Scaling Post Product-Market Fit

Scaling Post Product-Market Fit involves expanding operations, optimizing processes, and leveraging market demand to drive sustainable growth and profitability.

Once you have achieved product-market fit (PMF), have tested and run experiments on each of your business model elements, and obtained financing for your startup, it’s time to focus on scaling. Scaling is the process of growing your company and maturing your business model. It happens naturally throughout the company lifecycle as you take on new staff, new customers, expand your product suite, and bring in more revenue.

Scaling requires you to formalize processes and make them repeatable. This moment is when you work to take your business from a dirt road where you have just confirmed you are on the right path to a highway where you are trying to operate efficiently, profitably, and go as fast as possible. There are two general approaches to scaling, a more incremental one and an aggressive one. Business model characteristics and context influence which growth playbook you should use.

Khatabook

We will follow the story of one startup, Khatabook, headquartered in Bangalore, India. Khatabook is an app that securely tracks the transactions for micro, small, and medium-sized enterprises. These enterprises play a crucial role in the Indian economy, and Khatabook’s goal is to empower merchants with the digital tools they need to support their businesses.

Ravish Naresh, co-founder and CEO of Khatabook, shared insight into the decisions he wrestled with around scaling the SaaS business. But first, let’s learn a bit more about Khatabook and the solution it offers to merchants in India.

Digitizing Merchants' Paper-Based Ledgers

So, Khatabook is a simple, easy-to-use accounting software used by the small businesses of India. Their vision is to make software adoption across small Indian businesses and enable them to increase their efficiency and their incomes.

In India, there is a very common need of managing your credit because most shopkeepers in India and the entire supply chain in India operates on an informal credit. Before they got started, they realized that almost a trillion dollars of account receivables in India are being managed manually in written diaries.

And if you see manual diaries in India, they're extremely prone to data loss, they're extremely prone to manual accounting. And these shopkeepers spend a lot of time daily, in terms of tallying their diaries and in terms of following up with their customers to recover their money back.

Just to give a sense of scale here, there are roughly 60 million small businesses in India, and the average family size is four. There are roughly 250 million families and individuals that are directly linked to small businesses in India. And if you count by people who are directly or indirectly employed by these small businesses, almost half of the Indian population is directly connected to the small business economy.

So, what Khatabook did was to automate this process of data entry and follow up with their customers. Now, instead of using the offline diary, the pen and paper, the shopkeeper now uses their Android app, which automates the entire process. That is, managing their credit and making that lifecycle of credit management simple and easy.

The Kirana Culture

Let's learn more about the market context in which Ravish was operating in India at the time, and how it inspired the Khatabook app.

Remember, entrepreneurial opportunities often arise out of secular waves of innovation that affect day-to-day behavior. In this case, the kirana shops - small, typically family-owned retail shops that sell groceries and other goods, make up a large portion of the Indian retail economy. 75% to 80% of India's $900 billion in retail economy consists of 15 million of these kirana shops.

These shops, historically, had not yet been digitized. Instead, they used a traditional, paper-based ledger, known in India as a bahi khata, to manually record customer purchases and credit. In other words, a khata book. These manual systems are prone to errors, and make tracking and management more difficult than a computerized system.

As of 2022, India's population exceeds 1.35 billion people. For decades, India lagged the U.S. and other countries in terms of the penetration of internet access and smartphones. But in 2016, a new service launched, called Jio, a national

telecommunications network that brought inexpensive internet access to the masses. In 2010, only 5% of India's population was on the internet. By 2019, it was 40%. At the same time, smartphones built on Google's Android platform were becoming widely available at very low prices.

These two forces represented a massive innovation wave for India. By 2021, India had 1.2 billion mobile phone subscribers, of which about 750 million were smartphone users. With this backdrop, let's follow Ravish on his journey, as he rode this innovation wave to digitize the paper-based ledger system in these small kirana shops.

Buying Khatabook

Ravish found an app in the Google Play online app store called Khatabook, which had 2,500 reviews and a high ranking. This really piqued his interest, and he saw that the author of the app wasn't some company, but an individual, a son of a shopkeeper.

He had learned Android on his own, sitting in his father's shop, and seeing his father's problems every day and grappling with the credit and all the problems in his shop, he made this app to automate the exact process that they were thinking of building.

He was sitting out of some small town in India in the hinterlands of India. The app had almost 50,000 monthly active users at that time. It was made three or four years ago and was just put on Play Store. The app had no cloud support, no back-end. It was a simple, native, local solution.

But as with all ventures, the initial traction is what counts. With Khatabook, Ravish saw a great name, a very catchy name and some legacy, ASO (app search optimization) and SEO (search engine optimization). If your app has certain legacy, and it comes up rank one in search rankings, in organic searches, then it's easy to drive growth on your app. And this ASO and SEO takes some time to build.

Ravish's first idea was - hey, let's collaborate with this guy. He already has this legacy. This would shorten their go-to-market incredibly. Just by replacing this app with their own better app, they'll be able to shorten their GTM a lot more. So that's exactly what they did. They got the guy on board, and bought out the app from him, gave him equity, and replaced that app with a much better cloud-based solution. And instantly, they saw a virality in their growth.

Interpreting the Context

In 2018, while the new Khatabook team worked to rebuild the entire app by replacing the backend software and adding an SMS alert feature, their main competitor, OkCredit, was gaining ground in the market. The company had already raised a few rounds of funding and appeared well-positioned to provide value to Kirana shopkeepers. Khatabook would have to keep an eye on OkCredit and determine ways to outcompete them to capture the market.

