DTC Brands: Innovations and Challenges - Part 2

Marketing in the Digital Era

Let's build on the previous article!

Marketing

We’ll now turn to the next part of the value chain: marketing. As we have learned, DTC brands have introduced innovations at each stage of the value chain, and marketing is no exception.

Let’s begin by revisiting the story of DTC brand Dollar Shave Club and its traditional counterpart, Gillette. Where do you think you would be most likely to encounter a Dollar Shave Club ad? What about an ad for a Gillette razor?

The term “marketing channel” refers to the medium through which a company conveys its message. Social media sites, television, and newspapers are all examples of marketing channels.

Nick Ling and Suze Dowling describe the general approach that Pattern Brands takes towards its marketing. Note that in this video transcript, Suze mentions the term CPA, which is short for “cost per action” and refers to the cost to a company to get a consumer to take some action.

Nicholas Ling:

Maybe the most important part of the equation is the innovation of the advertising ecosystem across Google and Facebook, where you can target people not just based on demographics, but based on real interest groups. This makes it much more effective and efficient to find your consumer for your brand from day one, versus needing to put advertisements in newspapers or on TV channels to tell people about your brand.

Suze Dowling:

I'd say our core marketing channels are really paid social, specifically Facebook and Instagram, as well as Google for search and shopping. We focus on these core channels because they have the potential to drive substantial revenue and meet our audience where they are. These channels have expansive user bases on their platforms, along with advanced algorithms and targeting capabilities that allow us to drive very effective CPAs.

Importantly, they also offer clear measurement and tracking capabilities, enabling us to directly attribute the revenue influenced by these platforms and report accordingly. Once a brand is established and has a strong revenue stream coming from these core channels, we move into testing secondary channels such as Pinterest, TikTok, TV, and display.

Honestly, we have explored some out-of-home and TV options. However, the majority of our resources remain focused online, as that’s where we’ve found we can most effectively reach our customers. For us, our target customers spend the majority of their time online, making these channels the most impactful.

The rise of digital channels has changed how consumers search for information, buy products, and engage with brands. Instead of advertising on television, as brands like Gillette had traditionally done, new brands can now reach consumers through digital channels such as Google and Instagram.

Before the emergence of digital media, an entrepreneur needed millions of dollars to advertise on television to reach consumers. This posed a significant barrier to entry in a market dominated by established brands with large budgets. However, a new brand can now enter a market by spending only a few thousand dollars on digital channels.

DTC brands are more inclined to use digital channels to reach consumers. They know who their consumers are and interact with them directly. They can target potential customers through Facebook lookalike audiences—people Facebook identifies as having similar traits to their current customers. All these things allow DTC brands to be much more focused in their marketing, rather than relying on a mass marketing approach through television ads.

As you might guess, this targeted advertising is more efficient and effective. It's also more measurable because you can track the effectiveness of a Google or Facebook ad based on the number of clicks. The combination of targeted marketing and access to more data allows you to measure the performance of your marketing. You can better determine your return on investment and make more efficient budget allocations.

This approach is fundamentally different from the traditional advertising that brands have relied on for many decades.

Digital marketing has its benefits, but it also has its limitations. It's very good for what is called performance marketing. When people are ready to buy, they do a Google search, click on a particular ad, and buy the product. It's easy.

However, digital marketing has a harder time building brands, creating imagery, and crafting a story around the brand. This is changing over time, but typically, digital marketing has been more focused on performance marketing rather than brand building.

The second challenge with digital marketing is that the cost of customer acquisition has gone up tremendously over time. The cost of customer acquisition refers to the money you spend to win a new customer who buys your product or service. It was much cheaper to advertise on Facebook in 2004 but is far more expensive now, as so many brands advertise on Facebook. In fact, the cost of advertising on Google and Facebook has risen so much that it is becoming comparable to non-digital channels.

The third reason to consider non-digital channels is due to their synergy with digital channels. When we advertise on television, the number of people searching for your brand on search engines increases. Research shows that in many cases, these synergies can be very powerful, and the optimal budget allocation for most companies is to spend money on both digital and non-digital channels.

