From Storytelling to Story-making

Engaging Customers

Storytelling

As Julie Bornstein mentioned in the previous article, the advent of digital media has transformed the ways that companies can interact with their customers, turning engagement into a two-way street.

In this article, we will explore the ways that a company can engage customers by providing them with opportunities to make their own stories around the company’s products and services. We will also explore how this “story-making” can be used to drive business.

We will examine the story of the financial services company Mastercard. While you may think of Mastercard as a credit card, the company does not issue any cards. Banks, such as Chase or Citi, issue cards, and Mastercard processes the payments when customers use these cards. Mastercard provides service to consumers through its partnerships with banks and merchants, making it a business-to-business-to-consumer or B2B2C model.

Let’s meet Raja Rajamannar, Chief Marketing and Communications Officer at Mastercard, who will tell us more about the company’s business model.

I'm the Chief Marketing and Communications Officer of Mastercard, and I'm also the President of Mastercard's healthcare business. I have about thirty-six years of work experience. Originally from India, worked in companies like Asian Paints, Unilever, Citibank. Then I was also in the healthcare industry with Humana and with Anthem. And for the last eight years, I have been at Mastercard as the Chief Marketing and Communications Officer for the company.

Mastercard is not a credit card company. The reality is, we don't issue a single credit card. We are a technology company. So when you look at Mastercard's business model, we are not a direct-to-consumer company. We have relationships primarily with either the banks, which have a relationship with the consumers, or we have relationships with the merchants, where consumers use Mastercard-based products to get their services or whatever products they are buying from the merchants. So we are basically connecting the ecosystem—connecting the consumer, the merchant, and the bank.

So what we try to do in our marketing are two things. Number one, we try to empower, enable our partners, which are the banks, as well as the merchants, to do better marketing to their consumers who are using Mastercard products or who need to be attracted towards Mastercard products. So when I say Mastercard products, these are products primarily run either by the bank or by the merchant, but run on Mastercard's network.

My first job is to sell our network to the bank to issue cards on my network, as opposed to somebody else's network. And my first order of business, likewise, is to convince the merchants that it is a smart thing for them and it is good for them to accept payments via Mastercard network. So my primary customers are these—to the banks on the one side, what we call as the issuers, the people who issue cards, and then you have got the merchants.

As Raja explained, Mastercard is not a business-to-consumer (B2C ) company but a business-to-business-to-consumer (B2B2C ) company with three main stakeholders: banks, merchants, and consumers.

When Raja came to Mastercard, he inherited a marketing campaign that was primarily focused on a more traditional approach to appealing and reaching out to consumers.

Yeah, so when I joined Mastercard firstly, I inherited one of the top hundred brands in the world. Obviously, the company was doing things right for a number of years, consistently. And they had a fantastic advertising campaign called, Priceless, which became almost a part of the vocabulary, the vernacular in different countries around the world.

So, Mastercard operates in two hundred ten countries. We have got one hundred ten currencies that we deal with. Maybe the number is one hundred seventy currencies. So it's a humongous amount of global reach that we have. But this concept of Priceless has resonated across the world. And great campaign, very memorable, that's what I had inherited.

The Priceless campaign that Raja referred to started with a television ad in 1997, an excellent example of storytelling. The commercial is shot in a documentary style, following a father and son through a visit to a baseball game. The text on the screen keeps track of the father's purchases.

Tickets, $28.

Hot dogs, popcorn, and sodas, $18.

Autographed baseball, $45.

This list ends with a real conversation with an eleven-year-old son, Priceless. The screen fades to black with a smiling father and son, and the campaign slogan appears:

"There are some things in life money can't buy. For everything else, there is Mastercard."

As Raja said, it was an incredibly effective campaign. The Priceless tag became a defining characteristic of Mastercard's marketing and was featured in a series of ads. You may even be familiar with this campaign.

The Priceless advertisements were extremely effective all over the world. Raja explains how he came to the realization that despite the success of Mastercard’s Priceless campaign, it needed to evolve.

Marketing at Mastercard was seen more to be a creative function, which produces pretty ads, does some nice events, and that's pretty much it. So there was a need for us to rethink the entire approach at that point in time. And that's what we sort of embarked on.

So the first thing that I did was to understand what was working well. And if you look at Priceless as a campaign, this was created in 1997. The world was very different in 1997. There was not any significant presence of the internet whatsoever at that point in time the way it is today. There was no mobile, there was no social, there was no influencers kind of a concept at that point in time.

The whole world has changed, so there was a need for us to figure out if Priceless was still as relevant, and how does it evolve. And it became immediately clear that Priceless had to evolve.

Recharging Priceless

The Priceless campaign was very successful for almost two decades, and it has entered the vernacular in popular culture. And yet, Raja thinks that the campaign must evolve. But why change it?

Raja describes the drawbacks to traditional storytelling advertising in our digital world, and how Mastercard aims to move beyond it.

So firstly, advertising has been the main mode of communicating to the consumers, and with the consumers. Unfortunately, when every brand thinks of this same methodology to reach consumers, there is an information overload.

As a consumer, if I sit in front of, say, YouTube, and I'm watching—because I'm from India—I watch Bollywood. And I'm watching some Bollywood song, dance, and stuff like that, some silly stuff, or some animal videos. When I'm doing that, suddenly an advertisement stops the song right in the middle after about three minutes or five minutes, shows me an ad, which I could care less about. And what do I do? I move off by paying money to ad-free environments.

Consumers are saying, these ads are bothering me. They're interrupting my experience. Don't keep taking me for granted and just simply do stuff that you want to do. And if as a consumer I'm feeling like this, now I put on my marketer's hat, and say, what are we doing? We talk on one hand that we should give seamless, frictionless, delightful experiences to consumers. And here was Raja, who is having a good time by himself watching those videos. I said, no, no, I have to mess around. Let me introduce friction. Let me interrupt his experience. Is it a sustainable model? It just isn’t.

So therefore, what I say is advertising, which is all about storytelling, is dead. We need to rethink how we connect with consumers because the need to communicate with consumers doesn't change. So how do you reach consumers? How do you communicate your message? How do we impress upon them that they have to choose your product, and communicate the right motivations to them? Those are definitely there.

So we started trying to figure out what could be the methods. And the strategy that we adopted is we said, people remember things that they experience as opposed to things that they listen to or watch. So if you experience something, it lasts with you for a long, long, long time. And that's very evident, self-evident.

So we said therefore, from storytelling, can we go to storymaking? Meaning instead of simply celebrating people, observing and celebrating priceless moments in people's lives, can we curate priceless moments for people?

Raja decided that Mastercard had to move away from the older storytelling approach of traditional marketing to a new paradigm he calls “story-making.”

This approach means making the customer an integral part of the story—not just trying to craft a message that might appeal to them, but actively including them in creating their own stories.

Raja and his team believe that the key to success is to use the needs and desires of Mastercard customers to create experiences that involve them more deeply in the brand.

Raja knew that Mastercard’s Priceless campaign needed to evolve from an ad campaign to curated experiences. Here is Raja again, providing an example of a Priceless experience.

We started in a very limited fashion, and then we started learning along the way. So for example, our first experience, which we created, was with Justin Timberlake, who was our brand ambassador at that point in time.