It may be helpful to think about the Red Ocean and Blue Ocean metaphorical framework. Red Oceans are existing markets with defined boundaries and entrenched competitors. Companies within these markets fight for a greater share of the market and as a result of these fights, the water becomes bloodied. Thus, Red Oceans are highly contested markets - just as Khatabook was pursuing a highly contested market by going up against OkCredit. Blue Oceans are markets that do not yet exist and so remain untainted by competition. A Blue Ocean company typically creates a completely new industry or alters an existing industry enough that it becomes a Blue Ocean environment. To achieve this, the company needs to generate unique value that allows them to capture a new swath of the market that has differing demands from those using the existing solutions.

In any startup opportunity, context matters. Certain trends or dislocations within sectors create a tremendous amount of opportunity for new ventures. We can think of these factors as waves. And the opportunity for the entrepreneur is to spot these waves and, like a good surfer, ride them. Riding a strong wave makes everything easier for a founder. You don't have to generate all the energy to move a market

yourself.

Examples of past waves include e-commerce, which Amazon rode beautifully. They didn't invent secure credit card transactions, tools to build business websites, or provide internet access, but Amazon rode each of these trends expertly to create trillion-dollar company.

Current waves that many startups are riding include the rise of artificial intelligence, the importance of cybersecurity, and the growing digitization of the entire health care and delivery services system.

As noted earlier, Khatabook was able to take advantage of the powerful wave of

inexpensive smartphones and high bandwidth mobile technology networks, thanks largely to Jio. Ravish thought about how those waves might evolve in the coming years if they continued, and predicted that even small mom-and-pop merchants would be eager to transition to digital transactions. And he wanted his product to be their first choice.

Think about other waves you've seen or believe to be up and coming. How might an entrepreneur identify these waves and use them to their advantage?

There is a promising influx of new users using the revamped Khatabook app, and the app meets their needs. But, if you are in Ravish’s situation, you also have to keep in mind you are competing with OkCredit, which has raised VC money and is also popular in the market.

Ravish decided to focus on growth and use it to prove to investors Khatabook was a worthy investment that could command market share. Seeking capital from investors who were aligned with his strategy, Ravish joined Sequoia Surge, an incubator program for seed-stage startups in India created by Sequoia India, the Indian arm of global VC firm Sequoia Capital. At the end of the program, he successfully raised $1.5 million in seed financing from Sequoia India.

They quickly realized that they can't be number two in this game, especially when it's about capturing the users and especially when it's about a sticky-use case, a network-led use case. It's about getting the use of force and capturing as much of the market as fast as possible for you to enable you to raise the next rounds of funding. As a number two, it becomes extremely hard to raise your successive rounds, and you were already sort of coming from behind.

So it was critical that they utilize the majority of their capital for just keeping their top line. Irrespective of how much money they had in the bank, they had to, at least on the user-front, be neck-on-neck with the competitor. So most of the capital went on just growth.

Acquiring and Retaining Customers

After deciding to put their new seed funding toward improving growth, Ravish and his team searched for inexpensive ways to acquire new customers. They decided to put most of the capital they received toward paid advertising campaigns on Facebook and Google. But, shortly after running these campaigns, the team began to believe something was wrong with the data.

Performance Marketing and CPI

- Performance Marketing is a form of digital marketing where brands only pay advertising platforms such as Google or Facebook when a particular desired action has taken place, such as a click or sales transaction.

- CPI is the advertising cost required to get a new customer to install your app.

In its early days, they saw that there were some organic installs because of the ASO and SEO. The next step would be to test out how the app would perform with performance marketing on digital platforms. Another interesting thing had happened because of Jio. Almost 300 to 400 million new people, they were all very active on Facebook, on Google, on YouTube, and all these digital platforms. And they were, in fact, voraciously consuming content.

Since nobody had built new products or new services for them, there was a massive level of ad inventory that was empty and was lying unused in terms of targeting these new users. So when they started performance marketing, they were getting CPIs of as low as 6 rupees. That's less than $0.10, per install. And that's almost unheard of. So they quickly realized that what they had hit upon was an entirely new part of the economy that was completely untapped. And since nobody was marketing to it, that inventory there was extremely cheap, and this became their initial GTM for growth.

Recall that your CAC is your total cost of acquiring a customer, your combined sales and marketing costs, which includes personnel and programs, divided by the number of customers acquired in that period. In 2019, Khatabook used CPI, cost per install, as their key metric to represent what it costs to acquire a mobile app customer. Since launching in late 2018, they have been very successful at getting users to download their app with relatively low marketing and sales dollars spent, resulting in 368,000 new transacting users and 5 times growth recorded in May.

Product-Led Growth

Let's learn more about how Ravish approached customer acquisition and consider how that may impact whether he truly has PMF.

Interestingly, Ravish was able to acquire new users extremely cost effectively because not only did he find a new wave to ride, mobile phone penetration in India thanks to Jio, but because it was a wave that few others were surfing. Khatabook was one of the first companies in India to advertise on the mobile app versions of Facebook and Google. By doing so, they could acquire attractive advertising inventory at a low cost and be one of the few advertisers that mobile users would see and thus respond to.

Finding waves is one thing. Finding a unique wave, a wave in the midst of a blue ocean where no other entrepreneurs are surfing, can be even more powerful and valuable. Over time, other entrepreneurs find the same waves. And these user acquisition strategies become more competitive and thus more expensive.

In addition to reaping the benefits of being early to a new wave, Ravish is making a strategic decision about his business model design. Knowing that average revenue per user, ARPU, would be relatively low with these small shopkeepers, particularly in the early days when Khatabook is new and has a limited range of functionality, he would need to design the product to have a natural virality to attract users at a low enough cost to be a viable company.

Virality is the tendency for your product or service to be shared and spread widely

among different users, readers, or customers online. Think of a compelling clip from a pop star's music video or a funny joke by a famous comedian that suddenly goes viral and is shared so frequently that it feels like it appears everywhere online. Designing a product to be viral is an art. Business to business virality is even harder to achieve. Why would a business want to share its product with another business?

