Using Money to Produce Information

Spending money to produce information about future possibilities

So, you have a great idea for an entrepreneurial venture, but now you need capital. How do you make sure that your unproven idea is valuable?

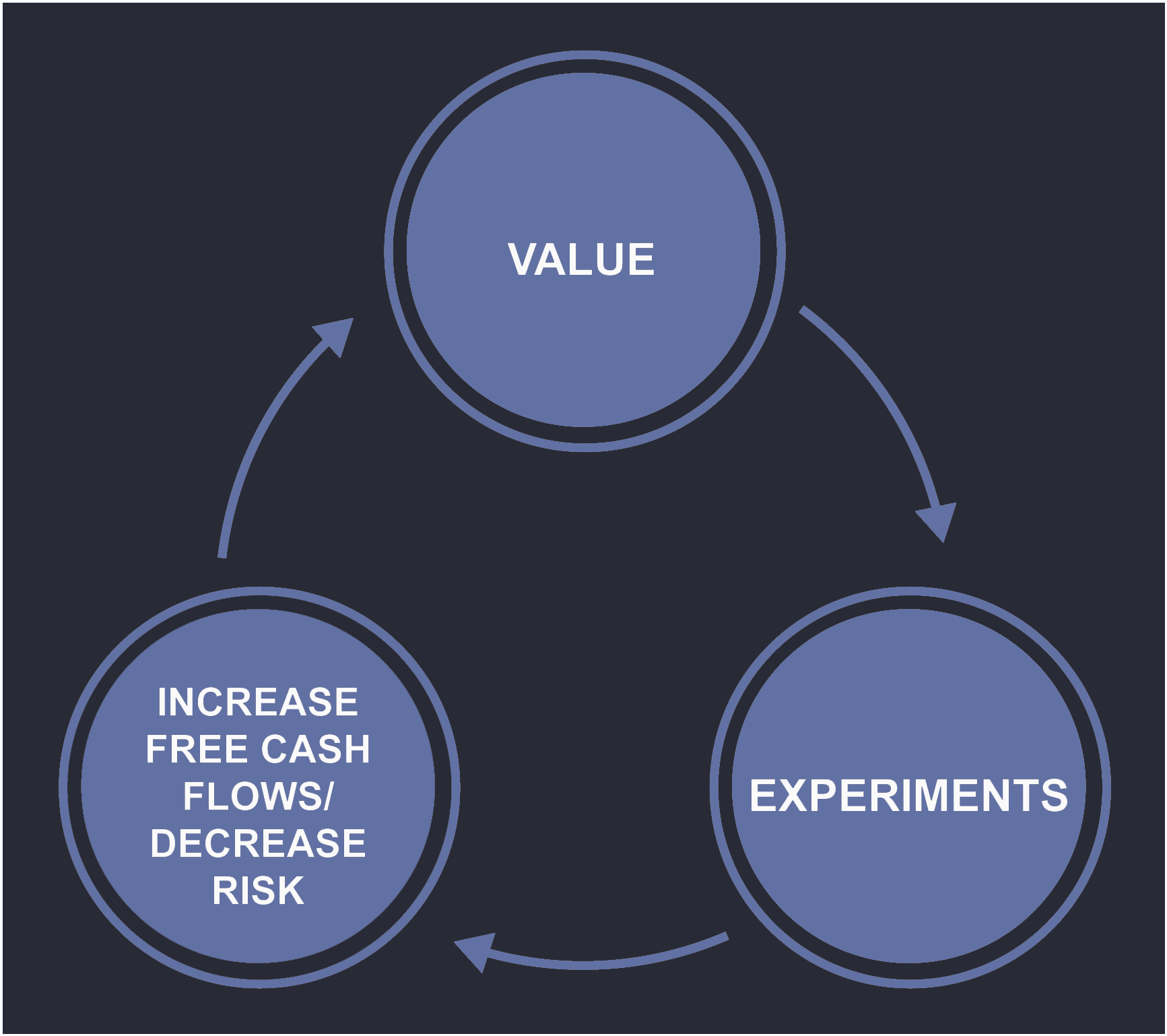

Value, or Net Present Value (NPV), is determined by free cash flows (FCF) and risk. Free cash flows demonstrate how efficient a company is at generating cash.