We introduced several new terms:

- Performance marketing: A marketing tactic where brands pay marketing service providers for meeting specific targets. It is usually considered to be a short-term tactic centered on measurable results.

- Brand-building: The process of building broader awareness and knowledge of a brand among consumers. It is usually considered to be a longer-term tactic.

- Customer acquisition cost: Also known as CAC , this metric is a measure of the amount of money it takes to acquire each new customer.

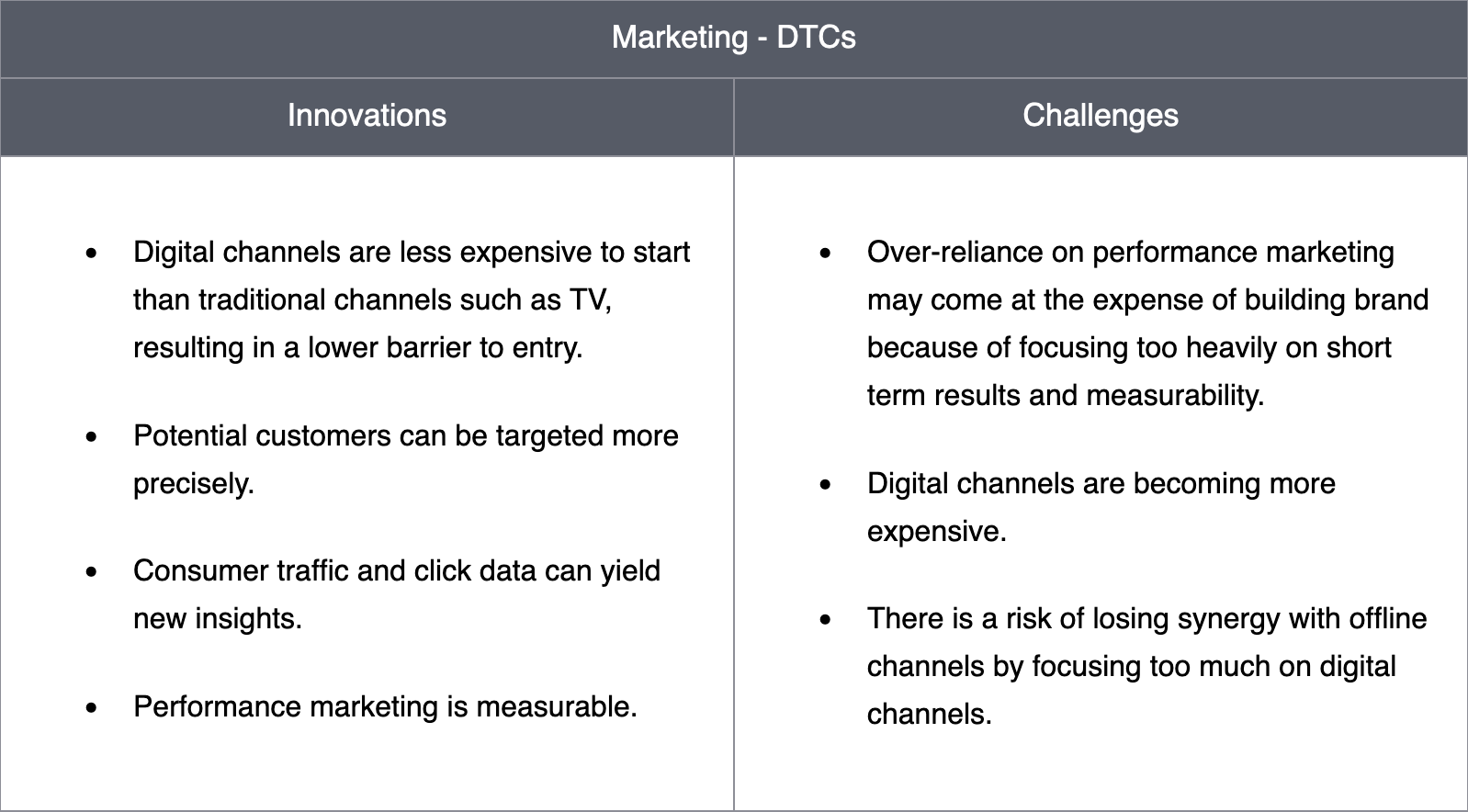

Here is a summary of the main innovations and challenges of the typical DTC approach to marketing:

Distribution

Traditional brands like Gillette have historically focused on gaining shelf space with retailers like Walmart.