Normally, we would have just put him in one of our videos and our TV and all that stuff, and he would say something smart, engaging, entertaining, and that's the end of the story. So we said, how do we now convert it into an experience?

Firstly, what we said is, we'll produce the videos for sure. That is that. But then slowly start building it into that whole experience—a real physical experience or a digital experience for consumers.

So when consumers are there on their social media stream, for example, they get a message saying, “Hey, congratulations, you have a Priceless surprise from Mastercard. Click here to find out.” So people click. When they click, they see, “You have got a free download of Justin Timberlake's song, ‘Mirrors’ or some other song.” The value of that is probably $0.99 in consumers' perception for that song. That was the kind of perception that people had at the time; they were buying songs at that level.

So we said, this is available to you free. You can just download it. It's just a cheap thrill. People like free things. Now, at one level, people sort of would roll their eyes, saying, what's the big deal about it? It doesn't seem to be anything big to talk about. Believe it or not, we had more engagement from consumers that evening than Pepsi had during the Super Bowl, where they were spending in excess of $100 million. And I was spending barely under $5 million for this whole thing.

We also now started expanding this. So from digital downloads of songs, we go to giving some sound equipment—some speakers, some players, whatever else it is. And then the prize value keeps going up as we are going closer to the Grammy Awards starting time. And then towards the end, we have got the biggest Priceless surprise: tickets to the concerts, you get a meet-and-greet with Justin Timberlake backstage. But the biggest surprise is Justin Timberlake will come to your home and spend a day with you.

We selected a person. She was a singer from a very humble background. And we went to her and said, “We are actually going to do an audition for you for a Mastercard ad because we saw you sing someplace.” She was delighted, she was thrilled. So we said, “We'll do the audition.” And we told her that we would do this audition at her home. So the crew went in, and then we told her to make sure that there is no disturbance from her neighbors and all that stuff.

Then we had our cameras and everything set up, and we asked her to start practicing. And then there’s a doorbell that rings. She looks up, annoyed, saying, “I told everyone not to really interrupt me. I'm so sorry about that.” She goes and opens the door, and there is Justin Timberlake. He says, “Hi, I'm Justin Timberlake. May I come in?” And she said, “Holy [expletive]!”—which we beeped out.

We recorded the whole thing. He actually spent half a day with her. He was teaching her, giving her some tips, and they were singing together. After that, the entire neighborhood became a Mastercard neighborhood, literally. Because she was going there, she became our single biggest advocate.

We captured all those, put them on social media, put them on television as well—this and the shortened versions of these videos, as ads. Now, if you're a Justin Timberlake fan and you see that Mastercard is sending Justin Timberlake to someone’s home, there is frenzy, right? And then people start to know, when you want to actually go and register for that, they say, “Do you have a Mastercard?” If you don’t have a Mastercard, sorry, this is only for Mastercard people. And then people say, “How the heck can I get a Mastercard? Let me just go and find out.”

So you're asking people to ask for a Mastercard at that point in time, literally speaking. In that single night—this was in 2014—in that single night, we had 48,000 new applications for credit cards, which we of course forwarded off to the banks that we had partnerships with.

Shifting from the storytelling approach of the Priceless advertisements to the story-making approach of curating Priceless moments meets several of the marketing challenges that Raja identified from the consumer’s perspective. But remember, Mastercard is not a B2C business. It is also beholden to its merchants and banks.

While the original Priceless ads were excellent at targeting consumers on an emotional level, the new Priceless campaign intends to provide benefits to all three stakeholders in Mastercard’s ecosystem. It aims to break through the clutter of traditional advertising for consumers. It differentiates Mastercard’s product from other credit cards, increasing customer acquisition for banks. Finally, it provides access to a more global customer base and a wider data pool for merchants. These changes eventually led to more transactions, which resulted in higher revenue for Mastercard.

Evolving Mastercard’s Priceless campaign from storytelling to story-making had an impact beyond advertising to consumers. Raja will explain how this shift also affected Mastercard’s other stakeholders: banks and merchants.

Priceless, as a concept, was leveraged only for advertising. So we said Priceless has to evolve from being an advertising campaign into a holistic marketing platform. This means, how do you infuse pricelessness into everything that we do, in terms of consumer engagement, and all the way throughout the life cycle of consumers—from acquisition to retention, and everything in between? How do you really leverage Priceless and make it a true marketing platform?

And we also said, more importantly, marketing is not a fluffy function that's in its own corner, doing some pretty stuff. It's not about that. Marketing is really a business driver. It should be something that creates a sustainable competitive advantage for the company. Of course, it is the steward for the brand, which we have to protect, nurture, and grow.

So we reconfigured our entire marketing mission—the reason why marketing exists at Mastercard—on three pillars:

Pillar number one: Build, nurture, and protect the brand.

Pillar number two: Fuel the business, which means you are really, really making a difference to the business results in a tangible, palpable fashion.

Pillar number three: Build platforms that will give the company a sustainable competitive advantage—platforms that are very difficult to replicate, platforms that are uniquely Mastercard, so that we are able to stave off any competition in our space as much as possible.

We provide those kinds of experiences that you can buy from Priceless.com. This is direct to consumers. But also, at the same time, there is a network effect where the banks and the merchants promote these. So what happens is, instead of me advertising and reaching all the consumers and telling them multiple times how they should actually be either looking at these offers or how they should take advantage of these offers, it is the banks and the merchants who communicate significantly.

So it’s literally—when you talk of a multiplier effect—that is the multiplier effect we have through our network play, which we execute pretty diligently and smartly. This is how we overall go about it.

Creating an Emotional Spark

In the Justin Timberlake story, Raja described an amazing experience that Mastercard amplified to acquire and engage customers. Raja wondered how Mastercard could use these experiences to allow thousands or millions of consumers to make their own stories and, at the same time, provide value to its bank and merchant partners and drive growth for Mastercard.

Many consumers have multiple credit cards in their wallet. Often, the goal of credit card companies is to increase their share of wallet through repeat purchases. In other words, even if consumers don't churn by canceling their cards, they may become dormant and not use them. Therefore, Mastercard's goal is not necessarily to acquire new customers, but to keep its existing customers engaged. Encouraging customers to use its card more often would eventually help Mastercard's bank clients who issue cards, as well as its merchant partners where the card is used.