Experiments can be used to increase expected and potential free cash flows and/or decrease risk, thus increasing value.

Experiments in this context are essentially small tests to determine the viability of your idea. For example, Uber first tested its concept in San Francisco in 2010. Once it was able to prove its model, Uber attracted more funding and expanded to more cities. Today, Uber is available in over 647 cities worldwide.

Let’s consider a project that incorporates uncertainty. You believe that you have a compelling idea; an app for an on-demand dog-walking service called UnLeash.

You’ve run some numbers, and you think that you need $100,000 to build the company. You’re excited about UnLeash, but there are many unknowns in the dog-walking market. You believe that in two years, your venture has a 20% chance of being worth $1 million. But, you know, a lot can go wrong. There is an 80% probability that the idea doesn’t pan out and UnLeash ends up worth $0.

In this article, we introduced the concept of discount rates – the idea that value in the future is not worth as much as value today. We’re going to ignore those right now for simplicity, and assume that the discount rate is zero. Ignoring discount rates means we can just multiply the probabilities and payoffs to determine the expected value of the investment.

This is the present value of the uncertain future cash flow:

($1,000,000 * 20%) + ($0 * 80%) = $200,000

This is the net present value of the uncertain future cash flow (in other words, the positive future cash flow value, minus the cost to build the company):

$200,000 − $100,000 = $100,000

As you can see, the project has a net present value of $100,000 – the expected payoff is $200,000, which is only twice the $100,000 investment required to start it. Your idea is profitable, though not terribly exciting given the high risk.

Let’s say you raised the $100,000 from an investor. What percentage of UnLeash’s equity (ownership) would you need to give them?

Since the expected return is $200,000 and the investment is $100,000, you would need to give them 50% of the equity in UnLeash.

Where does the discount rate come in? One way to think about discount rates is to think about them as the return an investor would demand from you. Since in this example, discount rates are 0%, the investor would demand only their $100,000 back in one year.

If their discount rate were higher than zero, they would need an even larger share to justify the investment. Thinking about it this way makes the investment even less exciting, compared to the risk.

But, all isn’t lost. Let’s say you identify an experiment that would cost $25,000 to run. You’d like to test a beta version of the app in Washington D.C. that matches dogs with local dog walkers and provides an easy way for owners to communicate with the dog walkers.

If the experiment works, you could discover that the probability of failure decreases from 80% to 50%, raising the probability of success from 20% to 50%. How much would the project be worth under those conditions, assuming the discount rate is still 0%?

Let’s go back to our formulas and calculate the expected net present value:

($1,000,000 * 50%) + ($0 * 50%) = $500,000 - $100,000 = $400,000

As you can see, the expected net payoff is $400,000. In other words, your $25,000 experiment resulted in a $300,000 increase in expected value!

Let’s take another hypothetical situation. After running the $25,000 experiment, the probability of success and failure remain the same, 20% and 80% respectively. But, if UnLeash succeeds, it will be worth $2.5 million instead of $1 million. Would this change expected net present value?

($2,500,000 * 20%) + ($0 * 80%) = $500,000 - $100,000 = $400,000

The expected net present value in this scenario is also $400,000. Once again, your $25,000 experiment increased expected value by $300,000!

Why should you invest in experiments when there’s a chance of failure?

Experiments are an important tool not only for increasing value and the attractiveness of your venture to potential investors. A failed experiment still provides valuable information, helping you decide when to abandon a venture before it becomes too costly. In the case of UnLeash, you saved yourself $75,000 by testing out the idea first.

In the UnLeash example, what if you had personal savings to cover the $25,000 cost of the experiment? You would own 100% of the idea before and after the test. If you had to raise external capital at that point, you would give up far less equity to do so.

Without the experiment, you would have to give the investor 50% equity in UnLeash! With the experiment, you increased the expected gross value from $200,000 to $500,000. This means you would have to give the investor only 20% of the $100,000 investment.

Even if you have no savings and need to get an outside investor to put in the $25,000, you would probably own more of the company than if you tried to raise the $100,000 immediately. For example, the investor might want 20% of the company’s shares for $25,000, valuing the company at $125,000 ($25,000 divided by 20%).

If the test increased the probability of a good outcome, the investor would take another 20% share in return for the next $100,000 investment. You would still own most of the shares, 64%, and the investor would own 36%. That’s a better outcome for you.