Ravish tapped into this power by designing Khatabook to be useful as a tool for businesses to communicate with other businesses. This was because shopkeepers did business with similar suppliers. As soon as a shopkeeper was on Khatabook, they wanted all of their suppliers on the platform. And once a supplier was on the platform, they wanted all of their shopkeepers on it to automate ordering and the flow of goods. Thus, there was an incentive for shopkeepers to tell their friends and business colleagues about the app and encourage them to use it. Shopkeepers would show their phones to their fellow shopkeepers while hanging around the market and/or while trading goods with them. This inherent virality, useful in consumer apps like TikTok or Snapchat, but particularly powerful in a B2B app, is the result of a strategy known as product-led growth or PLG.

PLG is a go-to-market strategy that relies on the product itself and product usage as the primary driver of customer acquisition, conversion, and expansion. Companies that successfully execute on PLG often design their product in such a way that the act of product adoption and usage itself drives actions that results in growth.

Slack is a good example of this. When a company adopts Slack, the product is designed to be easy to use. It's like text messaging, but instead of chatting with your friends, you chat with your business colleagues. It's also easy to connect each of the employees of a department or entire company. The product is initially free to use, so there is very little friction to adoption. A prospective user downloads it and installs it without communicating with anyone at the company and simply starts to use it, thus sign-up and usage are frictionless. The actual usage of Slack triggers more users. The more you use the product to communicate with colleagues, the more colleagues need the product to communicate with you and their colleagues. Suddenly, Slack adoption spreads virally throughout an organization and the free product is no longer adequate. A company is using the product at such a scale that it triggers a decision to pay for this suddenly essential corporate communications tool.

That's product-led growth, low friction to download and adopt, use, and then the usage experience is so easy and compelling that it drives more usage and broader adoption and, as a result, increasing revenue. PLG is a dramatic change in the way technology companies, particularly B2B companies, think about going to market and driving adoption. It requires an intense focus on building a product for end users that solves an immediate and obvious problem as simply and cleanly as possible, then allowing the demo and distribution of that product to be frictionless and not require any human intervention or explanation so that users can both discover and use your product easily.

Here are the four steps required to execute a product-led strategy:

- First, make it easy to find or discover your product or service online.

- Second, make it easy to start using your product, that is download and install or online sign-up.

- Third, deliver substantial value for free before asking the user to pay you anything. That is a free trial or a freemium pricing model.

- And four, only after your users are addicted to your product do you charge them.

Creating an effective PLG strategy requires intentionality and designing PLG elements throughout your business model. The founder and CEO of Slack put it well, saying "Our job is to build something genuinely useful, something which really does make people's working lives simpler. The best marketing campaigns will fall down if they are not supported by the experience people have when they hit our site, when they sign up for an account, when they first begin to use the product, and when they start using it day in, day out."

The Khatabook team found additional opportunities to employ their product-led growth strategy through another app that soon became very popular in India, TikTok. Ravish and his team ran three GTM experiments around customer acquisition:

- Testing paid advertising campaigns on Google and Facebook

- Testing paid advertising on TikTok

- Testing the quality of a video uploaded to TikTok as it relates to views and conversions

Ravish and his team realized if a video is high-quality compared to the other user-created videos on TikTok, it will stand out as an ad. They found that after users identified it as an ad in their feed, they would quickly scroll past it. But, once they posted a video that appeared as if a user posted it (low quality), users made the effort to watch it because they thought it was a genuine user upload. They also learned their customers preferred short, video-based content to text, as many were first-time internet users and preferred consuming content this way.

After this successful experiment, the Khatabook team recorded high conversion rates and were able to generate 70,000 daily app downloads at 20% the cost of advertising on Google or Facebook. The Khatabook team found the TikTok advertising wave before other entrepreneurs. But, over time, this same go-to-market tactic would become more competitive and thus pricier to execute.

In June 2019, after their rapid growth in May, the company had spent almost all of their seed capital and had to cut back on marketing spend. As a result, new transacting users dropped significantly from 369,000 to 282,000.

The new transacting users had fallen, and Ravish was concerned about falling behind their competitor, OkCredit, who had access to more capital. If you were Ravish, what would you do next? How would you become more efficient at attracting and retaining new users, particularly as you are running out of funds?

User Engagement

PLG is not a panacea. You can't just focus on growth. You have to also focus on making sure your customers are engaged over time and stick with you over time, that is, retention. You have to avoid what is commonly known as the leaky bucket problem, where you have a metaphorical bucket full of customers pouring in the top through great acquisition strategies, but then leak out the bottom just as quickly because your bucket has holes in it. Holes can occur when customers are not engaged with your product, and so they churn. Thus, the quality of your growth and what happens after users sign up is just as important as the quantity.

In the short-term, Ravish wanted to demonstrate that he could grow a large customer base so that he could prove to prospective investors that he could outcompete OKCredit. But in the long run, he knew he would have to demonstrate true product-market fit with strong engagement metrics and low churn over time, to prove he had a product that he could eventually monetize.

When you're growing your user base, you must focus on the marketing funnel. The marketing funnel is a representation of a prospective customers' journey toward becoming an actual customer. There are three areas of the marketing funnel you can focus on:

- top of the funnel, which is customer acquisition

- mid-funnel, which is conversion, and continued usage

- and engagement, and the bottom of the funnel, which is monetization.

At different points in a startup's journey, you want to focus on different parts of the funnel. Remember, entrepreneurs are running experiments with limited resources and a finite amount of time. Thus, focus is key. What experiments are you going to focus on, at what moment in time?

To determine what your focus should be in the current moment, you have to decide which part of the funnel will unlock your business model or help unlock more financing to run more experiments. No startup business model is perfect out of the box. It has to evolve over time through these sequences of experiments.