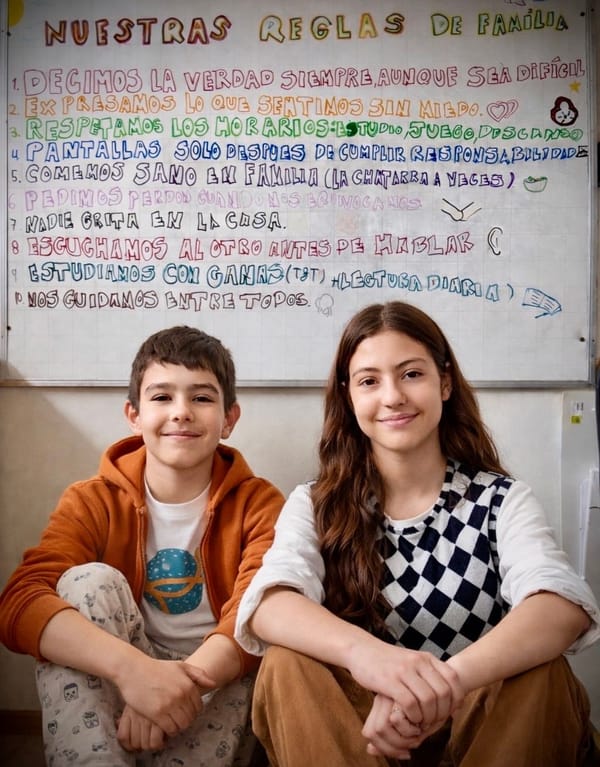

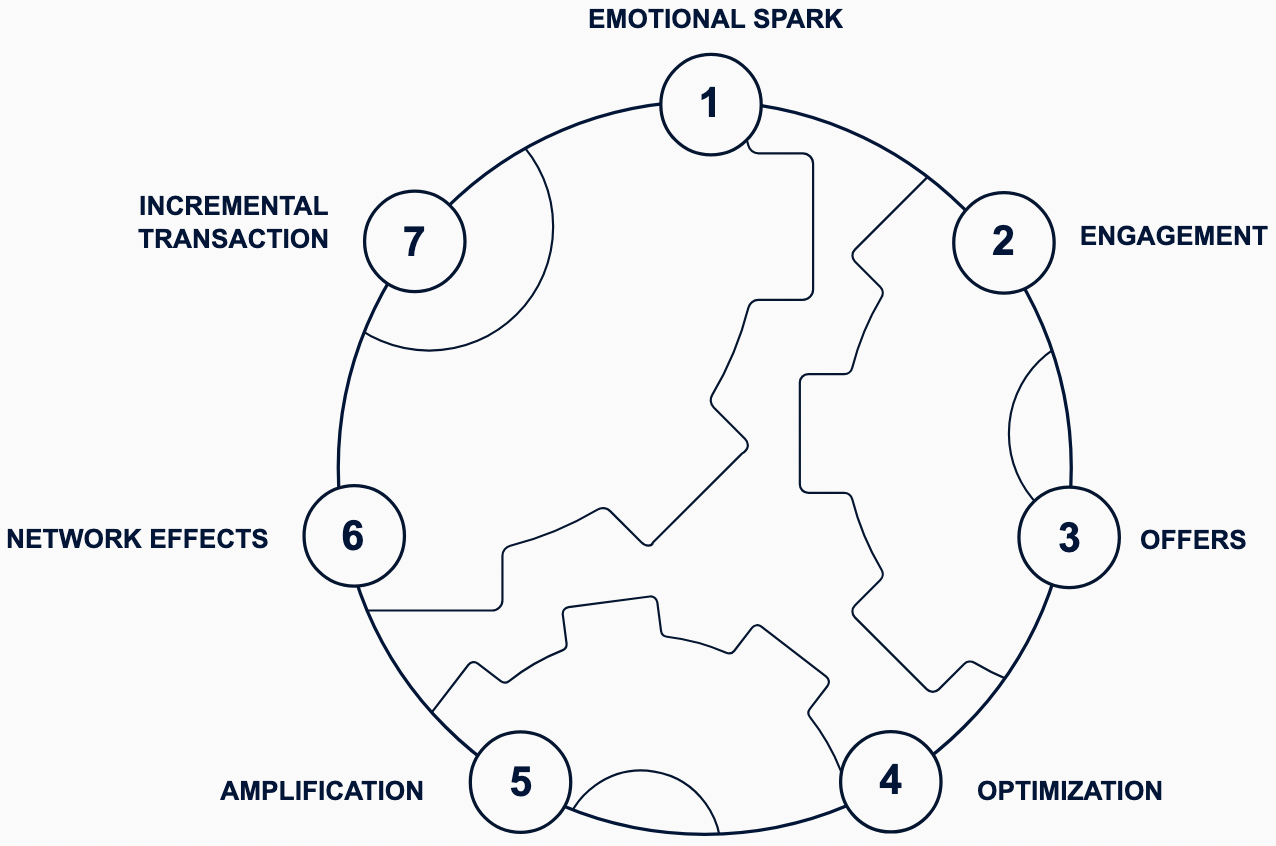

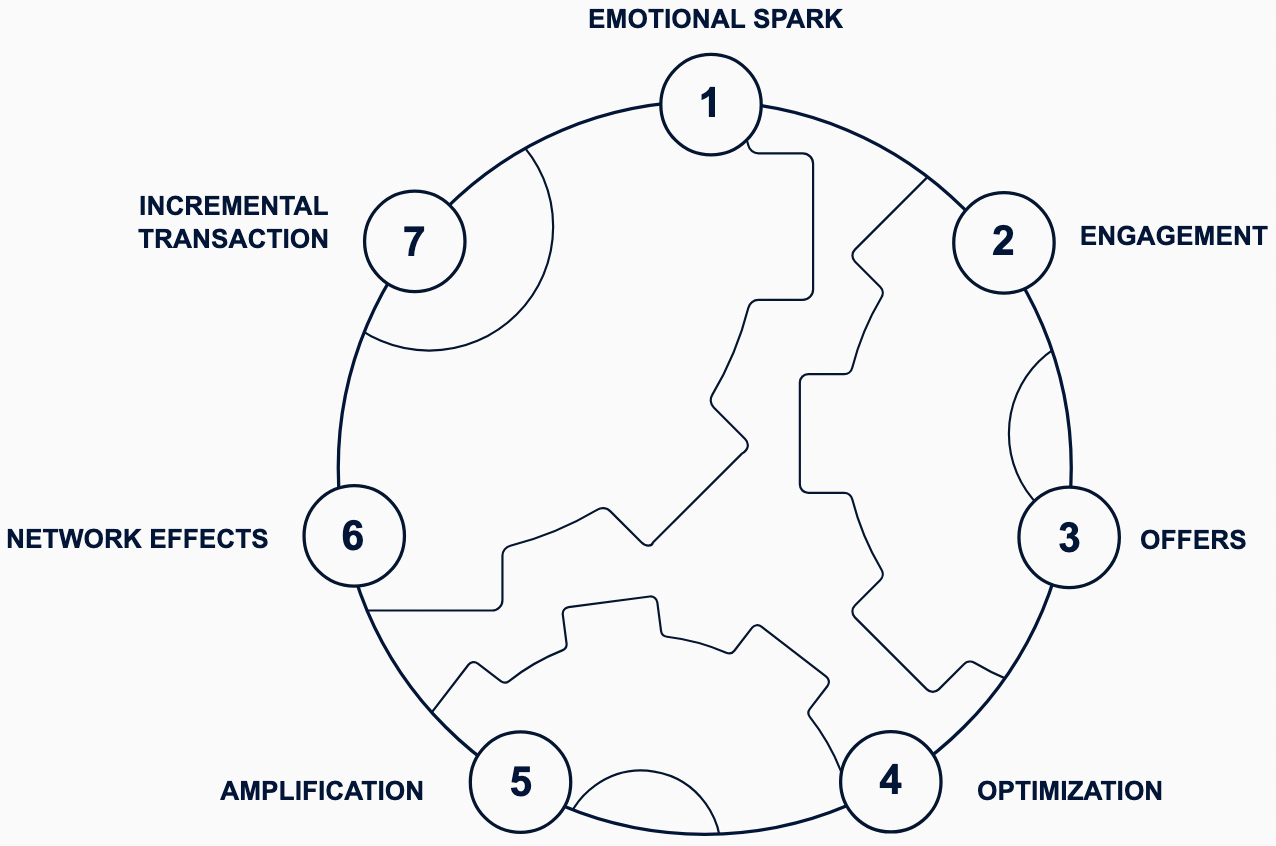

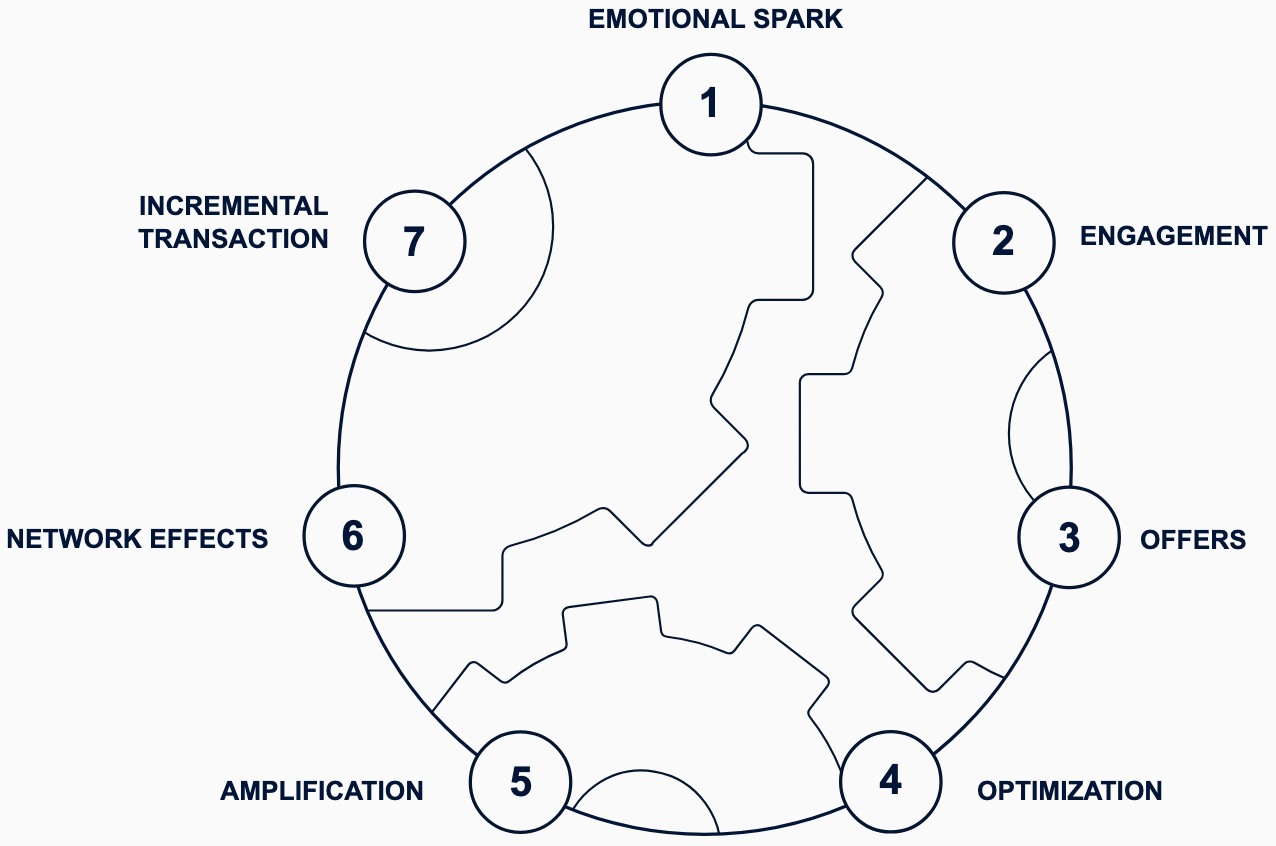

To achieve these objectives, Raja and his team created a digital engine. This digital engine has seven steps. The first step is to create an emotional spark with the aim to generate a sense of excitement for Mastercard customers and give them an inspiring example to help them create their own stories.

One example of this emotional spark was a video Mastercard produced with a famous actor, Hugh Jackman, several weeks before New Year's Eve. In this video, Jackman announced that Mastercard wanted to fly its cardholders anywhere in the world to let them celebrate with the family, friends, and mentors who shaped and influenced them. All customers had to do was share a story about an amazing person in their life to win a chance to reunite with them on New Year's Eve.

Notice that this is not a typical ad asking you to buy from the company or use its card. It is really about consumers connecting with their family, friends, and mentors and asking them to share their stories.

To encourage consumers to share stories and offer them an inspiring example, Mastercard produced a second video of Hugh Jackman surprising his mentor in New York. Here is Raja describing the second video of Jackman.

Hugh Jackman was doing a Priceless surprise for his acting teacher, the person who helped shape his career. The teacher was invited to New York under the pretense of conducting a master class for real acting students. Midway through the session, Hugh Jackman walked onto the stage, surprising both the teacher and the students. The teacher was visibly moved, and there was a heartfelt interaction between them. Hugh announced that he was establishing an acting scholarship in his teacher's honor, bringing tears to his mentor's eyes.