These retailers have limited shelf space in their physical stores, which makes gaining access to consumers through these retailers very difficult for a new brand.

DTC brands have circumvented these retail barriers by directly distributing their products to consumers.

Online platforms have substantially changed the possibilities for product distribution. Traditional brands have often invested in their own distribution facilities and sold their products through physical retail channels. For example, Procter & Gamble sells its vast array of products, from laundry detergent to beauty products, through retailers like Walmart.

In contrast, many new brands distribute their products directly to consumers without building their own logistics infrastructure. A host of third-party logistics, or 3PL services, have emerged in recent years to serve DTC brands. Amazon is also offering a direct distribution option to sellers through FBA, or Fulfilled by Amazon, which allows these sellers to reach millions of consumers globally, bypassing traditional retailers like Walmart.

Other players like Shopify allow sellers to create their own online store to promote, sell, and ship products in as little as 30 minutes for a low monthly fee. However, many DTC brands have realized that as they scale, they need to partner with retailers to place their product in stores. This is what Harry's did. Other brands like Warby Parker and Allbirds opened their own retail stores, which act both as showrooms and a place for transactions.

Here David Huang and Suze Dowling discuss how their respective companies think about opening offline stores.

David Huang:

I think we opened the offline stores for a few purposes. The first one is no matter what we do online or in the digital world, we still need to make people feel we are a real brand. So when people get into our offline store, they will have the 360-degree feelings and touchpoints for Perfect Diary. So that's one thing that we think what we call the engagement level is higher.

The second thing is we really need the space to collect more consumers' data and get more consumer insights. When we have real people interacting with the consumers, we can know more about the consumers.

Last but not least, even though the online penetration is really high today in China, there are still 40% of consumers who prefer to buy offline. This means that as our brand grows bigger and bigger, we need to make the brand have 100% coverage instead of 60% coverage of the market.

Suze Dowling:

We are primarily online, and we haven't yet ventured into company-owned physical retail spaces. That's something we may explore in the future. With that said, our physical retail space at the moment is really focused on strategic wholesale partnerships.

These provide us with a really exciting opportunity to both diversify our revenue streams and also maximize and enhance our brand awareness in the vast retail space. The margins in that are not as advantageous as DTC, but based on the volume, there's a substantive potential for a very healthy line of business and, of course, brand exposure.

Currently, we have partnerships with specialty boutiques around the U.S. alongside larger retailers like Trader Joe's, Nordstrom, and Bloomingdale's.

