know."

We can show a prototype for a website to an audience online and get feedback quickly. Then, we can edit our site designs the next day. We can present different design options, pricing options, or even test ad content on social platforms.

There are many ways to reach customers, potential customers, or community members for feedback. This also allows us to act quickly and adapt. We don't need a super extensive process or timeline to iterate.

We mix qualitative and quantitative data. You always need the quantitative data to support decisions, but qualitative insights are equally valuable. For example, we work with external agencies when we need expertise outside our core focus.

If we're moving into retail, we might get insights on how best to present an item in terms of shelf space. Since that's not traditionally a strength of ours, we seek insights and information to guide us.

While there are several potential answers to these questions, here are some things you may have thought of.

| Benefits | Drawbacks |

|---|---|

| Strong connection with target consumers’ desires via community | May be testing on too small of an audience |

Production and Manufacturing

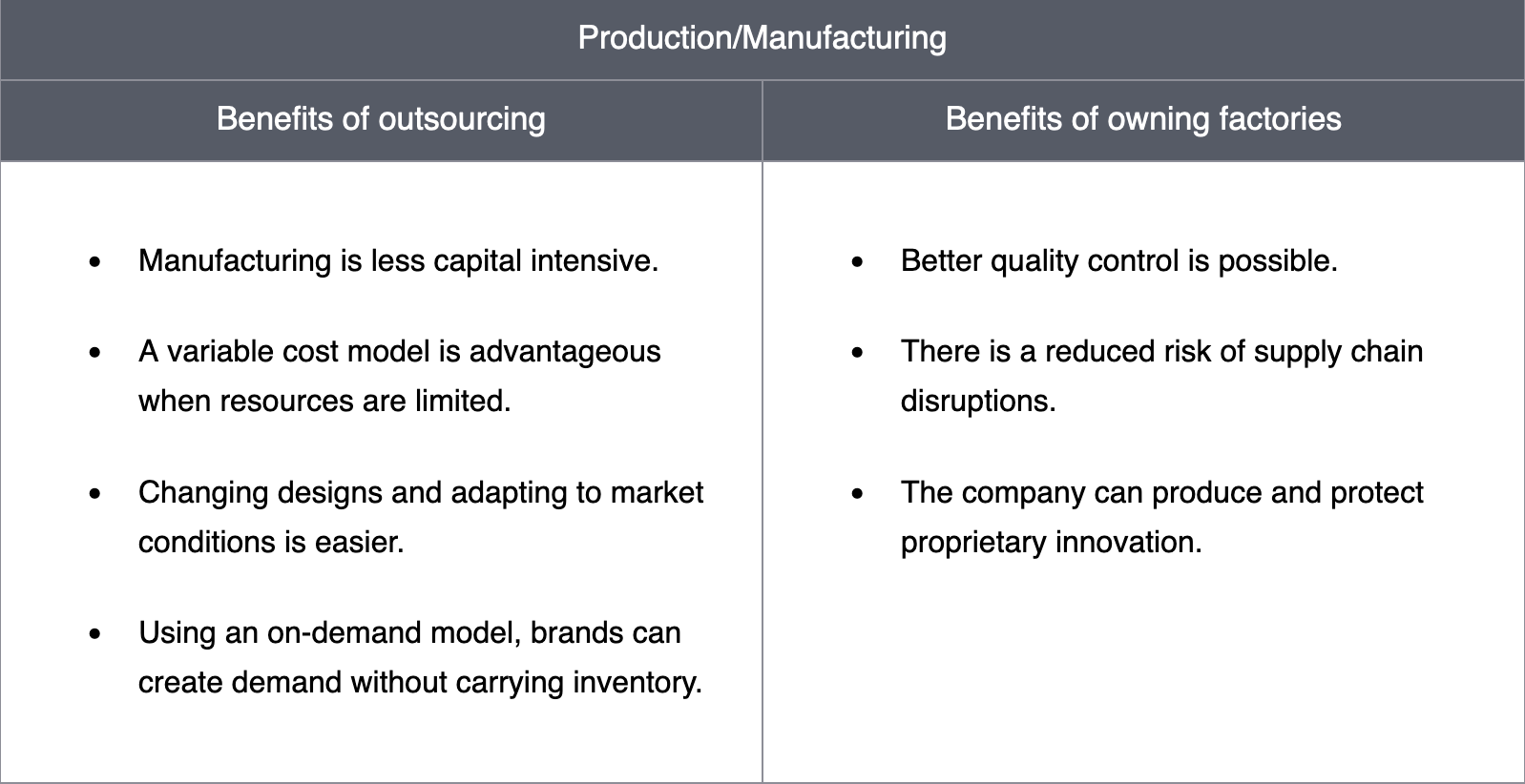

Traditionally, large companies such as Procter & Gamble and Unilever have owned their manufacturing facilities. Unlike these legacy companies, most DTC firms outsource manufacturing to third-party players. For example, Dollar Shave Club partnered with a South Korean company to design and manufacture its razors and blades.

Nick Ling and Suze Dowling discuss how Pattern Brands’ manufacturing and supply chain processes work.

Nicholas Ling:

To this theme that anyone can build a business today, the global supply chain has been a massive enabler. Previously, companies like Procter & Gamble needed their own factories to create tools and launch products.

Now, we can partner with incredible factories worldwide to create unique products in an agile and iterative way. These factories are accessible to anyone with the expertise and skills to navigate product development.

In the middle of that process, after developing your products on this supply chain, sits your store.

Suze Dowling:

We have suppliers globally, and this provides a network effect of operating within a global manufacturing hub. This includes access to affordable raw materials, world-class factory expertise, and an established infrastructure of roads, ports, and airports.

We are incredibly thankful to partner with our factories. One of the key priorities is retaining quality and oversight of manufacturing, whether done in-house or through contract manufacturers.

For us, this has meant developing very close relationships with our suppliers and ensuring they specialize in the product categories we are working on with them.