This “spark video” was designed to ignite emotional connections with viewers. It wasn’t just about Mastercard; it was about the value of gratitude, mentorship, and personal growth. By creating authentic experiences that resonate on a personal level, Mastercard shifted from storytelling to storymaking, allowing consumers to connect emotionally with the brand and inspiring them to create their own priceless moments.

Raja describes how the Hugh Jackman video captured the right emotional spark for Mastercard’s digital engine.

Hugh Jackman was doing a Priceless surprise for his acting teacher, the person who helped shape his career. The teacher was invited to New York under the pretense of conducting a master class for real acting students. We told the teacher, “We’ve heard great things about you, and we’d love for you to fly into New York to lead this session.”

The classroom was filled with real students, genuinely engaged in the lecture, unaware that something special was about to happen. Midway through the session, Hugh Jackman unexpectedly walked onto the stage. The students erupted with excitement, while the teacher stood there, stunned and pleasantly surprised.

There was an immediate and heartfelt connection between Hugh and his teacher—a beautiful, genuine interaction filled with mutual respect and affection. Then, Hugh Jackman made an emotional announcement: to express his deep gratitude, he was establishing an acting scholarship in his teacher’s honor for a deserving student. The moment was incredibly touching, bringing tears to the teacher’s eyes.

This was our "spark video." It wasn’t just content—it was an authentic, emotional story that resonated with universal themes of mentorship, gratitude, and personal growth. When such a video is shared in the right context—whether in conversations about acting, teaching, or the profound impact mentors have—it fits naturally and beautifully. This approach goes beyond traditional advertising, creating memorable experiences that inspire and connect with audiences on a deeper level.