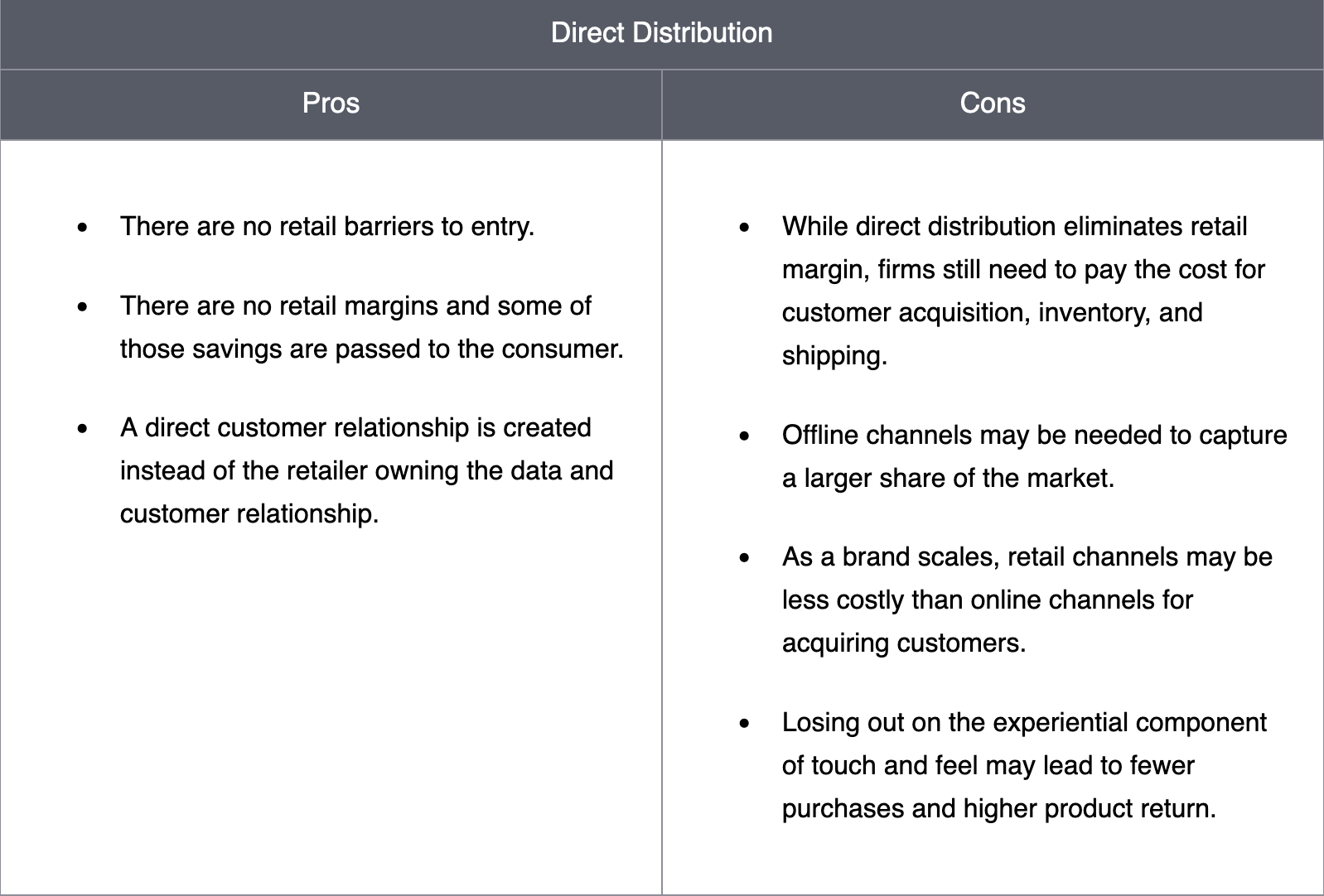

Direct distribution certainly has its advantages. DTC brands don't need to convince large retailers like Walmart to stock their brand. And without the retailer, they save margins that the retailer would take and are able to pass some of the savings to customers. Direct distribution allows these brands to have a direct relationship with their customers, and they know more about their customers than they would through the aggregate data they would get from a retailer.

With all these advantages, many DTC brands start with digital commerce, selling their product online directly. As they grow and scale, they realize that there is a limit to selling only directly. Here are a few reasons:

First, e-commerce is still a limited part of overall commerce. Many people still shop in physical retail spaces. In order to capture a large share of the market, many brands are using omni-channel strategies, which refer to using multiple spaces for distribution, rather than just being on digital or just in retail.

Second, as online competition increases, the cost of acquiring new customers through channels like Facebook and Google increases significantly. A retail store becomes another way to showcase the product and acquire customers. If you put your product in Target or Walmart, the shelf itself becomes an advertising vehicle for the product in addition to being a place for them to buy it.

Third, many consumers want to see, touch, and experience the product. For example, if you are selling apparel, consumers may want to try on the product before buying. For those categories, a physical store becomes important.