Now, let's turn back to Ravish and Khatabook, who after successfully designing for PLG and driving a lot of acquisition is finding that his bucket is leaking.

After focusing solely on growth for months, Ravish believed he needed to shift his focus to improving post-install usage to improve these metrics and get the startup’s marketing spending under control. This focus on the lower parts of the funnel would allow Khatabook to reduce churn and continue to attract valuable, engaged customers organically. After all, the product is more useful as the network of users that use the product day in and day out expands. Additionally, a more engaged user base is essential when they finally decide to monetize.

So product-led growth is actually about driving growth by leveraging just digital channels and improving your product funnels. Product funnel starts with an input and ends with an output. The input is a user installing your app, logging in, going

through a bunch of steps, and then retaining as a permanent user. That's the output. Product-led growth involves making this entire process more efficient, right from the input - that is the login, to the end user - that is retaining.

The ideal scenario would be 100% efficiency, which is 100 people logging in and 100 people retaining as permanent users on your app. But obviously, in the real world, that's not the case because there's a lot of inefficiency in every process, from targeting to your product and to the end result as well, and the user also not understanding your app.

What Kathabook did was they tried to improve every step in this process. From making the login easier to making the product onboarding easier to making the user use the product easier. Because if he's able to use the product easily, he's also able to retain and understand the use case and then retain also permanently.

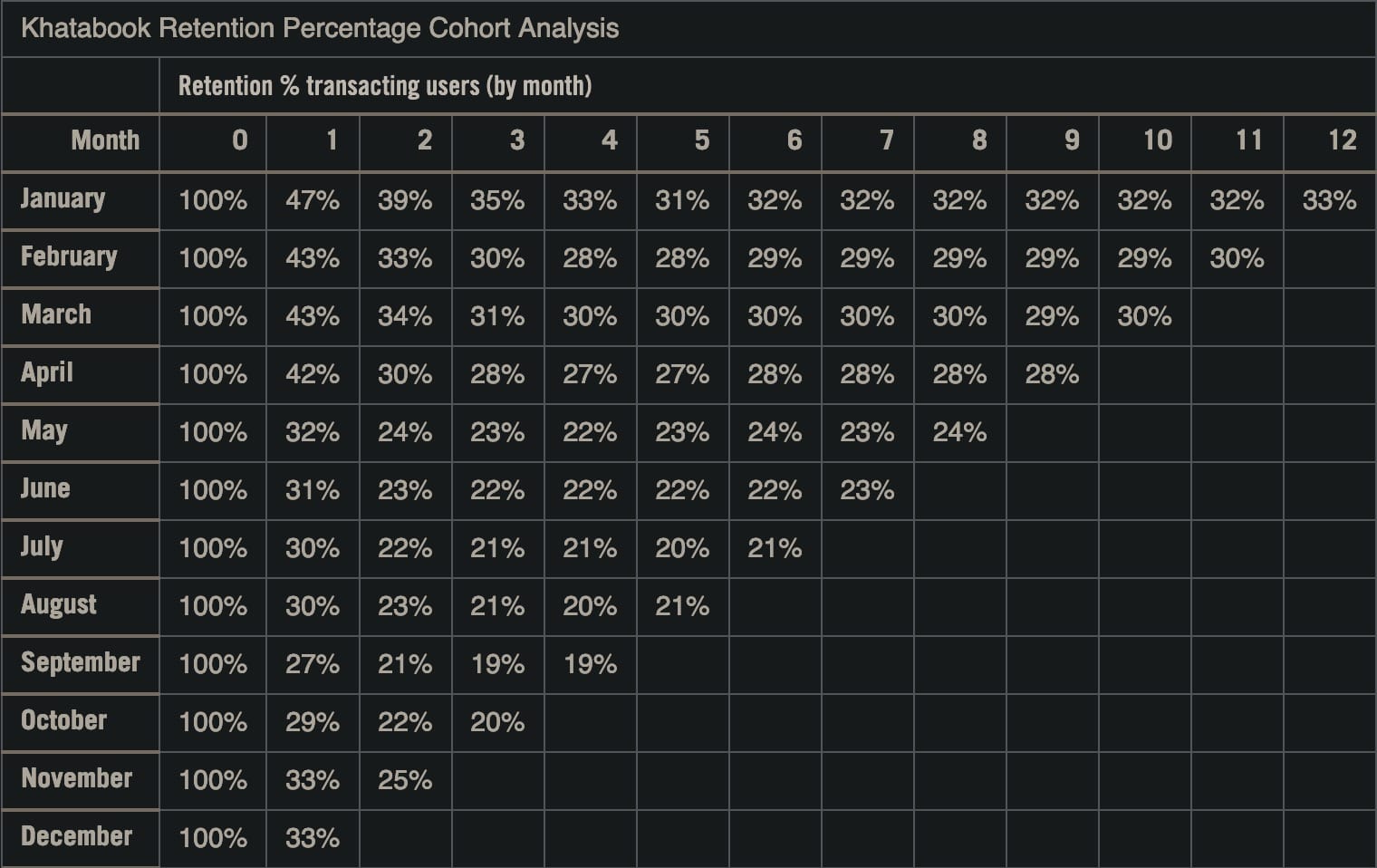

The number of transacting merchants is a good key performance indicator, or KPI, metric for growth. There is clear evidence of strong traction by the increasing number of new transacting merchants over time. But what should Khatabook’s KPI metric for engagement be? To answer that, we have to turn to cohort analysis.

With Squire, we analyzed how the customer cohorts spent money over time through the service, and saw spending growth over time - clear evidence of PMF. With Khatabook, we want to analyze product usage and retention over time.

