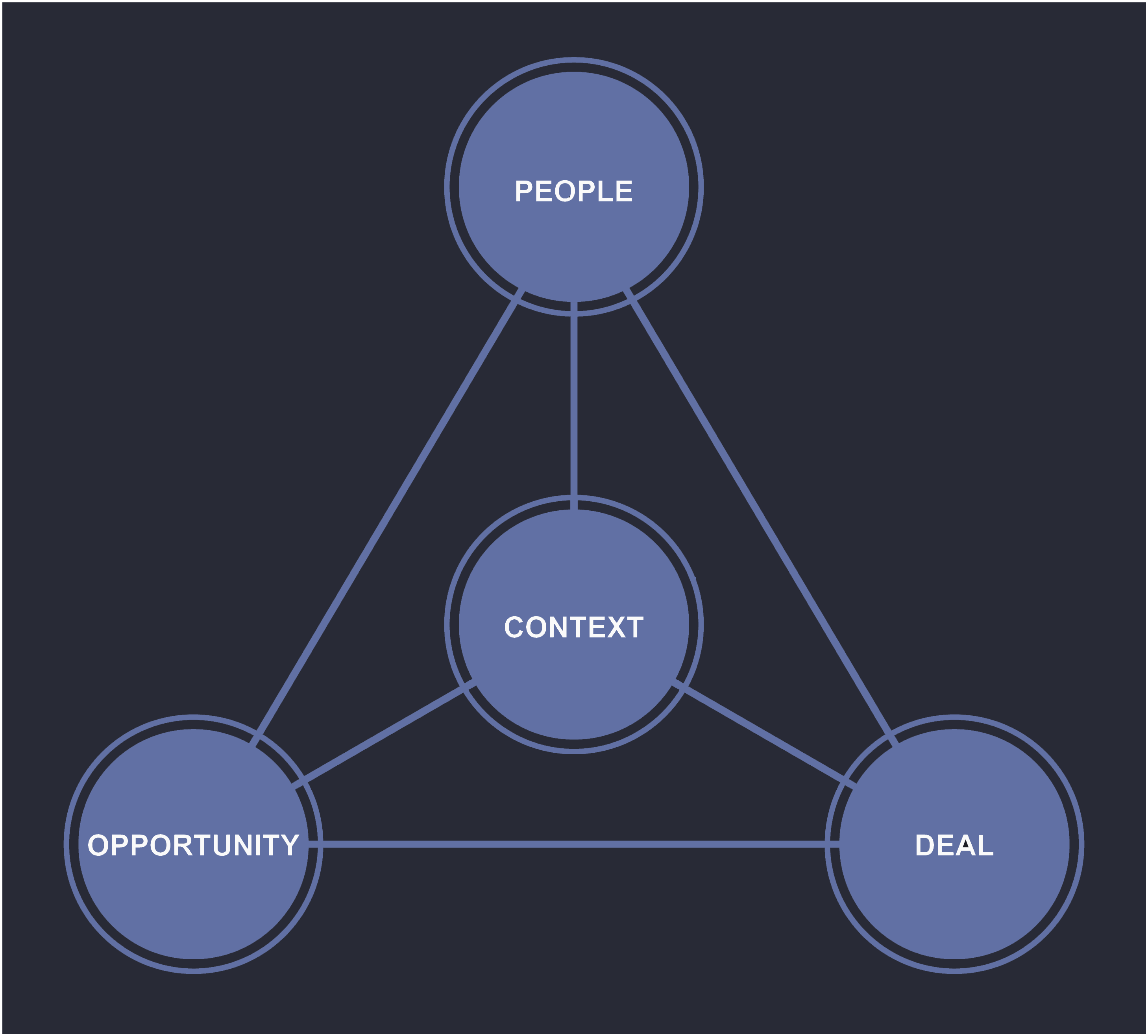

The POCD Framework

Building blocks for any venture

POCD is an acronym that stands for People, Opportunity, Context, and Deal, which is a framework used primarily in business and investment contexts to evaluate new business ventures or products. Each of the POCD components can be defined as follows:

People are the individuals who will have an important impact on a venture, whether they are actual employees. This category includes founders and employees, of course, as well as advisors, investors, lawyers, and key suppliers. In some cases, even customers can be considered part of the team. This element focuses on the team behind the business or project. It assesses their skills, experience, and their ability to execute the business plan effectively.

The Opportunity is an intended product or service for which customers will pay more than it costs the venture to provide it. In economic terms, an opportunity is a positive net present value project where the value of customer inflows exceeds the value of outflows to all resource providers. To create and capture value, a company must have a differentiated product or service and/or a sustainable cost advantage. They must have benefits of scale, including scale economies and/or network effects. And they must build barriers to competition. This aspect looks at the market opportunity being addressed. It evaluates the demand for the product or service, the size of the market, and the potential for growth.

Context refers to the factors that affect the outcome of the opportunity, but that are generally outside management’s direct control. This category includes interest rates, regulations, macroeconomic activity, technology, and some industry variables like the competition or relative business bargaining power. This part reviews the broader environment in which the business operates. That includes economic conditions, industry trends, regulatory issues, and technological advancements that could impact the venture.

Deals are the implicit and explicit contractual relationships between the venture and all resource providers. Deals allocate cash and risk and therefore affect the venture’s value. Examples of deals range from investment contracts to the terms of employment for managers. Ventures also strike important deals with customers and vendors. The final part of the framework examines the financial and structural aspects of the business. This includes the business model, pricing strategy, funding, and the potential return on investment.

These elements are the building blocks for any venture. Businesses and investors use the POCD framework to assess whether a venture is viable, if the team can deliver on their promises, what external factors might affect the business, and whether the financials make sense. This methodical approach helps in making informed decisions by considering all critical aspects of the business.

The Concept of Fit

To give a historical example of fit, consider Intel Corporation, the giant electronics firm. In 1968, Robert Noyce and Gordon Moore left Fairchild Semiconductor to form Intel; they had both joined Fairchild when it launched in 1957 and helped it grow to $100 million in annual revenue. Noyce was one of the inventors of the integrated circuit and was general manager of Fairchild. Moore was responsible for R&D. They intended to build faster, less expensive memory chips. Arthur Rock, a venture capitalist who helped launch Fairchild Semiconductor in 1957, organized a $2.5 million financing round, a large sum for a new company at the time. It would have been difficult to find two more capable co-founders for a semiconductor company than Noyce and Moore. Arthur Rock was the right person to organize the financing, and the capital gave the team plenty of money and time to build a profitable business. The market for memory chips was exploding as computers and other devices were introduced. Chip prices were high, and costs were declining. In short, the degree of fit between the people, opportunity, context, and deal was extraordinary at Intel, from the very beginning.

Many ventures begin with people who are far less qualified for their opportunity than Noyce, Moore, and Rock. That doesn’t mean they are doomed, nor did having these men guarantee success at Intel. Rather, improving the degree of fit as a venture progresses from an idea to a valuable company is a task for everyone involved. Improving fit increases the likelihood of success while lowering the likelihood of failure.