As DTC brands expand into offline stores, they are reimagining these spaces. They have become not only a place for transactions but also work as showrooms where people can come and experience their product. Some DTC brands have designed their offline stores primarily as showrooms rather than a place for buying the product.

For example, Bonobos, which started as an online distributor of clothes, created physical shops in cities called Guide Shops. These showrooms give consumers the opportunity to try out different items of clothing to ensure the right fit. It might surprise you to know that, at the time we filmed this in 2023, Bonobos does not sell anything in physical shops and carries no inventory. Once customers try and identify what they want, they order online.

Many large brands like Nike are also building mega stores, primarily to showcase their new products. So the idea of retail space is fundamentally changing. Rather than being a place for transactions, they are becoming a place for customer engagement.

For these reasons, many DTC brands that start with only online distribution begin distributing in retail channels as they scale.

Customer Experience

So far, we’ve discussed the parts of the DTC value chain that have to do with creating, marketing, and delivering products. But the final part of the value chain has to do with the overall interaction that a consumer has with a brand: the customer experience.

Suze Dowling discusses how Pattern Brands engages and fosters community among its customers.

Suze Dowling:

For us at Pattern Brands, it's really about building a community with our consumers. We're really focused on creating meaningful and thoughtful interactions with them. It's important we don't just talk to customers. Instead, we really want to talk with them. That's the crux of our direct-with-consumer philosophy here.

We really want to give consumers an outlet to engage with us versus them kind of reaching a dead end. And with those ideas, thoughts, and opinions that they offer to us, we're able to continuously improve and offer an enhanced experience to our customers, which in turn also translates into enhancing the ad assets that we're offering.

We've actually found post-purchase surveys to be a really great way to create that two-way dialogue. Within these types of surveys, we're able to incentivize our customers, whether that be via gift or a small coupon code, to offer their perceptions on the brand, their experience with us, and their likelihood of purchasing from us again or recommending us to a friend.

Pattern Brands uses post-purchase surveys as a tool to help build a deeper connection with its customers, but this method is just one of many ways that brands can foster engagement. What are some unique capabilities of DTCs that position them to do customer engagement well?

Let’s outline how DTC brands approach the customer experience differently.

DTC brands are often noted for providing a superior customer experience compared with many of the traditional brands for several reasons.

First, brands historically did not have direct access to consumers. Since Procter & Gamble sells its beauty products through retailers like Walmart, it does not know who is buying or using its products. It only gets aggregate data from its retail partners. In contrast, DTC brands know exactly who is buying. They are in direct conversation with the customer.

Direct access to consumers helps DTC brands to learn about their consumers' behavior and identify changes quickly. With this information, they can refine their product, improve their website, and respond to consumer complaints and concerns, thereby providing a better customer experience.

Because DTC brands are technology savvy, they are generally very good at creating a better user experience and better service through no-hassle returns, better graphics, and better product design.

DTC brands are also able to build a community of consumers that adds value over and above the product. Glossier is a great example of this. It provides and supports a community of online users where not only the company talks to consumers, but Glossier consumers communicate with each other and help each other. This builds a sense of community among its consumers and creates stickiness for the product.

Sometimes, DTC brands learn from unexpected insights from the communities of their users. BarkBox, which sells dog treats online, found that its customers were creating YouTube videos while opening the boxes of these treats with their dogs. The company learned that the act of opening that box with the dog was a source of excitement, entertainment, and value to the customers beyond the product itself. It then leveraged this insight in its communication and its value proposition.