A common form of cohort analysis is to examine all of your customers who signed up for your product or service within a particular month, and then examine how many of them continued using the service for each month after they signed up.

Khatabook’s user acquisition number has increased over time, but the retention rate is worsening (following down the column), which indicates the increased marketing investment is generating more sign-ups and short-term interest but with higher churn. This insight could indicate a big problem at the middle of the funnel, which eventually affects their ability to monetize at the bottom of the funnel.

The Khatabook team found that after an initial drop, new user retention stabilized, and retention remained flat in the 20-25% range after about three months. They studied the data from the first six months and found many people only downloaded the app and completed one or two transactions but did not continue using it.

Despite the usage dropoff, retention rates doubled for users who logged at least five transactions in the first month. So, the team became obsessed with getting users to the critical inflection point of logging at least five transactions. They initiated text reminders and targeted marketing campaigns. They shifted the focus from acquisition to encouraging usage, which meant they did not have the resources or bandwidth to target as many new users.

It is critical to have high quality of growth, not just quantity. Adding users that disengage shortly after signing on leads to a “leaky bucket” phenomenon. The team deciding to focus on the middle of the funnel will help address this leaky bucket issue and allow Khatabook to better retain customers. Ravish and the Khatabook team cannot focus on monetization until retention has improved.

The Hierarchy of Engagement

There are so many companies, so many teams that have experienced growth in the beginning, and they start building features that end up not being important. And then they start to realize that the churn is catching up with them. It's really, really hard.

The Hierarchy of Engagement is a framework to think about when you're building a consumer product and how to make a consumer product that endures. And there are three levels to it:

- The first level is around growth and, specifically, growing engaged users - users that are completing what is called the core action.

- The second level is retaining those users. So you don't want to have a leaky bucket. How do you take the users that you have and create a retentive product?

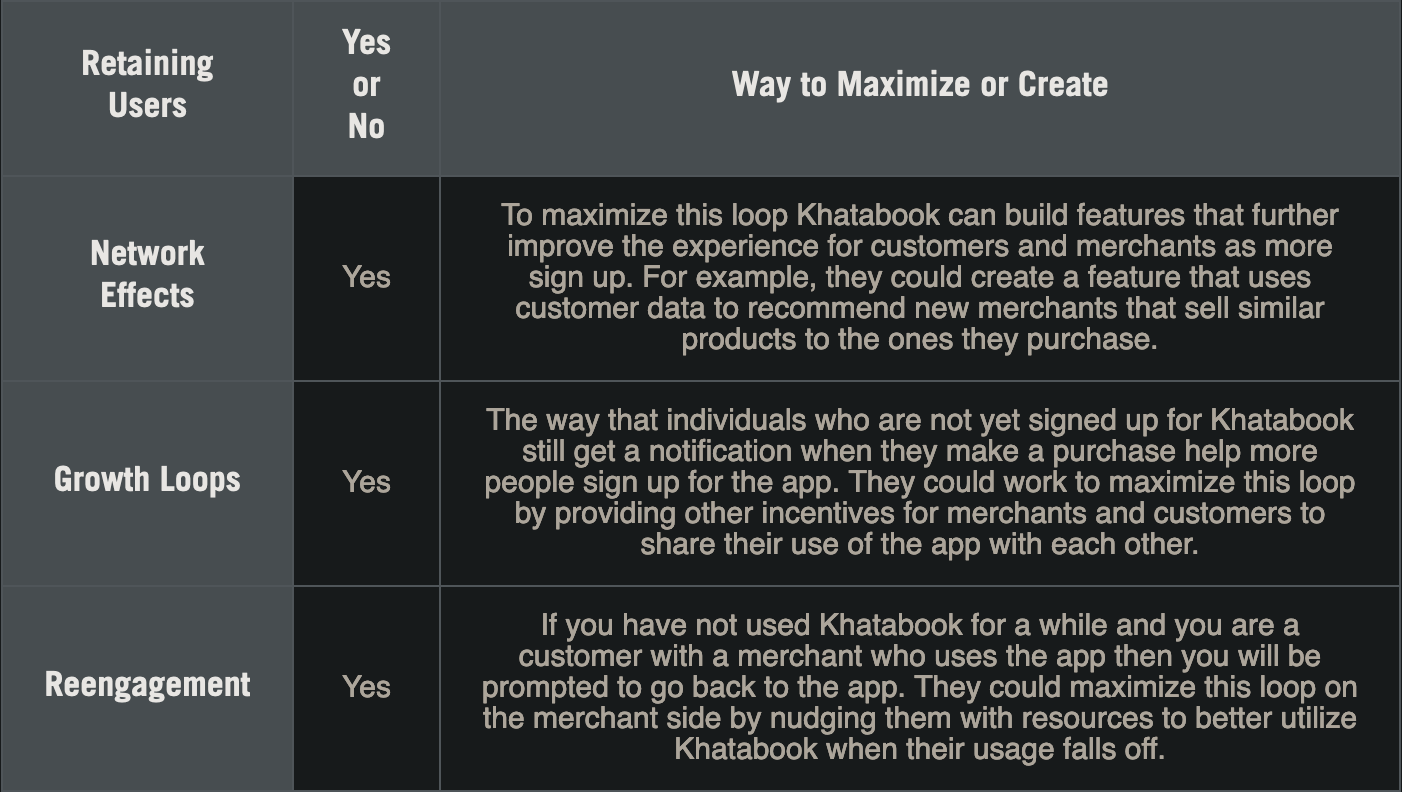

- The third level and the hardest level to get to is around this idea of making a self-perpetuating product, that there are loops in your product that you use to maximize the potential experience both for your users and for your company. And there are three loops specifically - network effect, growth loops, and re-engagement loops.