The purpose of these spark videos is to provide inspiration to consumers to create their own stories of gratitude and connections.

Mastercard’s Digital Engine

Digital Engine Step 2: Engagement

The emotional spark provides an inspiring example for consumers to create their own stories. The next step of the digital engine engages and encourages the target audience members to share their stories with Mastercard.

Mastercard identified its target audience on digital channels like Facebook and YouTube, where it shared Hugh Jackman’s videos and encouraged consumers to share their own stories for a chance to win a free trip to meet a family, friend, or mentor who influenced them.

Thousands of customers shared their own stories. These stories would provide Mastercard with ideas for unique offers (step 3) and experiences it could create to engage consumers.

But Mastercard has the challenge of sifting through all these customer stories to curate the right experience to engage its audience.

Mastercard conducted two types of analysis to identify the right offers for its consumers: macro and micro analysis.

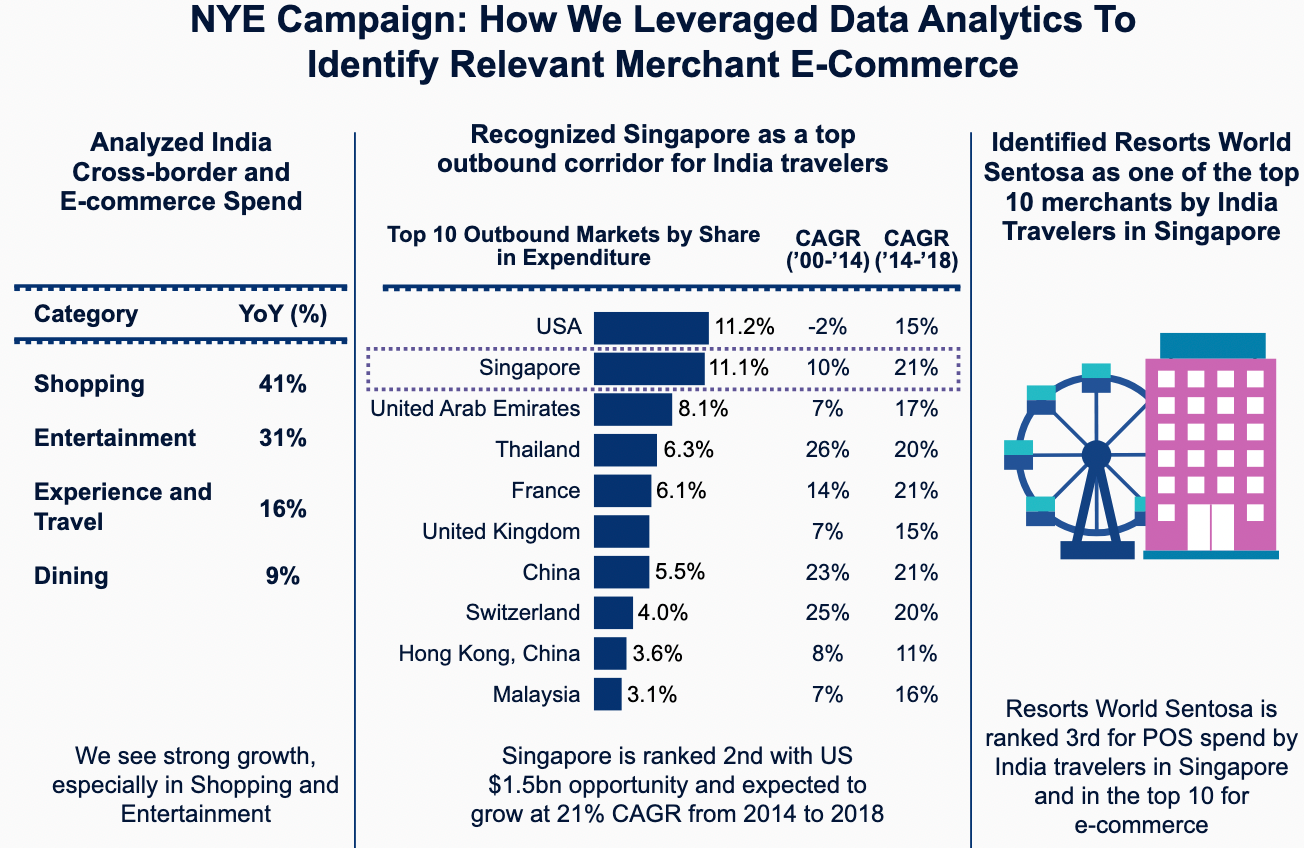

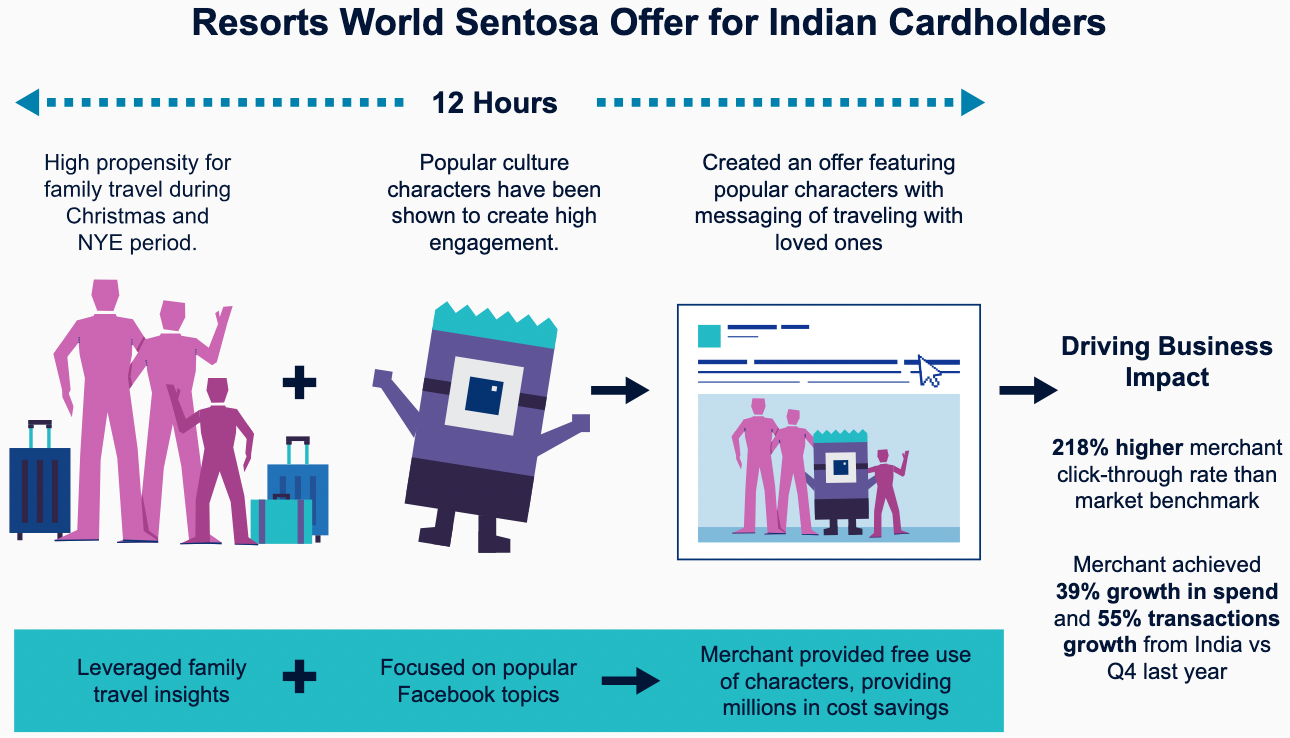

Macro analysis focuses on identifying broad trends in the marketplace. For example, during the Hugh Jackman campaign, Mastercard observed significant growth in shopping and entertainment activities among its consumers in India. Additionally, it discovered that the U.S. and Singapore were the most desirable travel destinations for Indian consumers. Within Singapore, Resorts World Sentosa emerged as one of the top ten preferred destinations for Indian travelers.