DTC Value Chain Conclusion

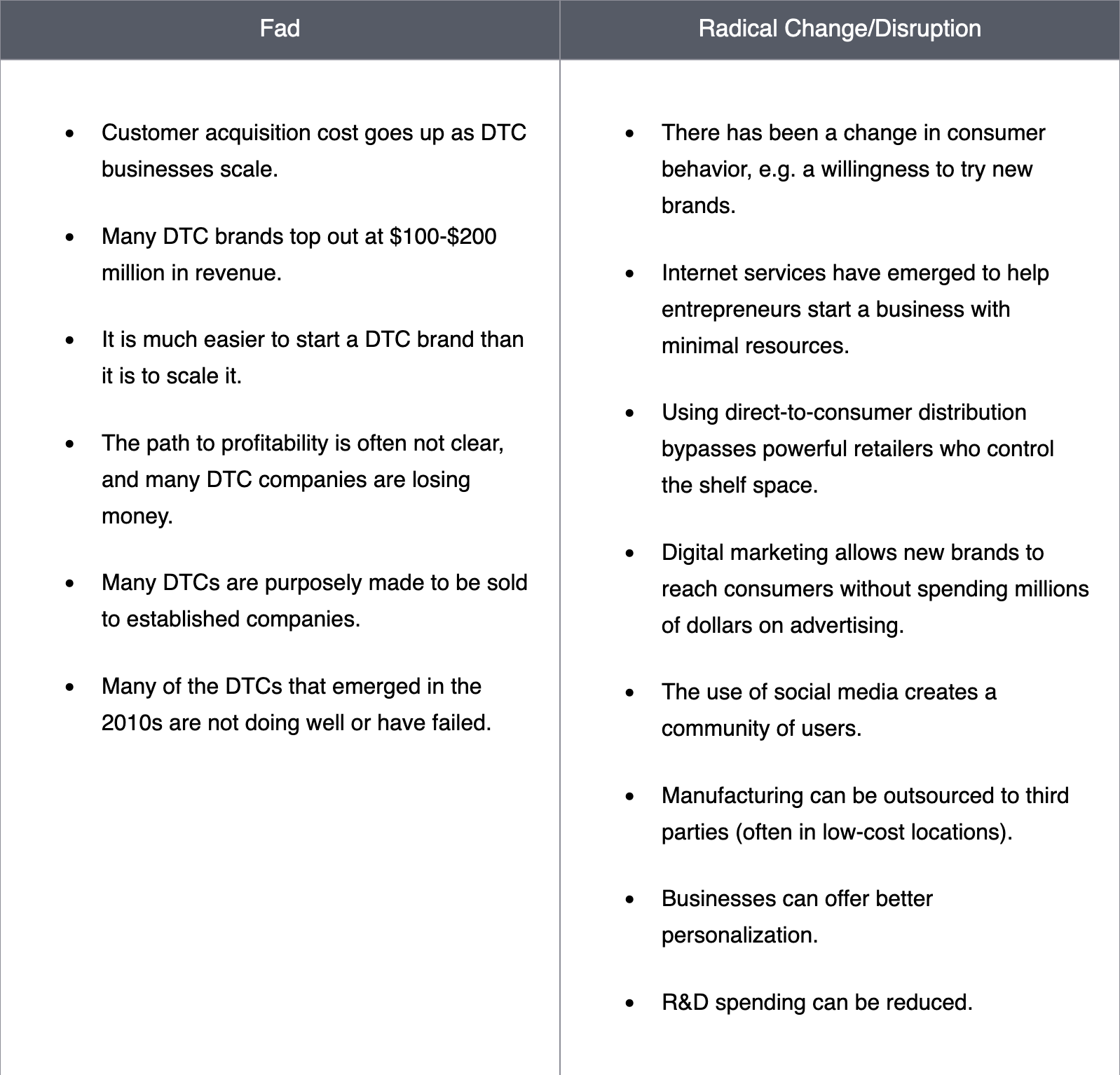

Now that you’ve learned about the innovations and the challenges of the DTC value chain, let’s revisit the question of whether DTCs represent a temporary fad or a permanent disruption in the way marketing is practiced.

DTC brands have transformed the competitive landscape in marketing. The response to DTC brands also reflects a significant change in consumer behavior. Given these changes, are they better characterized as a passing fad or a permanent disruption to business practices?