Everybody is oriented around growth. But what does growth mean? There are so many different things that you can look at when you're trying to understand growth. And the lowest common denominator that many people focus on tends to be monthly active users. A monthly active user is the very bottom rung of a metric. If you have a user coming once a month, you're not going to build a valuable company because that's not enough engagement to create a habit, to create all the things that are really difficult to do to build something that endures.

What you measure matters, it's so important to figure out the metric that really is the one to focus on and optimize for. That is what the core action is. A user comes to your product. There are so many different things that they can do. And there are so many things that they need to do to be able to use the product. But ultimately, there should be one metric, one action, that is the core action, that's the foundational action of your product and also is the thing that leads to that user becoming a retained user. So some examples of that.

If a user comes to Pinterest, and they don't pin something, then do they really understand what Pinterest is? No. And so, really it's about, you come to Pinterest, and you find something that you love, and you pin it. You save it to one of your boards. That's an example for Pinterest.

For YouTube, interestingly, the core action probably changed over time. So in the beginning, it's very much focused on that idea of bringing content into YouTube. But as YouTube evolved, they realized that actually subscribing was the core action on YouTube. If I find content as a user that I love so much that I want to make sure that I see more content from that creator, then I will subscribe to their channel. And that creates this experience for me that makes me want to come back. It's like the strongest signal of a user finding a real fit. And then on the other side, as the creator, I'm growing my audience. I know that as I create more content, there's going to be this group of people who have already subscribed to my content. And they're going to want to watch it. So it's this incredible single action that actually creates a lot of value for both sides of the network for YouTube. And so that is an example of a metric that you end up, as somebody working on YouTube, really want to optimize for.

Anything else than focusing on the core actions just sets you up for a leaky bucket, meaning what ends up happening if you're not focused on the right action, is that the churn is going to catch up to you. And it's going to be difficult to grow.

Level 1 of the Hierarchy of Engagement is about growing your company by getting users to complete your product’s core action. What is the core action for Khatabook? How can Ravish and his team continue to push users towards completing this core action?

Recall that while following the Khatabook story, we learned they are facing a leaky bucket problem. Users are signing up for Khatabook and completing the core action of logging a transaction, but they are churning before hitting the critical milestone of logging five transactions.

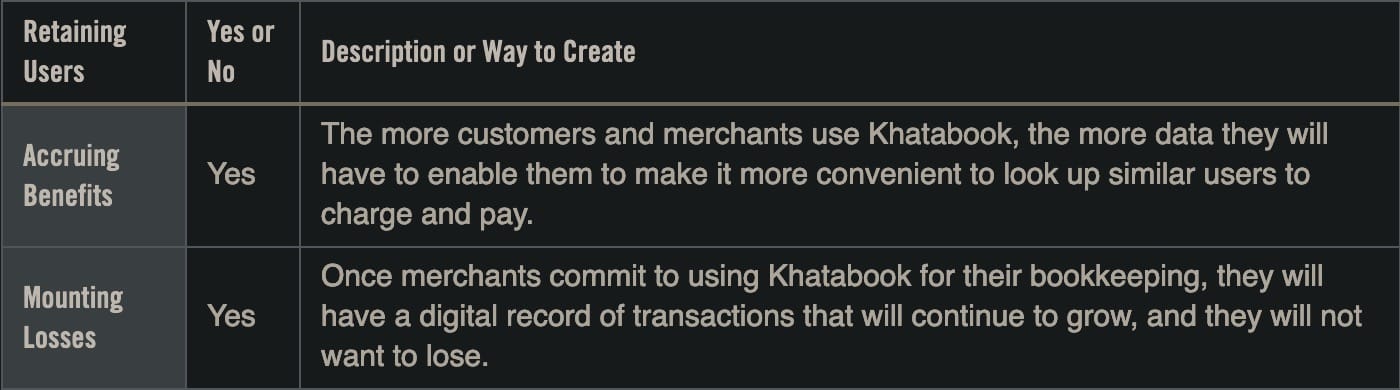

Let’s learn about the second level of the Hierarchy of Engagement. At this level, the company seeks to create accruing benefits and emphasize mounting losses to retain users and address the leaky bucket problem.

So you're a builder at one of these consumer companies. And you have clarity on your core action. You have an action that you know if a user does it, they understand the product, and they're going to come back. That's incredible progress. Now, the question is, how do you make the product sticky when a user does that? And there are two things - creating accruing benefits and mounting loss.

Accruing benefits is the idea that, as a user uses the product, you take that information, the explicit and implicit data that they're giving you, to improve the product for them. The more they use it, the better it gets for them.

On the mounting loss side, the idea there is that you also want to have a product that, the more I use it, the more I have to lose by leaving the product.

And so you want to have these two things come together, where a user will say that the more they use the product, the better it gets for them, and the more they have to lose by leaving it.

Accruing benefits occur when the more a user uses a product, the better and more personalized the product becomes for them as the company uses its engagement data to improve the product. Mounting losses occur when the more a user uses a product, the more they lose by leaving it.

Does Khatabook have accruing benefits and mounting losses for users?

Level 3 of the Hierarchy of Engagement is about using virtuous loops to make engagement and growth self-perpetuating.

So we have a product now, where you're growing users who are completing the core action. When a user does the core action, it creates a more engaging, more retaining product. And now we have level 3. The idea with level 3 is, how do we take that kinetic energy that the user is giving you, and make the product self-perpetuating? There are three loops that matter here:

- The first, and unquestionably, the most important, and the most aspirational for many products, is a network effect. If you pick the right core action, and you have a product that has the potential for network effects, the idea is that, as a user completes that core action, the experience gets better for everybody, each incremental new user who comes into the product, and the people already using the product. So to take Pinterest as an example. If I pin something, if I save a pin that I discover on Pinterest, or find from outside Pinterest, bring it into Pinterest, and I save it to a board, what I'm doing is I'm creating a new edge in the Pinterest graph. I'm a human-curating machine. And every board has these pins that are related somehow. So Pinterest then uses that information, each edge in the graph, to create recommendations to increase the relevance that somebody else who might have some similar pins can give a new recommendation to them based on my board, and the millions of other people on that. So the core action there is, not only creating a more engaged product, a more retained user experience, but is also making the experience better for everybody else on Pinterest. And that's pretty powerful.