Most DTC brands rely on outsourcing for manufacturing, which has several advantages and disadvantages. Let’s break them down:

Outsourcing provides cost efficiency, requiring lower capital investment as startups avoid building factories, turning fixed costs into variable costs. It also enables scalability, allowing brands to scale production as demand fluctuates without major upfront investments. In terms of agility, outsourced models enable quick adjustments to market trends and product demands, facilitating faster product launch cycles in weeks rather than the traditional year-long cycles. Outsourcing also allows brands to focus on core competencies by freeing up resources for marketing, customer engagement, and design. Additionally, partnerships with specialized factories provide access to world-class manufacturing techniques and materials.

However, in-house production has unique advantages, particularly for traditional brands. It offers stringent quality control, as seen with firms like Procter & Gamble and BMW. It also ensures supply chain reliability by reducing dependence on external suppliers, mitigating risks like disruptions. Proprietary technology is better protected in-house, safeguarding sensitive innovations. Furthermore, traditional brands with substantial R&D investments benefit from tighter integration between design and production. Despite these advantages, in-house production comes with higher fixed costs and slower responsiveness to market shifts.

Inventory management is critical, whether production is outsourced or in-house. Mismanagement can lead to costly overstocking or stockouts. While advanced analytics and demand forecasting are commonly used, DTC brands have pioneered innovative alternatives, such as on-demand business models. Alibaba’s model in China collaborates with influencers to create limited-edition fashion collections, with production beginning only after customer orders. Similarly, Amazon’s The Drop offers influencer-designed collections for limited periods, with production based on pre-orders. These on-demand models eliminate inventory holding costs, reduce overproduction risks, and align production closely with consumer demand, making them especially effective in volatile industries like fashion.

In conclusion, outsourcing provides DTC brands with agility, cost efficiency, and access to specialized expertise, making it ideal for startups without proprietary technologies. For traditional brands, in-house production offers control, reliability, and integration with R&D. Innovative inventory management, particularly on-demand models, enhances the DTC approach by minimizing risk and aligning production with consumer demand, showcasing the synergy of direct customer access and digital distribution.

Here, we covered customer insights, R&D Product Design and Production, in the next article, we will finalize discussion about value chain, starting with marketing.