Let's revisit this question as we review the fundamentally different approach to creating value at different points in the value chain. Traditional brands had a dominant position because of their control over retail channels, a significant barrier for a new business. The second big hurdle new players faced was the high price of television advertising. Digital marketing has fundamentally changed that. Now, instead of spending millions on TV, you can launch a brand with a limited budget to advertise on Google and Facebook and have a much more targeted ad campaign to generate demand.

DTC brands have outsourced manufacturing, personalized products, and spend less on R&D. They gain customer insights in a fundamentally different way than legacy brands. Rather than using surveys, they learn from constant feedback from customers and design products they want. They distribute directly to customers, and they communicate directly with them. They use digital marketing channels to carry out effective marketing campaigns and engage with customers in their own online communities. At times, DTC brands have created entirely new communities of users.

Another change that has occurred with the rise of DTC brands is that each part of the value chain has become modular. Different parts used to be deeply intertwined and dependent on each other. Now, each one can be easily broken out and outsourced to third-party players without impacting the other value chain stages.

Let's now revisit the challenges DTC brands face. And in doing so, consider if DTC businesses might be an unsustainable fad more than a long-lasting disruption. Although it's easy to launch a DTC brand, it is much harder to scale due to low barriers to entry in marketing and distribution. DTC brands usually have no unique differentiation in R&D and production. There are no economies of scale. This creates low barriers to entry for other new brands, which in turn creates more competition. For example, hundreds of DTC beauty brands have been launched in recent years. As competition increases, the cost of customer acquisition increases, as everyone tries to reach the same consumers, and it becomes difficult and unprofitable for any single brand to scale.

As a result, many DTC brands fail or remain small. Many brands achieve $50 or $100 million in revenue and then find it challenging to grow. You can argue it's perfectly fine to create a niche brand with $100 million in revenue. That's not bad. You could never have created that 20 years ago so easily. But can they become a billion-dollar brand? Is the era of billion-dollar brands over? Or will we have hundreds of smaller brands that will serve specific customer needs as they utilize targeted marketing?

Regardless of whether DTC brands succeed or fail, they have fundamentally changed how brands are created, distributed, and marketed. We'll continue to examine how all these changes have impacted marketing in the digital era throughout following articles.

As technology, economic conditions, and consumer preferences evolve, a DTC company will need to continually innovate to remain relevant and grow. Here is Nick Ling discussing how Pattern Brands has shifted to a multi-brand model in response to the increasing competition in the DTC space.

Nicholas Ling: When I first started running Gin Lane, there were 40,000 Shopify brands online. And when I sit here today with you in 2021, there's 1.7 million. And those same forces that allowed these entrepreneurs to start DTC brands in 2009, 2010 allowed literally anyone to start a brand in 2016 and 2017. And I think what we're looking to do with Pattern Brands was to accept that there are more and more brands out there. So how can we build our own portfolio of brands to work together to go after a mission rather than one individual massive brand?

Challenges like increased competition may mean that DTC companies will have to re-evaluate their business model. Let’s examine a few strategies that a DTC brand can use as it attempts to scale.

- One strategy is to expand its product line to include adjacent products. For example, Casper started selling mattresses, but expanded to become a “sleep company” and introduced bed sheets, pillows, and night lamps to its product offerings. Harry’s expanded to define itself as a men’s grooming company rather than a razor company. In this way, the company leveraged its existing customer bases to sell additional products and reduce the cost of acquiring new customers.

- Another approach for DTC brands is to create a multi-brand platform. Pattern Brands is taking this approach by acquiring multiple brands to create a “house of brands,” not unlike P&G and Unilever. This allows it to cross-sell different brands to the same customer.

- A third strategy is to build multi-brand marketplaces, where a company sells not only its own brand, but also other DTC brands—offering them exposure and support.

- These alternatives provide new ways to work with the DTC model in an effort to scale.

We’ve now learned how the DTC business model contrasts with traditional ones, and how these differences have set the foundation for contemporary marketing practices. While some DTC brands will succeed, others will fail. Regardless of their success or failure, they have changed the practice of marketing and pose a significant challenge to established brands. How should legacy brands respond to this new challenge? We will turn to that topic next.