- The second type of loop is growth loops. The best way to grow a product is to have your users do all the work to grow for you. They are clearly having a great experience. You encourage word-of-mouth. But ultimately, if you can create a product that channels that in a very direct way, you've got something powerful. How many of you have had somebody else send you a TikTok video? Or seen a TikTok video in some other experience that you have? Each time that happens, if I am not a user of TikTok, somebody sends me a funny video from TikTok, then I'm going to be curious. What is this TikTok thing? And I'll click on the video. I'll end up on the TikTok link, or maybe I'll go to download the app. And that's an example of a user having such a great experience on TikTok that they just want to send it to somebody else. And it creates a growth loop, which is super powerful.

- The third loop is re-engagement. Let's say I actually am a user of TikTok, but I just haven't used it for a while. And then a friend of mine sends me a TikTok video. I click. It opens the app. And then all of a sudden, I'm back on TikTok. And then you get sucked right back in.

So, again, there are all these other ways that you can grow a product. You could spend money on ads. You could do events at a college to get people to download the app, and play with it. There are just so many things you can do. But the best and most scalable thing is to create a product that has these loops organically in them.

Which of the three types of virtuous loops already exist within Khatabook’s product? For those that exist, how might Khatabook maximize on those loops to compete with OkCredit? For those that don’t exist, how might they create them?

Ravish worked to improve engagement with his product. He set up a trigger-based SMS campaign that provided reminders to Kirana shop owners to encourage them to reach the five-transaction threshold. Further, he iterated on the app’s design to reduce any friction to encourage users to record their transactions and connect with a few of their trading partners. In parallel, he also has to turn his attention to fundraising so he could continue to drive growth and compete with OkCredit.

Scaling Decisions

At this point in the journey, Ravish is once again out of money and needs to raise more. Having raised $1.5 million and $2 million, he must determine his strategy for this next fundraiser. Is the company at a stage where he can be aggressive?

When a founder chooses to scale rapidly, they prioritize speed over efficiency in the face of uncertainty, as opposed to scaling more incrementally or cautiously and learning more as they go. When scaling rapidly, entrepreneurs deliberately make aggressive growth decisions and commit to them even though their confidence level is not 100%. Their startup may not have hit all the indicators of PMF yet. This makes scaling risky, but a founder must be willing to pay the cost of significant operating inefficiencies in exchange for the ability to move faster to capture the market opportunity. With scaling quickly, the founder is giving up an opportunity to incrementally scale and learn in a more deliberate way to instead “go big, fast” in an attempt to win the market.

To make a choice to scale aggressively, the entrepreneur should have high conviction the startup has a massive market opportunity (i.e., huge Total Addressable Market, or TAM), strong PMF, the potential for a high-quality business model (i.e., network effects and attractive unit economics), strong competitive dynamics, and enough financial capital available at a low cost (i.e. modest dilution) to support growth. And, they should be operating in a market where the competitive threat is strong - if you don’t seize the opportunity, someone else will.

After Ravish invested resources in reducing churn and improving engagement metrics, and given what you know about the quality of its business model and results of its experiments, has Khatabook achieved PMF? Recall the HUNCH framework:

- Hair on fire value proposition: is the value proposition a must-have need for your target customer who is 10x better than the alternatives, and where many of your users would be very disappointed if you took it away?

- Usage high: your product usage and engagement are high and growing—something you can observe by carefully analyzing the behavior of certain customer cohorts over time.

- NPS, or net promoter score, exceeds 40: A net promoter score measures customer experience and satisfaction. It is calculated by surveying customers and asking how likely it is, on a scale of 0-10, they would recommend the company to a friend. You take the percentage of customers who rate 9-10 (promoters) minus the percentage of customers who rate 0-6 (detractors) to get the score.

- Churn low: ideally less than 3% per month, showing an enduring value proposition over time.

- High LTV/CAC ratio: ideally greater than three using conservative calculations, showing your unit economics are positive, and thus you can acquire customers and generate positive returns at scale.

Recall the five factors that contribute to deciding the pace of scaling:

- total available market size or TAM

- product-market fit

- business model quality (including network effects and high gross margins)

- competitive dynamics

- available financial capital at a low cost

Deciding Growth Speed

Let's examine each in turn.

Regarding the TAM, rapid scaling only makes sense in a massive market. You need a big potential reward to compensate for the risks and costs involved. It doesn't make sense to expend massive resources to win a small market. In the case of Khatabook, the market is massive, as there are so many small businesses that can be served, in an environment where the internet and smartphone adoption is becoming universal in India, and throughout Southeast Asia.

PMF - you can't swiftly achieve market leadership unless users and customers adopt and buy your product. PMF is important for scaling because it enables product-led growth. Having an efficient distribution strategy, such as PLG, makes a product more likely to win big, and win fast in a market. The ease of use of Khatabook, its ability to be downloaded rapidly, and to provide an immediate and obvious benefit to its customers upon download, and the cohort behavior, suggests strong PMF and efficient distribution.

Business model quality - the reason to scale rapidly is to win the market so that the company can generate massive profits for years, or even decades to come. While a company might not have high gross margins, or indeed, even profitability on day one, it needs to have a reasonable hypothesis on how to achieve them in the future. And in markets that exhibit strong network effects, an entrepreneur can choose to focus on building network value before extracting value. This area is arguably Khatabook's weakest. The company has proven strong network effects, but has not yet monetized its user base, or even run monetization experiments. Willingness to pay is an open question. Thus, the company chose to scale very rapidly on the belief that they would eventually demonstrate a high willingness to pay, and extract revenue from their users.