Micro analysis dives deeper into consumer-specific data, focusing on individual preferences and aspirations. Mastercard achieved this by analyzing the thousands of stories shared by its consumers during campaigns. Manually sifting through this volume of data would be impractical, so Mastercard employed text mining and natural language processing (NLP) algorithms. These technologies helped identify key themes, sentiments, and aspirations hidden within the stories.

For instance, NLP could reveal patterns where parents expressed their desire to create memorable family experiences by taking their loved ones on vacations to destinations like Singapore. Such insights help Mastercard understand not just what consumers are doing, but why they are doing it—their emotional drivers.

By combining macro trends with micro-level consumer insights, Mastercard could tailor specific offers that resonated with their audience. This dual approach not only enhanced customer engagement but also created value for Mastercard's bank partners and merchants by aligning offers with real consumer desires.

Mastercard’s macro analysis examined large trends in the market. The company identified the desire to travel to the United States and Singapore among its Indian consumers, its target audience. The micro analysis used computer algorithms to examine social media stories to identify the target audience’s specific wants and needs. Mastercard used both the macro- and micro analyses to narrow down its merchant offers. Mastercard still needs to know whether its merchant offers will actually appeal to its target customers.

Once Mastercard selects and convinces merchants to participate in its campaigns, it tests and refines creative content, copy, and themes as part of the fourth step of its digital engine: optimization.

To do this step, Mastercard uses A/B testing. A/B testing is a randomized experiment in which two or more variations of a variable (the content of an ad, for example) are shown to different customer groups to determine which version has the maximum impact on them.

Here is an example of five offers that were tested for a New Year’s Eve campaign with different creative, budget, and media placement. The offers were measured by their click-through rate and their engagement rate. The engagement rate is the percent of consumers who reacted to an ad by viewing the video, clicking on a link, or sharing with a friend.

| Food Campaign | Lanterns Campaign | Food Offer | Tuk Campaign | Lanterns Offer | |

|---|---|---|---|---|---|

| Website click rate | 0.59% | 0.51% | 0.47% | 0.43% | 0.39% |

| Engagement rate | 0.72% | 0.87% | 0.99% | 1.65% | 1.15% |

Mastercard refined these offers and adjusted the promotion according to click-through and engagement rates.

Until this moment, Mastercard only spent its own marketing dollars to test, refine, and measure the effectiveness of these offers.

Once it had evidence of their effectiveness, Mastercard contacted its partners—banks and merchants—to encourage them to put their marketing dollars towards amplifying (step 5) these campaigns.

Banks and merchants invest in these offers because they can now see tangible evidence of the effectiveness of promotions suggested by Mastercard.

Without Mastercard and its global reach, a bank in India or a merchant in Singapore would not know that the bank’s Indian customers might want to spend a holiday in Singapore.

Mastercard is able to connect Indian consumers with an offer from a Singapore resort that benefits both the Indian bank and the Singapore merchant.

The sixth step of Mastercard's digital engine focuses on amplifying consumer stories to enhance engagement and brand visibility. Mastercard shares these personal stories on platforms like Facebook and other social media channels, encouraging participants to spread their narratives within their own networks. This creates an organic ripple effect, where authentic, emotionally-driven content resonates with wider audiences. This is network effect.

To elevate excitement and deepen consumer connections, Mastercard selects standout submissions as winners. These winning stories often feature heartwarming surprises facilitated by Mastercard. For example, one winner from India shared an emotional story about his mother, describing her as his hero. Mastercard helped arrange a surprise meeting between her and Bollywood actor Anil Kapoor, creating a touching, memorable experience.

These experiences are not just personal moments; Mastercard transforms them into powerful marketing assets. Videos capturing these surprise meetings are shared across digital channels, sparking further interest and engagement. As Raja Rajamannar explains, this process shifts the focus from individual Priceless Moments to broader Priceless Movements, fostering a community-driven marketing ecosystem where consumers actively contribute to the brand narrative.

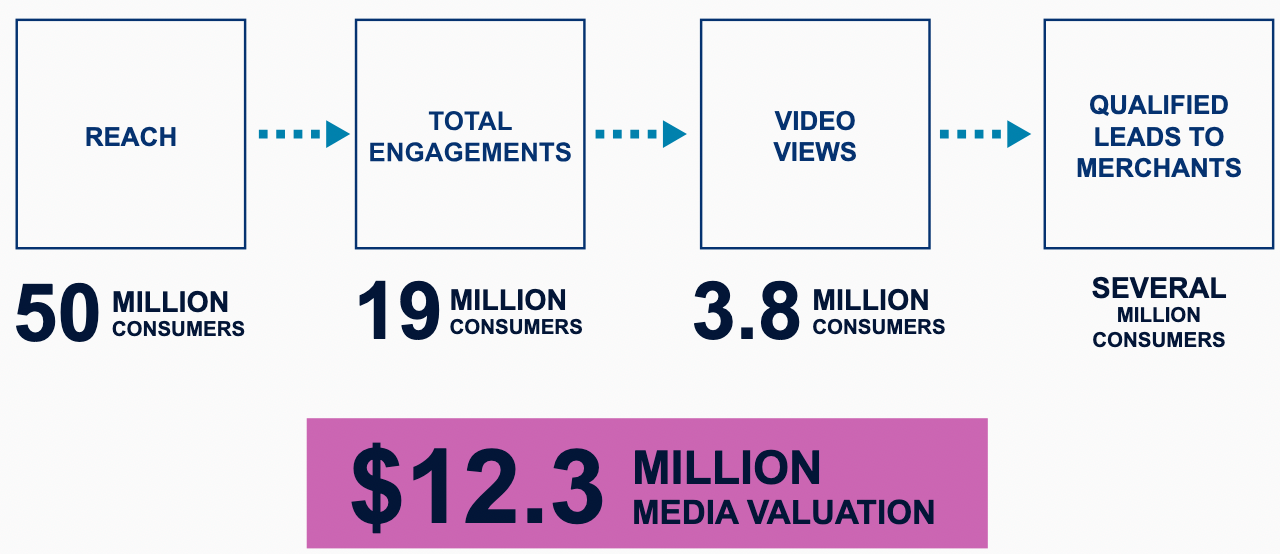

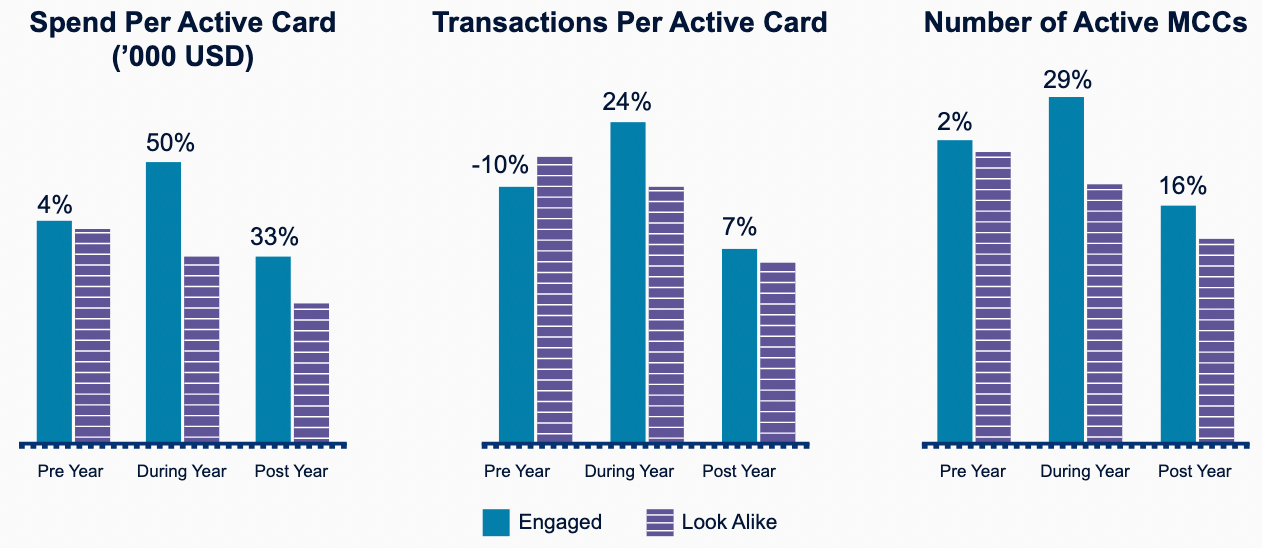

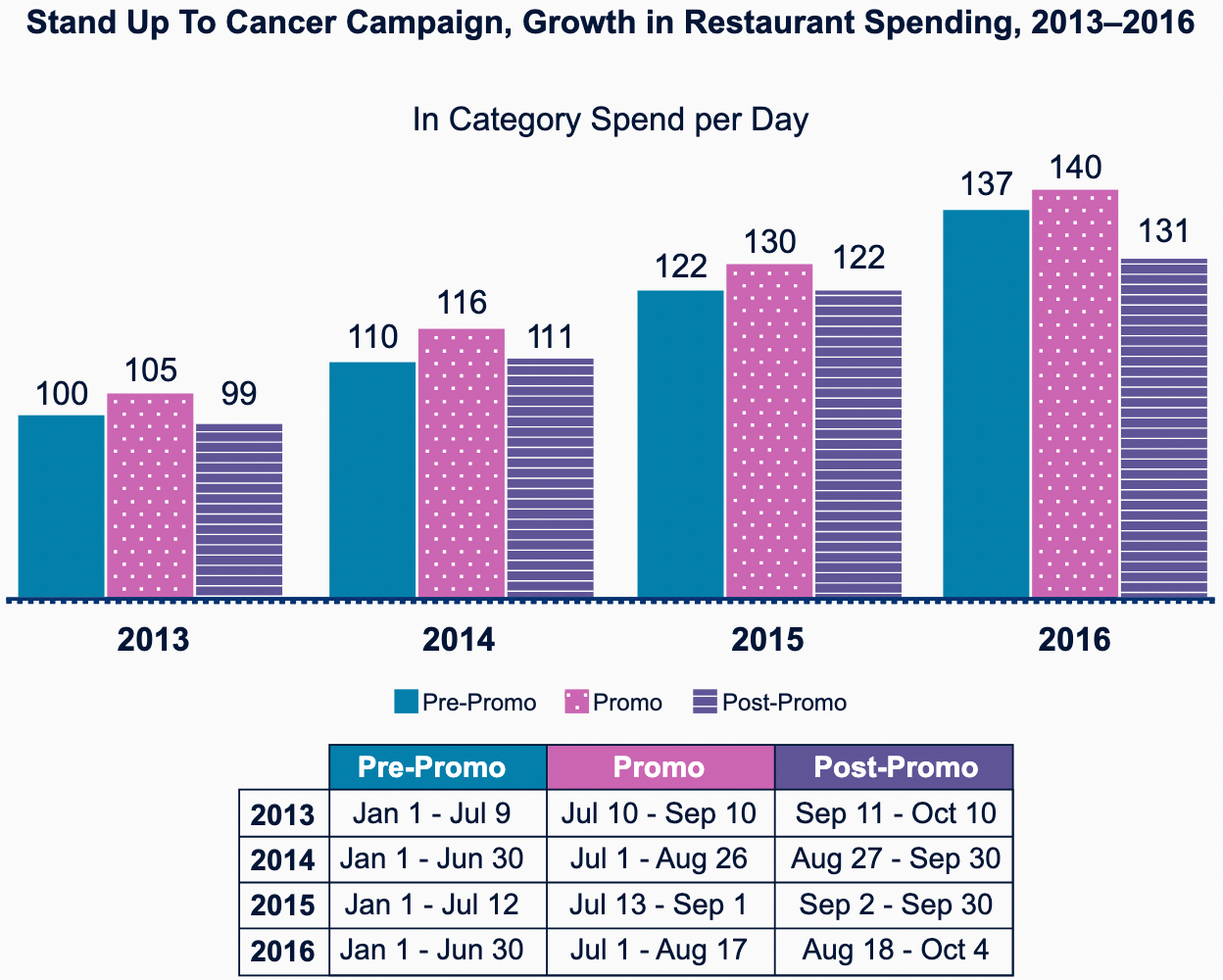

The final step in Mastercard’s digital engine is to measure effectiveness. Given Mastercard’s role as a platform connecting consumers, banks, and merchants, it’s crucial to assess the impact of its Priceless Possibilities platform across all stakeholders.

- For Consumers: Mastercard tracks metrics such as reach (how many people saw the content), engagement (likes, shares, comments), and views to gauge brand visibility and emotional resonance.

- For Merchants and Banks: Mastercard measures qualified leads (potential customers showing interest in products or services) and incremental transactions (additional sales attributed to the campaign) to demonstrate tangible business growth.

- For Mastercard Itself: The company focuses on key performance indicators like the number of active cards and spend per card to assess the overall effectiveness of its campaigns in driving customer usage and loyalty.

By closing the loop with robust measurement, Mastercard ensures that its marketing efforts not only create emotional connections but also deliver measurable business outcomes for all parties involved.

Note that the final step of Mastercard’s digital engine, incremental transactions, refers to the additional transactions that occur as a result of the marketing campaigns—in other words, transactions that would not have happened otherwise. These transactions benefit Mastercard, its merchants, and its banks. In other contexts, these are sometimes referred to as “incremental sales.”