Competitive dynamics - in economics, a winner-take-all market is one in which the leading product or service gets a disproportionate market share relative to the number two company. For example, search is a winner-take-all market. There's one dominant search engine, Google, with over 90% market share. And all others pale in comparison. If you're operating in a winner-take-all market, where the market characteristics are such that you can achieve a sustainable competitive advantage, or what Warren Buffett refers to as a large competitive moat, then scaling rapidly makes all the sense in the world. Khatabook seems to be operating in just such a market. Merchants will likely use one, and only one, app. And once they get addicted to that app, and register all their transactions, and link up all their trading partners, they will never switch out. With these high switching costs, the market is likely to be a winner-take-all market.

Finally, companies can scale rapidly if they can access capital cheaply.

These elements are often interrelated. A more compelling business model and more obvious product-market fit, will enable an entrepreneur to raise a large amount of capital at an attractive valuation. But there are times when the macroeconomic environment, or other external and internal factors, is such that the fundraising environment is difficult for the entrepreneur, preventing truly rapid scaling.

In the case of Khatabook, during the initial years of operation, 2018 to 2021, the fundraising environment was very robust in India, and the company was able to access a large amount of capital at a reasonable price. Khatabook is currently taking an adoption before monetization strategy. By 2022 and 2023, the macro environment had changed. Thus, scaling rapidly is no longer an appropriate strategy as compared to scaling more gradually and efficiently.

Ravish used a rapid scaling approach and quickly went after his next two rounds of funding. After Khatabook’s Series A round, the startup hired more people, grew more, surpassed OkCredit, and immediately went for Series B Funding. Ravish knew for Series B, he would need to present his monetization plan, so he started coming up with potential PF experiments aimed at expanding Khatabook from just a ledger system to an entire operating system for small merchants.

The monetization delay allowed Ravish to refine his product, scale distribution rapidly, and plan for a second and third act that would enable monetization and increase average revenue per user (ARPU). These second and third acts were fintech and e-commerce in nature. In 2021, he raised a $100 million Series C - thus raising nearly $200 million in less than 24 months in three separate rounds!

Speed to market was a critical strategy for Khatabook to achieve massive returns, so it made sense to grow rapidly, even though they still needed to fully determine their PF. This approach allowed them to get a lead on other competitors in the market, learn quickly, position themselves as a market leader, and secure an enormous amount of funding. As a result of the funding, they could scale rapidly, run more experiments, and show market leadership - creating a virtuous cycle.

As a startup operating in a developing country, Khatabook had the ability to append multiple business models - as compared to the United States, where every market segment is so competitive and thus thinly sliced with scores of startups pursuing each slice - and had the opportunity to have high gross margins once it began pursuing its second and third acts because of the lack of competitive offerings.

Sometimes the opportunity set is even bigger in developing markets because there tends to be less competition in adjacent categories, and winning companies can cover multiple categories. For example, one of the most successful startups in the history of Latin America is Argentina-based MercadoLibre, an online marketplace founded in 1999 with a market capitalization of over $40 billion. Argentina is a relatively small country to produce such a valuable company, with only 45 million people and a gross domestic product that is one-fortieth the size of the United States. MercadoLibre grew rapidly and created an enormous amount of scale and value by combining multiple business models that were wildly successful in the United States (e.g., an eBay-like marketplace, a PayPal-like payments platform, and an Amazon-like e-commerce superstore); It also expanded to other countries in the region, such as Brazil (population: 214 million) and Mexico (population: 127 million), thus becoming a regional powerhouse. Khatabook hopes to follow a similar playbook, just as other international startups with ambitious plans might, and expand their business model beyond a single product or a single market category.

Ravish realized the importance of quickly growing in the competitive emerging market and knew investors who were familiar with these markets would prioritize growth metrics over engagement metrics until a company had clearly won the majority of the market.

Determining the Playbook

There is no one playbook to startup success, there are multiple playbooks you can apply in different situations, and you need to assess the context and apply the playbook that fits best. At Khatabook, they decided to grow rapidly and wait on monetization.

One final important note here is about the nuance of product-market fit. Khatabook has achieved one measure of product-market fit in that the high volume of app downloads demonstrate a strong value proposition that its target market finds appealing. But in another crucial metric - enduring usage over time - the company still has work to do. Note that as of 2023, Khatabook’s scaling decisions seem to be paying off as it continues to thrive and is reportedly making progress on its monetization and user retention journey.

Wrap Up

This article is all about scaling challenges and opportunities post-product-market fit. Choosing the pace of your scaling is a critical strategic decision, and one that can be informed by many factors. There's no one startup playbook, but there are a number of frameworks that can help guide your decisions regarding the pacing of scaling.

The first is assessing the quality of your business model and the degree to which it has network effects and a self-perpetuating flywheel. In the context of a massive TAM, the presence of these attractive business elements suggest that more rapid scaling could be an appropriate approach. To scale rapidly, you need access to capital. Raising capital isn't easy, but if you can demonstrate product-market fit and some of these attractive business model elements, it gets a lot easier.

Like many markets, startup capital markets have cycles. There are times and certain geographies where raising capital is easier than during other times or in other locations. You can't necessarily time your market cycles, but you can pick an approach that takes these cycles into account.

Finally, there are risks that come with scaling rapidly. If you run out of money too

soon, you will hit the wall and destroy your startup. The faster you grow, and the larger you are, the harder the fall. Founders need to decide if they and their team are ready for that risk and manage it accordingly.