Mastercard's digital engine showcases several unique qualities that set it apart from traditional marketing strategies. Unlike its 1997 campaign, where Mastercard communicated its value proposition directly to consumers, the new approach empowers consumers to tell their own stories. These narratives aren't centered around credit cards or payments, but instead focus on personal aspirations and meaningful life experiences. This strategy fosters deeper emotional connections, tapping into consumers' passions and future dreams rather than relying solely on historical data.

Mastercard strategically aligns its campaigns with themes that resonate with consumers' interests—such as travel, entertainment, and personal growth. These passion points naturally encourage more spending, which benefits not just Mastercard, but also its bank and merchant partners. By focusing on experiences that inspire, Mastercard shifts the conversation from transactional rewards like miles or discounts to fulfilling deeper consumer desires.

A key strength of this platform is its ability to create synergies between global and local markets. Mastercard connects consumers from local banks in one country with merchant offers from another, leveraging its global network in a way that individual banks or merchants couldn't achieve independently. This interconnected approach creates a win-win scenario: as Mastercard's customer base grows, its partners gain access to new audiences, expanding their reach and potential revenue streams.

Additionally, the digital engine's modular design allows it to be easily customized to align with the specific goals of banks and merchants in different regions. Whether the objective is to boost customer engagement, increase transactions, or enhance brand loyalty, Mastercard’s platform can be adapted to meet diverse business needs across markets.

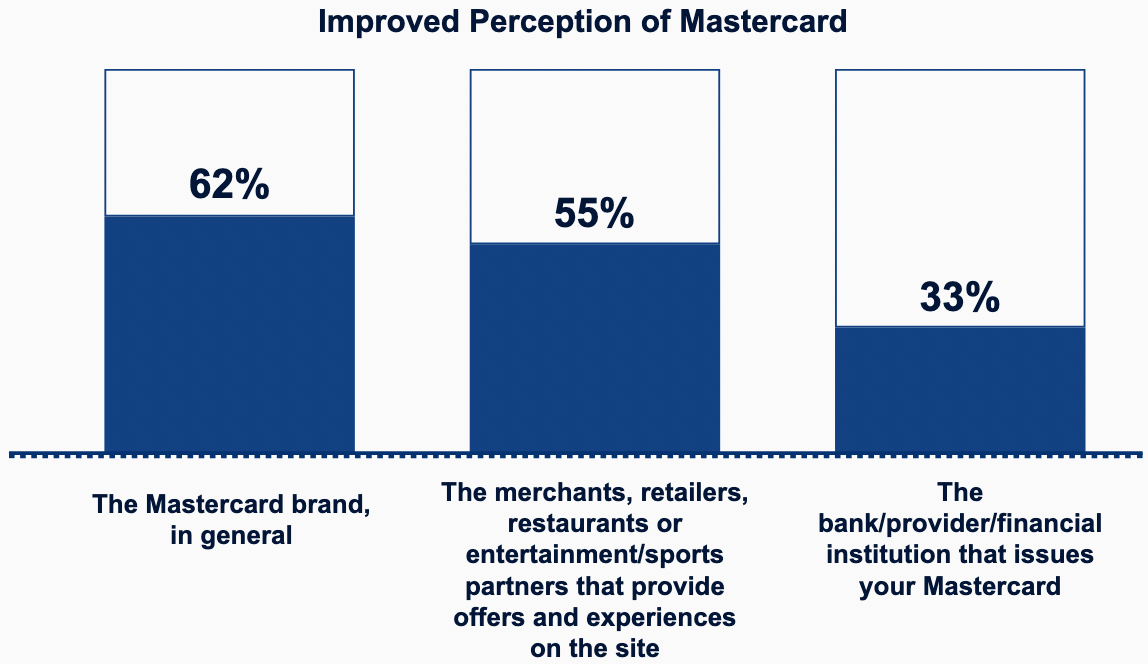

The effectiveness of this strategy is evident through various performance metrics. Mastercard has seen:

- A significant increase in positive brand perception, with consumers viewing the company as more than just a payment processor, but as a brand that supports their life aspirations.

- Enhanced perception of its bank and merchant partners, as consumers associate these entities with the meaningful experiences Mastercard facilitates.

- A measurable boost in consumer spending, driven by emotionally engaging campaigns that inspire action beyond traditional marketing incentives.

- Revenue growth for both Mastercard and its partners, showcasing the platform’s ability to drive tangible business outcomes alongside brand-building efforts.

Overall, Mastercard's digital engine exemplifies how modern marketing can go beyond advertisements, creating authentic, scalable connections that deliver lasting value for consumers, partners, and the brand itself.

Beyond Story-Making at Mastercard

The digital engine proved to be a successful tool in helping to implement Mastercard’s shift in marketing strategy towards story-making.

Raja needs to find a way to scale campaigns without adding a lot of complexity to the process.

With hundreds of these campaigns implemented around the world, Mastercard should analyze them to determine best practices. More work can be done to assess ROI of these campaigns for Mastercard and its partners. Mastercard should also examine the long-term impact of these initiatives.

Mastercard decided to use a story-making approach for its marketing campaign.

Engaging customers through story-making is a powerful marketing strategy that extends beyond Mastercard. Many brands have successfully turned customer experiences into marketing assets, creating emotional connections and fostering brand loyalty.

A historical example is Michelin, the French tire company. In the early 1900s, Michelin launched the Michelin Guide, a publication designed to encourage more road travel—and, consequently, more tire usage. The guide featured detailed recommendations for restaurants, hotels, and travel routes across France. Over time, the Michelin Guide evolved into an authority in the culinary world, with its star rating becoming one of the most prestigious accolades a restaurant can receive. This strategic initiative transformed Michelin from a tire manufacturer into a cultural icon synonymous with quality and adventure.

In a more contemporary example, Refinery29, a lifestyle brand, created 29 Rooms, an annual pop-up event featuring twenty-nine interactive art installations. Partnering with various brands, Refinery29 curates immersive spaces that invite visitors to engage, explore, and share their experiences on social media. This approach not only generates organic content but also deepens the emotional bond between the brand and its audience, turning consumers into active participants in the brand narrative.

Similarly, e.l.f. Cosmetics leveraged story-making through its viral TikTok campaigns. By encouraging users to create and share content featuring e.l.f. products, the brand tapped into the power of user-generated content to amplify its reach. This strategy not only increased brand visibility but also strengthened e.l.f.'s connection with its online community, fostering a sense of belonging among its followers.

Story-making offers a dual advantage:

- Expanding Brand Awareness: By turning customers into storytellers, brands can reach new audiences through authentic, relatable content that resonates more deeply than traditional advertisements.

- Enriching Brand Communities: Shared experiences foster connections among customers, transforming isolated consumers into vibrant communities. These communities often become self-sustaining ecosystems of brand advocates, amplifying marketing efforts through word-of-mouth and social sharing.

In the next article, we'll delve into how companies cultivate and sustain these brand communities. You'll learn strategies for nurturing customer relationships, fostering engagement, and creating spaces where brand advocates thrive. This evolution from story-making to community-building is the next frontier in creating lasting, meaningful connections with consumers.